CashPlus fundamentally rethinks call money by improving the weak points of a classic call money account regarding interest, flexibility, and security. In today’s article, we talk about how CashPlus works technically. For those who would like to learn more about CashPlus generally, we recommend the article “The Interest is Back.”

Table of Contents

What does call money 2.0 mean?

While banks offer classic call money accounts and thus fall under the deposit business, CashPlus is a capital market product. Compared to stocks and bonds, however, it is not associated with large price fluctuations, as investments are made in a portfolio on the capital market that reflects the performance of an interest rate set by the European Central Bank. Currently, this interest rate stands at 3.73% per annum. An investment via the capital market has the advantage that you receive the interest credit daily, and you are always charged interest at the daily interest rate of the ECB (bye, bye interest hopping). Furthermore, there are no conditions such as a limited interest guarantee or a maximum amount compared to classic call money accounts. At the same time, the UnitPlus call money 2.0 allows interest-bearing money to be used immediately for worldwide payment transactions at no cost. This makes the associated UnitPlus Mastercard the highest interest-generating bank card in Europe (you know, a bank card that also pays you interest? Then we’d love to hear about it).

There are no fixed fees for CashPlus; you only pay 0.6% of the invested money per year. Compared to classic call money accounts, where it’s common to experience a noticeable decrease in interest rate after six months, the call money account 2.0 allows interest to be earned permanently until the European Central Bank adjusts the interest rate. Therefore, CashPlus currently offers Germany’s most appealing interest rate, even annually.

How it works explained

CashPlus is traded on the stock exchange, like stocks and bonds. However, the price of CashPlus is based exclusively on the interest rate policy of the European Central Bank, as CashPlus tracks the so-called short-term euro interest rate (€STR) of 3.90% plus a positive adjustment of 0.085%.

Since the price is determined by the daily valuation on the stock market, interest is only credited to CashPlus on working days. Background: On weekends and holidays, the stock exchanges are closed. But you won’t miss out on interest. On the Monday after a weekend or the day after a holiday, the accumulated interest of the preceding days is included in the value calculation as a positive factor.

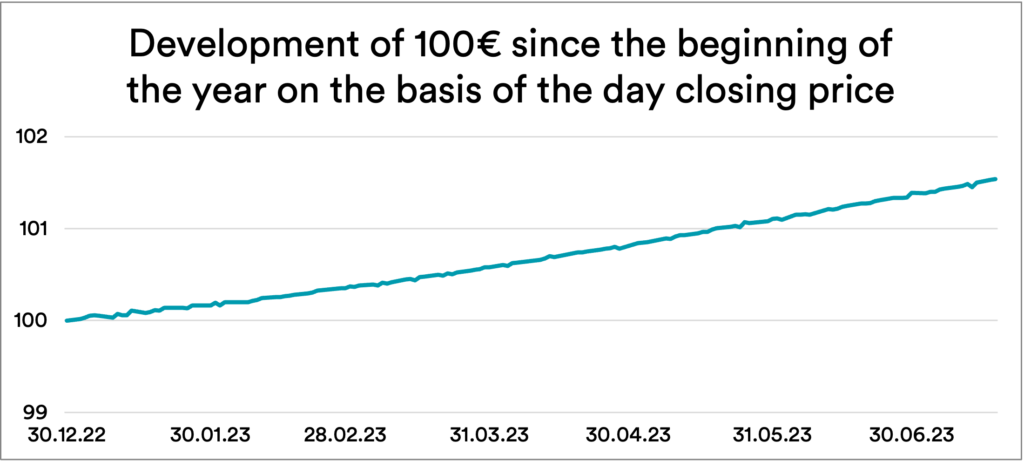

Therefore, in the long term, the performance is based only on the interest rate of the European Central Bank. On individual days, however, there may be an effect on the stock market that leads to minimal fluctuations in the portfolio. This has to do with the so-called bid-ask spread. The bid-ask spread is the difference between the purchase and selling prices on the stock exchange. It occurs with every financial transaction and, therefore, also with CashPlus. Over the last two years, the average bid-ask spread has been 0.02%. In other words, a minimal value. This spread must only be paid when trading on the stock exchange, i.e., buying or selling. Therefore, on the first day after the deposit on CashPlus, the investment is often slightly in the minus because the bid-ask spread is above the positive interest received on the first day.

In addition, to calculate the daily portfolio amount, we multiply the bid price on the stock market by the shares held in CashPlus. On some days, the widening of this spread overcompensates the daily interest; thus, we show a slightly negative performance. And this is despite not actively trading on the stock exchange. Therefore, we can see occasional slight fluctuations in CashPlus, but these are only due to the calculation method and therefore do not play a role in the long term. Let’s take a closer look at this:

The first chart shows the development of 100€ in CashPlus since the beginning of the year based on the daily closing price using the bid price on the stock exchange. As can be seen, there are marginal setbacks on some days, but they do not matter in the long run.

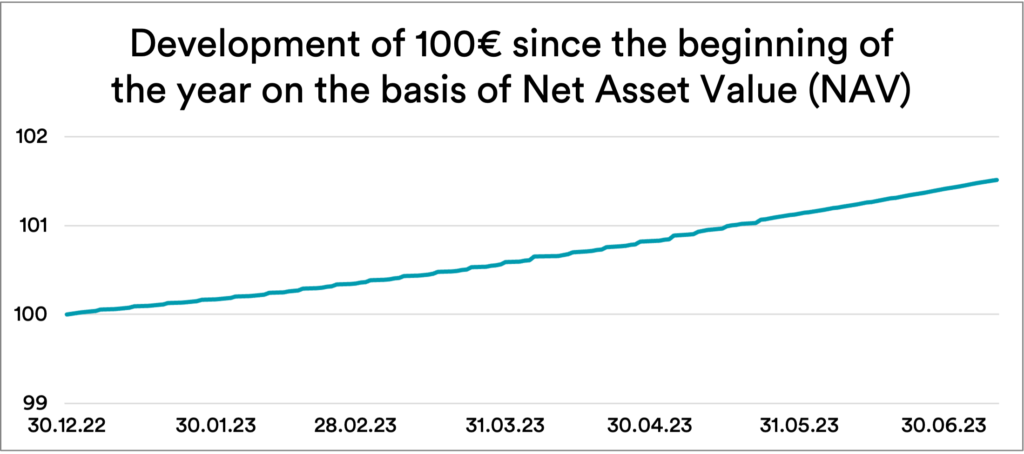

If, on the other hand, we look at the development based on the net asset value, i.e., the net asset value (“intrinsic value”), these minor setbacks do not exist.

Overall, both graphs develop almost identically over time, and thus, there is no deterioration due to the calculation based on the bid price.

Incidentally, this is also why there is 0.10% cash back for each payment with CashPlus so that the bid-ask spread can even be overcompensated, which no broker or other investment product does.

Conclusion

CashPlus is not a classic call money account but an innovative development based on the capital market. This not only ensures a higher interest rate in the long term based on an interest rate of the European Central Bank but the interest is also paid daily. At the same time, investments over 100,000€ are protected as special assets.

Safety notice required by law

This article is not to be understood as an investment recommendation. Nor is it advice to buy or sell financial instruments. There are risks associated with capital market investments that can lead to a total loss. Historical performance is not a reliable indicator of future performance.