Today, UnitPlus launches its most extensive update since the market launch after six months of development. In addition to the ability to invest in any number of investment strategies simultaneously, the app’s user interface has been completely overhauled and offers an even more intuitive user experience with lots of helpful information on investment and payment behavior. The cost model has also become more transparent and less expensive overall.

Table of Contents

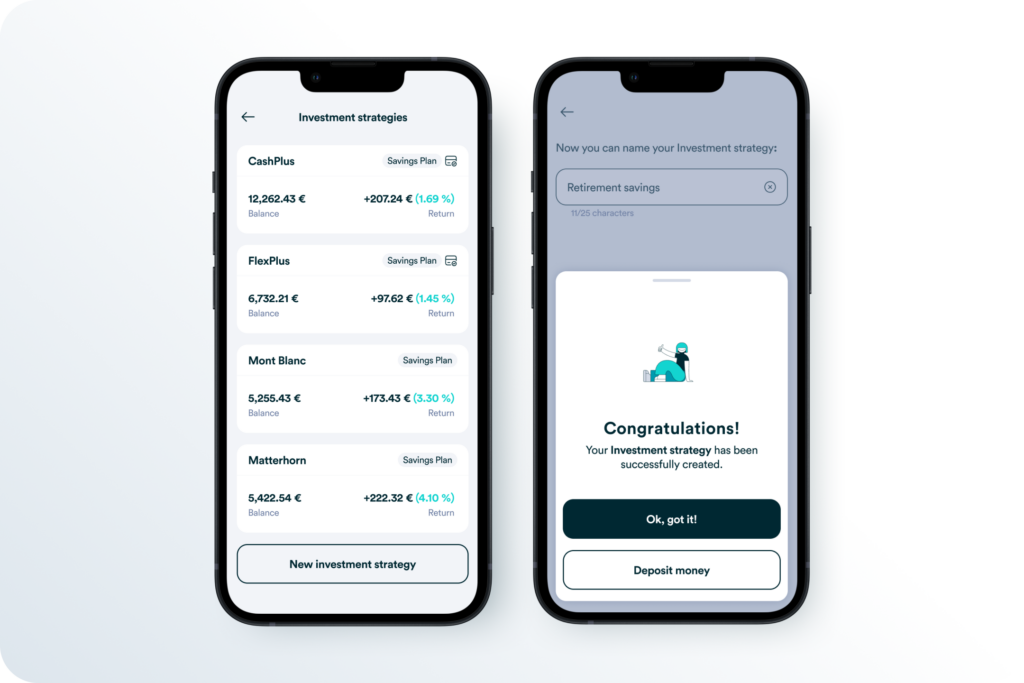

Invest in unlimited strategies at the same time

Thousands have wished for it, and now it’s possible: whereas previously, you had to choose one of three investment strategies, with the update, you can now invest in as many investment strategies as you would like simultaneously. For example, it is now possible to invest part of your money in CashPlus and thus always have optimal interest while at the same time also investing in the Berg Series strategies, which are particularly suitable for long-term asset accumulation.

CashPlus was developed as a call money 2.0. in such a way that it improves conventional call money accounts in terms of interest, flexibility, and security.

CashPlus is a newer version of call money accounts, a call money account 2.0 that offers improved interest rates, flexibility, and security.

The fact that the interest rate of currently 3.23% p.a. is directly linked to the interest rate of the European Central Bank means that the interest rate is permanently up to date and immediately adjusts to the new interest rate environment in the event of a changing interest rate policy. Thanks to the UnitPlus bank card, Apple Pay, and Google Pay, the interest-generating money can be used for payments worldwide free of charge.

FlexPlus invests the money in one of the world’s “safest havens,” short-dated European government bonds. Therefore, the portfolio is particularly well suited as a risk-preserving addition in a broader portfolio context, as government bonds have become more attractive again after the interest rate turnaround and pay relatively safe interest rates.

The Berg series invests money in over 800 companies worldwide, managing to realize return potential globally while diversifying risk broadly. As recently as August 2023, these portfolios were named best investment newcomers by the independent Institute for Asset Accumulation and are particularly suitable for long-term asset accumulation.

With the new update, it is now possible to invest money in any number of strategies simultaneously, activate multiple savings plans, and select the preferred investment strategy for payment. This allows for even greater flexibility and finding the perfect-fit investment for the short and long term.

