Economic outlook for 2026: Germany, Europe, and the World

Europe 2026: Stable Growth with a New Focus on Germany

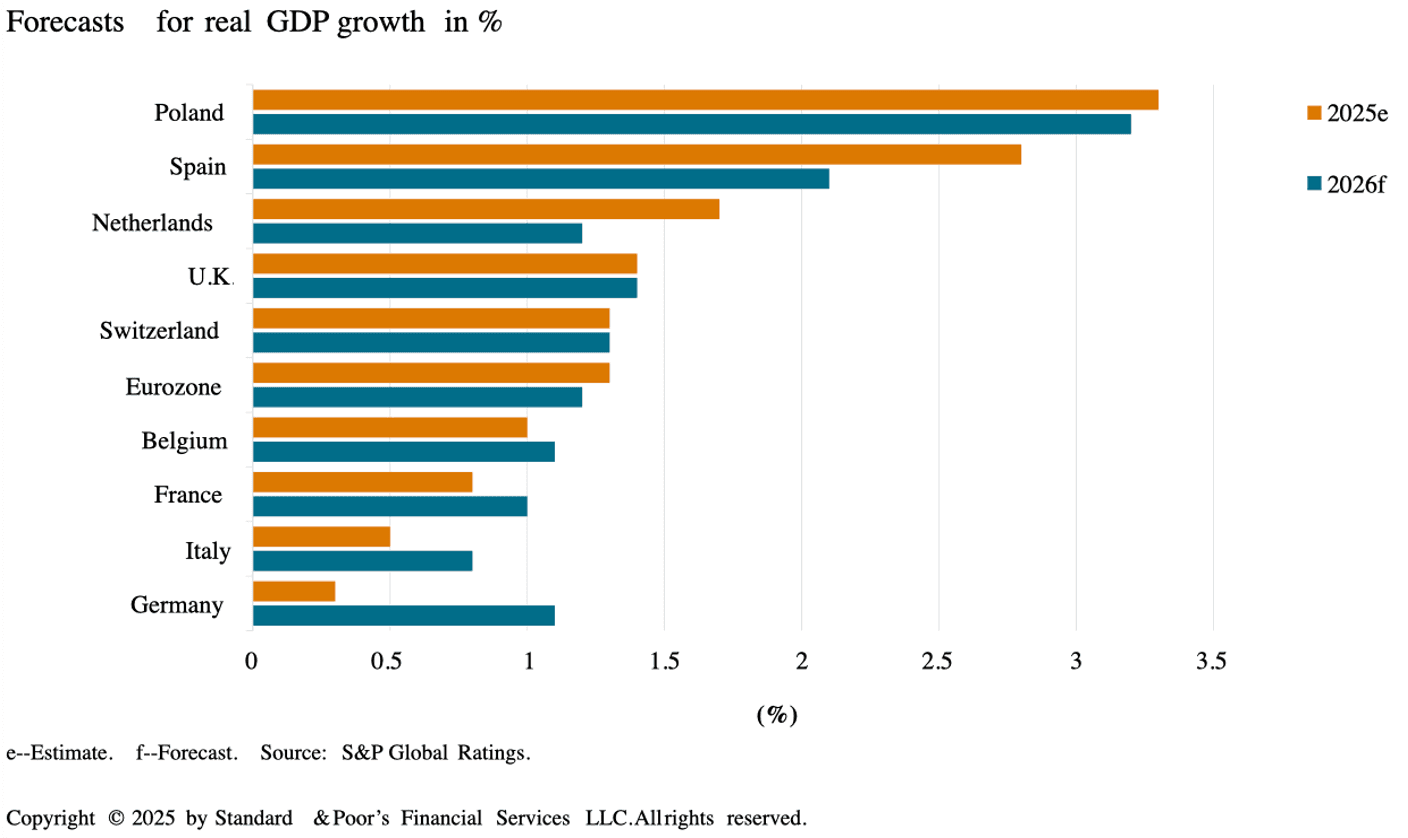

The European economy is expected to grow steadily overall in the year 2026, even though growth dynamics will develop differently across regions. In many economies, GDP growth is likely to remain broadly in line with the pace seen in the year 2025, while differences between individual countries are becoming more pronounced.

Germany is particularly in focus: after several years of stagnation, Europe’s largest economy is expected to regain momentum, supported by a new fiscal policy package from the federal government. In Spain, by contrast – which has been a key growth driver in Europe in recent years – a noticeable slowdown is expected. Overall, S&P Global forecasts economic growth of around 1.2% for the euro area in the year 2026.

On the demand side, S&P Global expects consumer spending in 2026 to grow at a similar pace to the previous year (1.4% following 1.3% in the euro area). The labor market is likely to provide less support, and real wage growth is also expected to slow. At an average of around 1%, however, it should remain positive.

At the same time, savings rates could decline as consumer confidence continues to normalize and interest rates fall. Private investment is expected to contribute positively to growth – supported by lower monetary policy rates, the ongoing global boom in AI infrastructure, and spillover effects from higher public spending on infrastructure and defense. These factors should help at least partially offset the negative effects of trade volatility and geopolitical uncertainty.

