What to Expect from the Capital Markets in 2026

The past year was everything but dull. Geopolitical tensions, surprising market movements, and especially rapid technological advancements have shaped the capital markets. One topic stood out in particular: Artificial Intelligence (AI).

But what does this mean for investors in the year 2026? Which trends will persist, where will new risks emerge, and where will opportunities arise beyond the well-known tech giants?

Where is the growth happening? In the infrastructure of the AI-Boom

The capital markets of recent years have been strongly dominated by a single major trend: Artificial Intelligence. What initially began as an evolutionary advancement in the semiconductor industry has developed into an unprecedented concentration of market power.

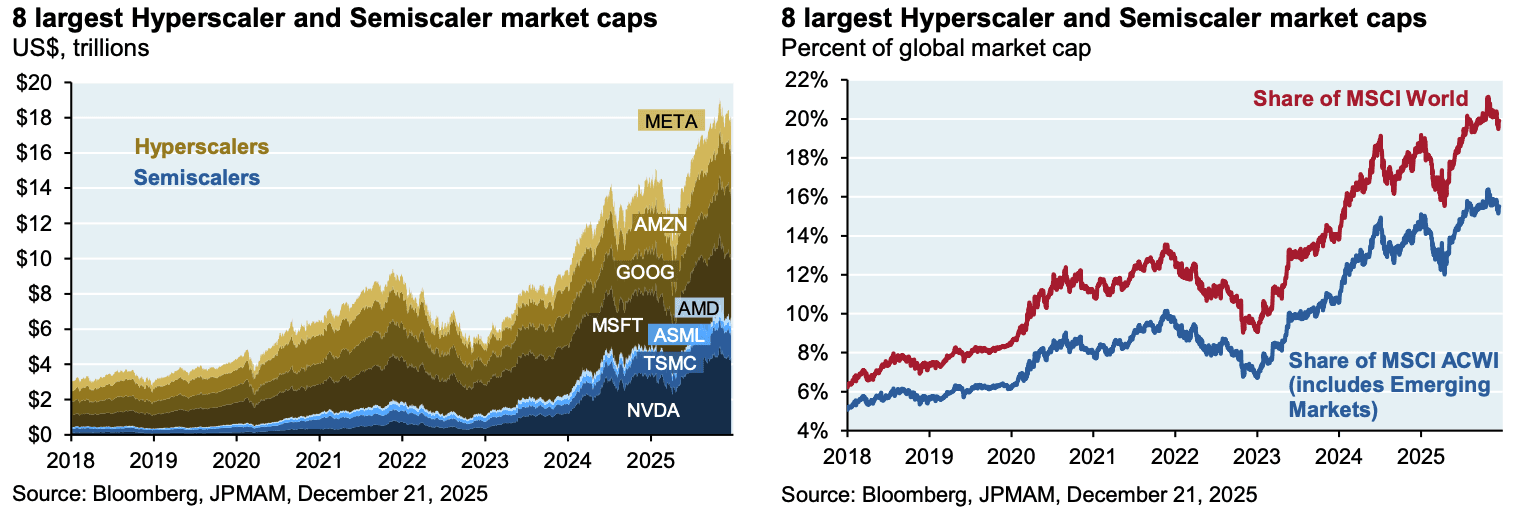

Companies like NVIDIA, TSMC, and ASML are no longer merely suppliers. They form the technological foundation of the entire AI value chain — from chip design and manufacturing to highly specialized lithography. Together with the major US hyperscalers (Microsoft, Amazon, Alphabet, Meta), they have built a structural competitive advantage that is hardly vulnerable in the short term.

Since the launch of ChatGPT in 2022, around 42 directly AI-related companies accounted for between 65% and 75% of the total profit growth, revenue dynamics, and investments of the S&P 500. The market capitalization of the four hyperscalers plus the three leading semiconductor companies increased from around $3 trillion to about $18 trillion in just a few years. The following graphics illustrate this development:

USA vs. Europe: Why the market appears so unbalanced

This concentration is also reflected at the macroeconomic level: In recent quarters, approximately 40–45% of the total US GDP growth was attributable to the technology sector.

