Between tariffs and opportunities: How Trump 2.0 is reshaping the markets

Since Donald Trump returned to the White House earlier this year, one thing has become increasingly clear: the tone of U.S. economic policy has shifted—significantly and not just in subtle ways. The so-called “Liberation Day” on April 2 marked a turning point in American trade policy. Trump announced a sweeping package of tariffs that sharply increased the cost of imports from a wide range of countries. For financial markets, it was a major wake-up call.

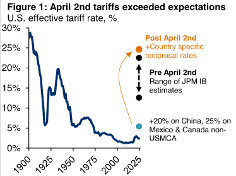

What stands out: According to estimates, the new tariffs are roughly 20 percentage points higher than before—levels not seen since the early 1900s. Only a small number of investors had anticipated such a drastic move, which explains the initial wave of market uncertainty.

Figure 1: Following “Liberation Day,” average U.S. tariffs surged to a record high—far exceeding most market participants’ expectations.

New Tariffs – A New Reality

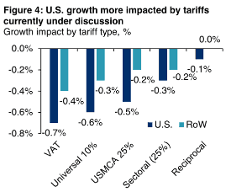

The economic consequences of this trade policy shift are not to be underestimated. JPMorgan now expects U.S. growth to fall to between 1.75% and 2.25% this year—a notable downgrade from earlier forecasts. While the U.S. economy had shown surprising resilience in recent months, the mix of higher tariffs, geopolitical tensions, and weakening consumer sentiment is increasingly weighing on the outlook.

What’s particularly interesting is that cyclical and export-oriented sectors are coming under pressure, while companies with a strong domestic focus or in defensive industries—such as utilities and certain financials—are holding up much better.

Figure 2: The U.S. is more affected by the new tariffs than the rest of the world—its export dependency is now turning into a disadvantage.

Gold Shines, Stocks Struggle

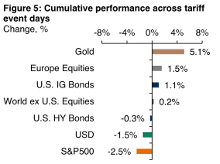

Market reaction has followed a familiar pattern: Gold has outperformed significantly in the days following the tariff announcements—gaining more than 6% against both the U.S. dollar and the S&P 500. European equities also posted gains, buoyed in part by fresh investment and fiscal stimulus initiatives coming out of Germany.

For investors, the takeaway is clear: those who diversify broadly—both across sectors and regions—are better positioned to weather this kind of volatility. Especially in times when political decisions can shake markets within hours, strategic portfolio positioning is key.

Figure 3: In times of heightened tariff tensions, gold once again proved to be a resilient “safe haven,” significantly outperforming stocks and the USD.

What Matters Now

At this moment, the most important thing is to stay calm and take a strategic approach to portfolio positioning. Diversification remains essential—across asset classes and geographic regions. Especially in an environment marked by uncertainty, such strategies can help mitigate risk more effectively. UnitPlus portfolios embrace this approach as well, investing globally and broadly diversified—with a notably lower U.S. weighting than the MSCI World index.

Conclusion

Trump 2.0 is stirring the markets—and yes, bringing with it a considerable dose of uncertainty. But it’s often in such phases that new opportunities emerge. The key is to avoid chasing short-term trends and instead focus on the bigger picture: solid allocation, clear risk diversification, and the flexibility to respond to shifting conditions.

Fabian Mohr