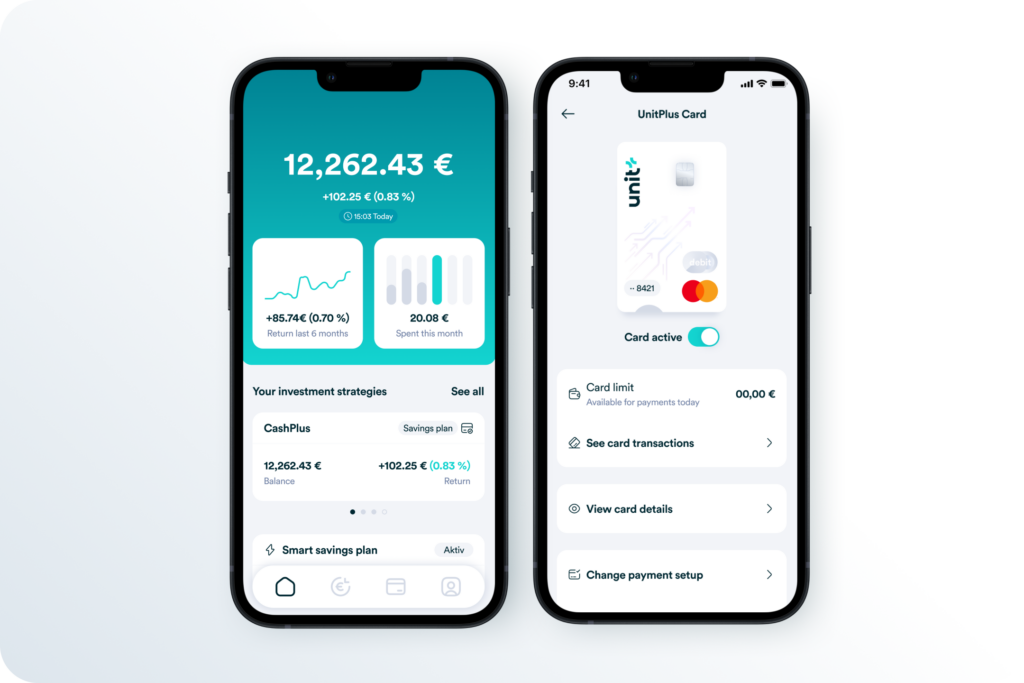

A new user interface

With a completely redesigned user interface, we’re making the app intuitively easier to use while getting significantly more information about your investment and payment behavior. The new home screen shows your earned interest with CashPlus and your returns in other strategies more efficiently. You can also see your spending with the UnitPlus Mastercard separately. Exciting articles and relevant news are broadcast directly through the app, and the document view is improved.

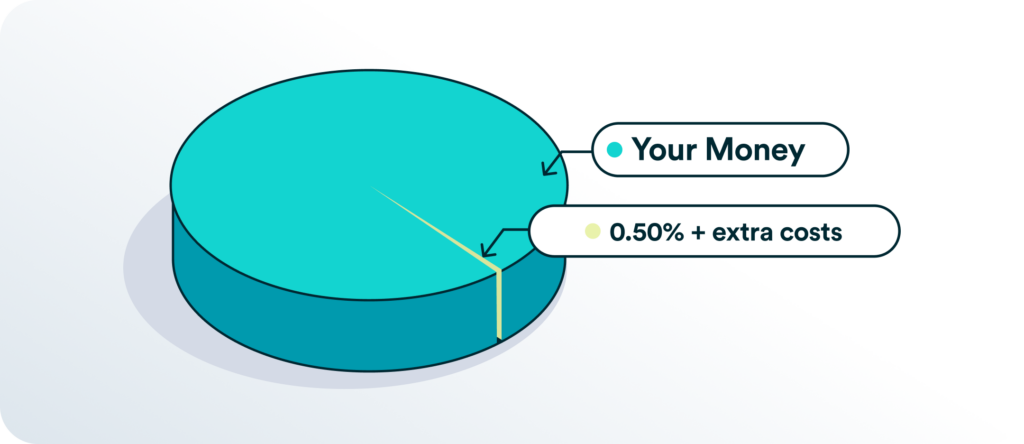

Simplification of the cost structure

The cost structure of UnitPlus will be more straightforward and cheaper in total. While there used to be a fixed monthly fee of €2 for FlexPlus and the Berg series, the fixed fee is now being eliminated. Regardless of whether CashPlus or any other investment strategy is used, only 0.50% of the invested money will be charged for an investment strategy each year. In addition, there are only the fees for the investment products and ETFs.

You will be charged additional fees if you activate additional investment strategies after the first one. If you choose to activate a second, third, etc. investment strategy after the first one, you will be charged €1 per month for each additional investment strategy. For example, if you have three investment strategies, you will be charged 2€ in monthly fees and 0.50% of the invested money across all three investment strategies. This leaves everyone free to decide whether, for example, only CashPlus should be used as a call money account 2.0 or whether a short- and long-term broad investment should be built up over several strategies. This makes UnitPlus one of the most innovative investment products in Europe and one of the most cost-effective.

Outlook

We want to express our gratitude to our users for the abundance of feedback and suggestions for improvement that we have received. As product development is still in its infancy, we are already planning further updates by the end of the year.

Do you have questions or comments about the new UnitPlus app? Then we’d love to hear from you: support@unitplus.eu