This is particularly relevant for European investors. Without the strong performance of US AI stocks, the S&P 500 would have significantly underperformed compared to Europe, Japan, and China. The relative lead of the USA is thus almost entirely based on the AI sector — while large parts of the broader market have hardly benefited from it.

Energy and Capital: The critical factors of the AI era

The technological lead of major AI companies is real. At the same time, new structural dependencies are emerging. Two factors are coming into focus: Energy supply and financing models.

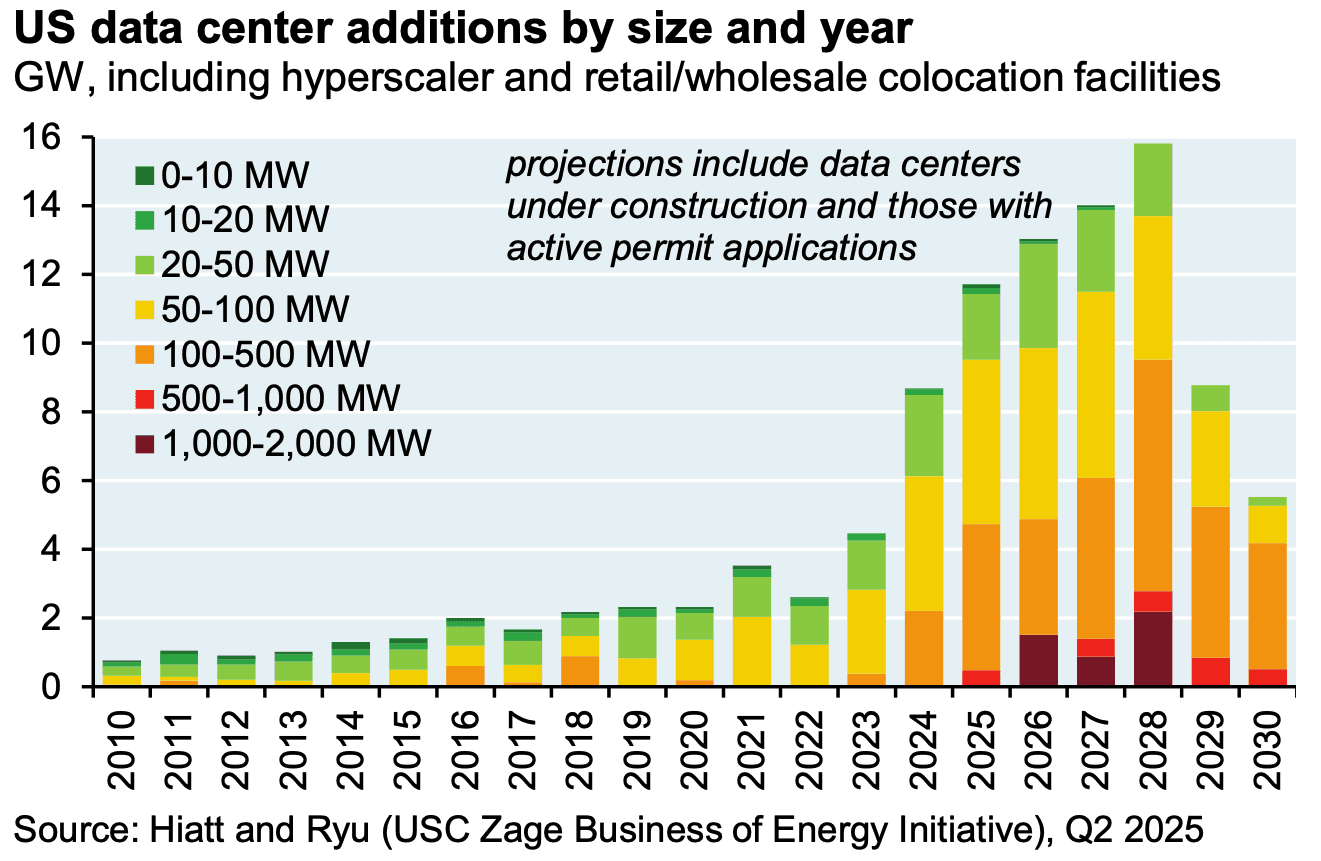

Global electricity demand is rising significantly — driven by digitalization, data centers, and AI infrastructure. At the same time, many economies are in the midst of transforming their energy systems. Energy thus becomes a strategic production factor again.

For 2026, this means:

increased investment needs in grids, storage, and generation

greater importance of supply security

growing differences between regions and companies

Companies with stable access to affordable energy secure clear competitive advantages. For investors, there are opportunities along the entire energy value chain — from infrastructure through utilities to specialized suppliers.

AI scales — and so does the capital requirement

For a long time, the major technology companies financed their investments almost entirely from operating cash flow. The leading AI players, in particular, were considered debt-light and extremely capital-strong. But with the rapid expansion of data centers and AI infrastructure, this picture is changing.

The reason is simple: The investment volumes are now reaching a magnitude where even very high ongoing cash flows are no longer sufficient to flexibly finance growth. Therefore, a part of the financing is increasingly shifting to the debt markets.

Two examples illustrate this trend:

Oracle is increasingly financing the expansion of its cloud infrastructure for OpenAI through external capital.

Meta has created a special purpose vehicle (SPV) with Blue Owl for its Hyperion data center in Louisiana. Through this vehicle, around $27 billion of investment-grade debt was raised.

These financing models decouple large projects from the operational business and partially shift risks to capital markets. Even if the balance sheet impact is limited, a clear trend is emerging: AI expansion is no longer solely financed through cash flows. This makes interest rates, refinancing costs, and capital market access relevant risk factors for tech giants.

