CashPlus combines the best of both worlds: attractive interest rates and payment flexibility. You benefit from interest rate developments unprecedentedly and receive interest rates significantly higher than current accounts and most call money accounts. While the interest received may vary, there is no risk of loss due to fluctuations in value. And the best part? CashPlus finances itself entirely because the returns lie well above all costs. We’ve summarized what makes CashPlus so attractive below:

Table of Contents

Above-average interest

While there is hardly any interest on current accounts, and many banks also struggle to offer attractive interest rates on overnight and time deposit accounts, CashPlus uses the money market and uses an ETF to track the performance of a deposit that earns interest at the short-term euro interest rate (€STR). The European Central Bank calculates the interest rate daily, which is currently 3.65% per annum (as of June 12th, 2024). This interest rate has a significant meaning for the banks in the European Monetary Union, and the German Bundesbank also publishes it daily on its website. The abbreviation €STR stands for “Euro Short-Term Rate” and is the one-day interbank interest rate for the Eurozone.

Another unique feature: because the interest rate is recalculated daily, CashPlus has a constant up-to-dateness. This implies that if interest rates continue to rise, CashPlus will also generate higher returns for you without any effort on your part.

By the way, with CashPlus, the accruing interest is automatically reinvested so that you can also enjoy the compound interest effect, and the interest received can also generate interest again. This way, you can easily and conveniently increase your interest income without taking any action.

Worldwide free-of-charge payment

As with the other UnitPlus portfolios, CashPlus allows you to conveniently make free payments worldwide using the associated Mastercard debit card, Apple Pay, and Google Pay. In the meantime, however, your money has not lain unused in accounts but could earn interest for you in the CashPlus portfolio. So with CashPlus, your payments take place without risk of loss, and you can earn interest gains. Thus CashPlus beats over 150 million bank cards in Germany regarding interest.

Your UnitPlus deposit finances itself

The current interest rate of CashPlus is 3.73%, which means that minus all ETF and UnitPlus costs totaling 0.60%, CashPlus finances itself and, after expenses, you make significantly more return than you get interested on current accounts and most overnight deposit accounts.

No restrictions and conditions

Overnight and time deposit offers almost always come with certain restrictions. Whether minimum term or interest guarantee for a specific and usually short period. In some cases, certain amounts must be invested to take advantage of the offer. With CashPlus, there are no such conditions. Instead, money can be deposited and withdrawn flexibly. Even the term and minimum investment amount are determined only by you.

Double protection via a safety basket

There is no need to worry about fluctuations on the capital market with CashPlus. In addition, there is a double safety net, as the only risk is a so-called counterparty risk. This would occur in the event of the insolvency of Germany’s largest bank. This is considered extremely unlikely and even in that case, CashPlus is backed by additional collateral assets that protect the deposits. Of course, CashPlus also enjoys the status of special assets in your UnitPlus securities account and is therefore protected against the insolvency of UnitPlus itself or our partner bank. Hence, we have not only developed CashPlus so that you can benefit from interest rate developments in the simplest and most flexible way possible, but also to do so as securely as possible.

In summary, with CashPlus, you can achieve interest rates significantly higher than those of current accounts and almost all call money accounts and pay with it at any time, free of charge. At the same time, fluctuations in the capital market are non-existent, so you are always in the interest plus when making payments.

Legally required security notice

This article is not to be understood as an investment recommendation. Nor is it advice to buy or sell financial instruments. There are risks associated with capital market investments that can lead to a total loss. Historical earnings performance is not a reliable indicator of future performance.

Appendix:

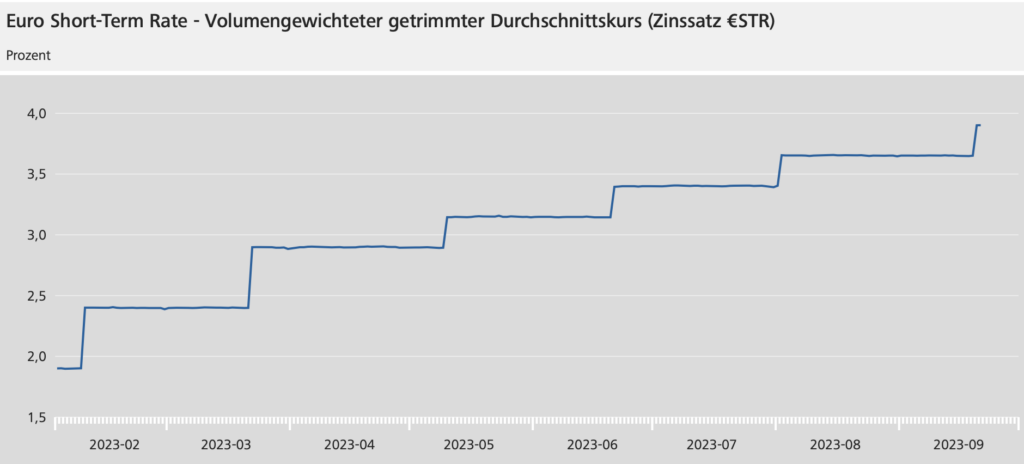

The chart below shows the interest rate of the Euro short-term rate (€STR). CashPlus tracks this plus 8.5 basis points. That’s why the total interest rate stands currently at 3.73%:

Since the European Central Bank stopped charging negative interest rates and interest rates in the European Monetary Union have been raised significantly over the past few months, each interest rate increase has also increased the one-day interbank rate. The stair-stepping can see these rate hikes of the blue line in the chart.

Source: Deutsche Bundesbank (as of September 24, 2023)