Germany’s Fiscal Policy Shapes European Economic Growth

The expected cyclical upswing in Germany is primarily driven by the federal government’s expansionary fiscal policy. With a comprehensive program aimed at strengthening growth and competitiveness and modernizing the economic framework, the largest fiscal package since reunification around 35 years ago has been adopted – a remarkable step given the constitutionally enshrined debt brake.

Triggers for this policy shift include rising geopolitical tensions, increasing pressure from the United States to meet NATO defense spending targets, and intensifying global competition, which is putting Germany’s traditional growth model under growing strain.

Planned government spending amounts to more than €1.1 trillion over twelve years, equivalent to around 25% of Germany’s GDP or more than 6% of EU GDP (as of the year 2025). Funds will be directed in particular toward transport and digital infrastructure, defense expansion, and the green transition. Around €100 billion alone is earmarked for climate- and energy-related measures, with the aim of lowering energy costs and promoting electric mobility.

In addition, tax relief measures are planned. Corporate tax is set to be gradually reduced starting in 2028, and companies will be able to depreciate investments more quickly. Further relief is planned through reductions in value-added tax and electricity tax.

The labor market is also a key focus. Measures include tax-free overtime, tax incentives for retirees who continue working as well as for part-time workers, and an increase in the minimum wage. At the same time, bureaucracy is to be reduced and deregulation advanced, for example through simplified procurement procedures and replacing the German Supply Chain Act with a less burdensome EU regulation. Faster planning and approval processes are considered particularly crucial to actually accelerate infrastructure investment.

Time-Lagged Effects and Regional Spillovers

Although the fiscal package was adopted in the year 2025, S&P Global expects a noticeable growth effect only from 2026 onward, strengthening further in the years 2027 and 2028. In the baseline scenario, the program increases real German GDP by around 0.5% in the year 2026 – a significant impulse given that Germany’s potential growth is estimated at 0.5% to 0.8% per year. For the euro area as a whole, growth could increase by around 0.2% over the next three years.

In addition, positive spillover effects are expected, particularly for countries in Central and Eastern Europe that are closely integrated into German supply chains, including Austria, the Czech Republic, Hungary, Poland, Slovenia, and Slovakia. Larger economies such as France, Italy, Spain, and the United Kingdom are also likely to benefit – albeit to a lesser extent relative to the size of their domestic markets.

At the same time, uncertainty remains high. The actual impact depends on numerous assumptions, including the timing and composition of public spending, absorption capacity, multiplier and price effects, and import shares – particularly in defense spending.

Monetary Policy: Limited Scope for Further Rate Cuts

Inflation in Europe eased noticeably over the course of the year 2025. Key factors include lower energy prices, a stronger currency, and easing labor markets, measured by the ratio of job vacancies to unemployment. Since the beginning of the year, inflation in the euro area has fallen by 0.3 percentage points, with around two-thirds of the decline attributable to core inflation.

However, the scope for further rapid disinflation is considered limited. Accordingly, little room is expected for additional interest rate cuts in Europe. National measures, such as Germany’s recent reduction in VAT on restaurant services, are also unlikely to have a significant impact on inflation in the year 2026, as they are not expected to be fully passed on to consumers.

Consumption Supports Growth—Without New Momentum

Private consumption is expected to continue supporting growth in the euro area in the year 2026, but not to accelerate it. S&P Global forecasts an increase in consumer spending of 1.4%, similar to the current year. While labor markets have weakened slightly in many countries, a sharp further rise in unemployment is not expected. A key reason is demographic change: Europe’s working-age population is aging, and aside from immigration, labor supply is barely growing. Reviving economic activity is also likely to stabilize labor demand.

At the same time, wage growth is expected to slow in the coming year. Combined with slower disinflation, this results in a smaller increase in real purchasing power. This trend is already visible: real disposable income in the euro area grew by only 1.5% in mid-2025, down from 3.1% in the year 2024. Nevertheless, consumption is unlikely to decline sharply, as households are expected to save a smaller share of their income. Falling interest rates reduce the incentive to save, and consumer confidence is likely to continue recovering as previous stress factors – such as the COVID-19 pandemic, the inflation shock, and political uncertainty – gradually lose importance.

Digital Transformation and AI as Structural Growth Drivers

Digital transformation remains a key long-term growth driver. Since the pandemic, Europe’s information and communications technology (ICT) sector has created around 1.8 million new jobs – more than any other sector. At the same time, around 800,000 jobs have been lost in the industry, primarily due to high energy costs and intensifying global competition.

Investment in IT equipment has risen sharply, reaching more than €100 billion in the euro area in the year 2025. Since 2021, the ICT sector has contributed around 0.4 percentage points per year to gross value added growth. The slight weakening of this contribution in the first half of the year 2025 is mainly due to stronger growth in other sectors.