Semiconductor dependence as a systemic market risk

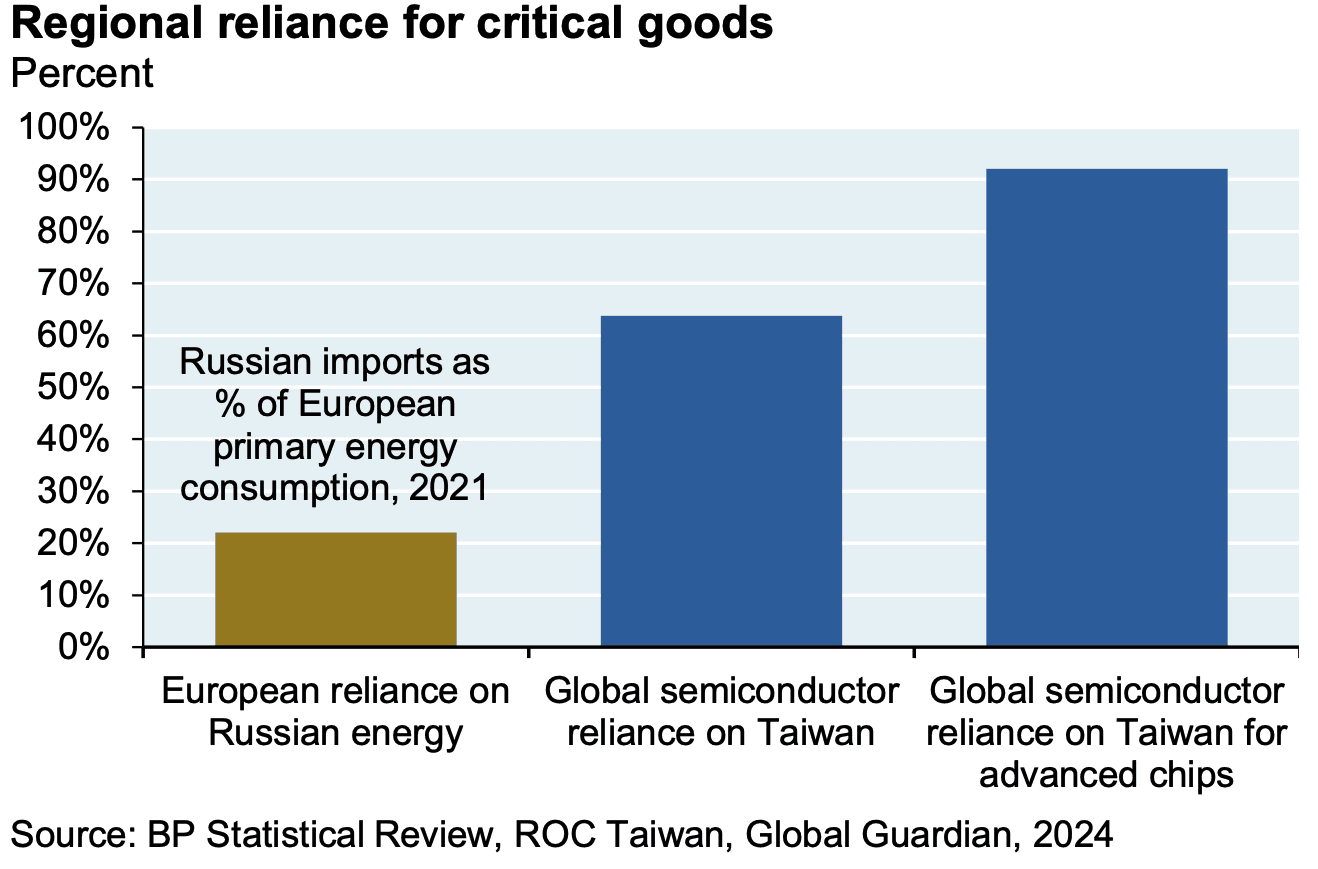

The Achilles' heel of the AI value chain is Taiwan. The island produces an overwhelming share of the world’s most advanced chips — a monopoly-like dependency with enormous geopolitical risk potential.

China is pursuing the strategic goal of building its own semiconductor ecosystem. Massive state subsidies are driving this process forward. Chinese companies are indeed making increasing progress, especially with specialized chips, but in high-performance computing, the gap with the leading western providers remains significant.

More decisive than the technological race is the structural dependency on Taiwan. A large share of the world’s most advanced chips is manufactured there.

The situation is often compared to Europe's past dependency on Russian energy — but this comparison falls short. While energy could be sourced from other suppliers in the medium term, there are no short-term alternatives for cutting-edge semiconductors currently. This technological vulnerability runs deeper and is more challenging to resolve over time. The growing geopolitical tensions between China and Taiwan — from military maneuvers to economic countermeasures — significantly exacerbate the risk for 2026. A conflict or blockade would have immediate consequences:

Collapse of global supply chains

Halt in industrial production

Exploding inflation and plummeting corporate profits

For investors, this means: Geographic diversification and the resilience of supply chains will become the decisive evaluation criteria in 2026.

Conclusion for 2026: A complex environment requires active management

2026 remains characterized by the dominance of Artificial Intelligence — however, with a more differentiated view on the associated risks. Energy supply, financing, and geopolitics come increasingly into focus and increasingly determine the sustainability of growth.

For investors, this does not mean turning away from the AI trend but keeping it consciously and actively managed.

This is exactly where UnitPlus comes in. With actively managed ETF portfolios in collaboration with renowned partners like J.P. Morgan Asset Management and Goldman Sachs Asset Management, investors gain access to professional strategies tailored to a complex market environment like 2026.

Whether with a pure equity portfolio like AktienPlus or a balanced solution like MultiPlus: UnitPlus combines active management, transparency, and daily availability — so that opportunities can be seized and risks can be controlled.

Oussama Aissani