With our major update in mid-November, it is now possible to invest in multiple investment strategies simultaneously. Here, we explain who this approach is useful for and how you can activate additional strategies.

Table of Contents

Harnessing the power of the capital market

Many of you currently use CashPlus from UnitPlus, the overnight money account 2.0, where the daily interest rate is directly linked to the interest rate of the European Central Bank, which currently generates 3.23% interest per year. With the UnitPlus bank card but also via Apple Pay and Google Pay, you can access your interest-bearing money anywhere in the world.

However, if you want to invest part of your money not only in the short term and very securely but also in the long term on the stock market, you will find what you are looking for in our portfolios. If you want to beat inflation in the long run and make adequate provision for the future, there’s no getting around the stock market. The great thing about UnitPlus is that we have already done the groundwork and developed portfolios that invest globally and broadly diversified in different countries and industries, thus realizing return opportunities globally while spreading the risk widely.

Compared to investing in individual equities, bonds, or ETFs, the UnitPlus portfolios are characterized by a sophisticated mix of equities and bonds and aim to generate a long-term return of 4% to 8% per year, while significantly reducing the risk compared to individual investments.

High returns and reduced risk

In a well-thought-out investment, different instruments are used for different investment periods. While CashPlus is particularly suitable for short-term investments, FlexPlus is a good companion for medium-term investments and our Berg-series is intended for long-term asset accumulation.

For example, if we look at the annualised return of our Mount Everest portfolio compared to that of the German benchmark index, the DAX, Mount Everest has generated a higher return in the last three out of five years, with significantly lower risk. The annualised return over five years in the period under review was 5.23%, while that of Mount Everest was 7.74%.

Even if historical performance does not allow any conclusions to be drawn about future performance, it demonstrates how profitable investing in other UnitPlus portfolio strategies can be. Incidentally, this is not only our view but also that of the Institut für Vermögensaufbau, which named the UnitPlus Berg series the best investment newcomer of the year in the summer of 2023.

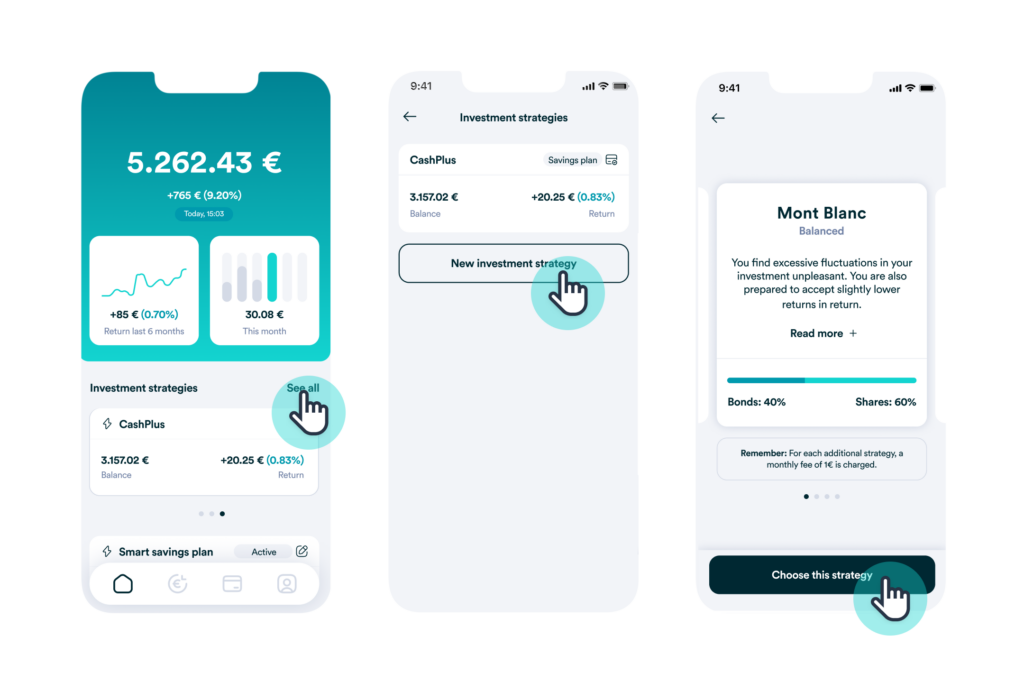

Activation is child’s play

Open your UnitPlus app and click on “Show all” in the investment strategies section. There, you will find a “new investment strategy” button, which you can click on and then select the strategy you want. Once you have confirmed the activation of the strategy, you can deposit money via a manual bank transfer, usually within two working days. However, please do not forget to specify the intended use, as each of your portfolios has its purpose. It is not yet possible to transfer money from one portfolio to another, but this will be possible in a few weeks.

If you are worried about high additional costs, we can reassure you. For each additional strategy you activate, there is a monthly fixed fee of €1. In return, you receive a professional portfolio strategy with which you can make deposits and withdrawals at any time. Of course, you can delete the strategy completely at any time and transfer the money back to your reference account.

Summary

We know that investing can be a complex subject. That’s why we are developing UnitPlus in a way that is as simple and flexible as possible to obtain an investment that is not only innovative but also very sensible and ideally suited to all stages of life and all market phases.

Statutory safety notice

This article is not intended as an investment recommendation. Nor is it intended as advice to buy or sell financial instruments. There are risks associated with capital market investments that can lead to a total loss. Historical performance is not a reliable indicator of future performance.