S&P Global expects investment in AI infrastructure to continue rising strongly in the year 2026. While the United States leads the global boom, the EU is also supporting digital transformation. By the end of 2024, €306 billion had already been disbursed to member states under the Next Generation EU Recovery and Resilience Facility (via the European Commission) – around 2% of EU GDP. Of this amount, 64% consisted of grants, with the remainder in loans. These funds are intended to accelerate both the green and digital transitions.

So far, however, productivity gains from Europe’s digital transformation have been uneven. While the European ICT sector has recorded annual growth rates of around 2% since the year 2023, these effects have not yet broadly spread to other parts of the economy. Overall, productivity in Europe has declined by an average of 0.3% per year over the same period.

Foreign Trade Remains a Source of Elevated Volatility

Foreign trade is likely to remain characterized by elevated volatility in the year 2026. Although the euro area’s trade balance with the United States improved unexpectedly in September of the year 2025, this increase was largely price-driven rather than the result of higher export volumes. At the same time, the trade deficit with China has continued to widen, as Europe has been importing more than it exports in key industrial sectors such as vehicles, pharmaceuticals, and machinery since the beginning of the year 2025.

Global Outlook for 2026: Growth with Regional Differences

Europe enters the year 2026 with stable domestic growth impulses. Germany’s expansionary fiscal policy and the associated spillover effects, resilient labor markets in Western Europe, moderately declining inflation rates, and the delayed effects of accommodative monetary policy support growth. At the same time, stronger currencies and higher U.S. tariffs weigh on foreign trade bringing the global context increasingly into focus.

United States: No Downturn, but Growing Headwinds

According to S&P Global, the U.S. economy is not heading toward a recession in the year 2026. Instead, growth close to potential is expected, supported by fiscal impulses such as tax cuts for households, higher rebates, and rising federal spending, particularly on defense and border security.

However, growing headwinds remain: increased uncertainty, declining investment in manufacturing, rising credit spreads for companies, and falling equity valuations. Overall, growth remains stable but is more vulnerable to external shocks.

China: Slowing Growth, Focus on Structural Transformation

In China, growth is expected to slow in the year 2026 compared with the year 2025. External uncertainties and weakening export momentum in the previous year shape the outlook, even though lower U.S. tariffs and China’s growing share of global trade – particularly with emerging markets – provide some cushioning.

The government plans to expand consumption-oriented stimulus measures, especially through subsidy-supported promotion of services consumption. Nevertheless, high savings rates and a weak labor market are likely to dampen private consumption. On the investment side, the state is shifting its focus away from sectors with overcapacity toward infrastructure and innovative future industries such as artificial intelligence (AI), new materials, aerospace, and quantum technology. The emphasis is therefore less on short-term growth and more on long-term structural transformation.

India: Strong Growth with a Slight Loss of Momentum

India will remain the fastest-growing major economy in the world in the year 2026, although growth momentum is expected to ease slightly. Higher U.S. tariffs and increased uncertainty dampen foreign trade and private investment. These effects are partially offset by strong service exports, robust private consumption, and fiscal and monetary policy measures. These include, among other things, reductions in the Goods and Services Tax (GST), which are intended to strengthen household purchasing power.

Developing Economies: More Resilient than Large Emerging Markets

Interestingly, developing economies are expected to grow faster than many larger emerging markets in the year 2026. Their stronger domestic market orientation and lower integration into global supply chains make them less vulnerable to international trade conflicts and U.S. tariffs. In larger emerging markets, by contrast, real GDP growth is slowing. One reason is that tariff-related front-loading effects from the year 2025, particularly in the Asia-Pacific region, are fading.

Weaker export prospects are likely to be partially offset by positive effects on domestic demand. Moderately declining inflation rates and further monetary easing by central banks contribute to this, although the scale and impact vary by country.

AI: Growth Driver and Risk Factor at the Same Time

Rapid developments in artificial intelligence remain a key source of uncertainty for the global outlook in the year 2026 – bringing both opportunities and risks. On the positive side, investment in AI infrastructure, software, equipment, and research and development could exceed current expectations. The Asia-Pacific region in particular has the potential to further expand its global role. Strong U.S. demand has already supported the region’s technology exports in the years 2024 and 2025, and this momentum is expected to continue in the year 2026. Investment in data centers is also likely to keep increasing.

On the risk side is the possibility of a sharper correction in equity markets, which could weigh on demand through various channels. While large technology companies today are largely established and profitable, the risk of a stronger market correction remains. This is because economic conditions in many regions have become more fragile, increasing vulnerability to recessions. In addition, the scope for monetary and fiscal policy to cushion new shocks has become significantly more limited.

U.S. Dollar: Moderate Depreciation with Strong Divergences

The U.S. dollar is expected to continue its weakening trend in the year 2026, albeit at a moderate pace. S&P Global forecasts a decline of around 2% in the broad dollar index, following an estimated drop of 5% in the year 2025. The main drivers are less favorable interest rate differentials in favor of the United States and persistent – though gradually shrinking – external imbalances.

While most currencies of advanced economies are expected to appreciate against the U.S. dollar, the picture for emerging market currencies is far more heterogeneous, depending on country-specific fundamentals.

Shirel Feingold-Studnik