Hidden Billion-Euro Loss: Why SMEs Lose Out on Overnight Interest Rates – and How Companies Can Counteract

The German SMEs – the backbone of our economy – is being systematically disadvantaged in the current interest rate environment. A recent analysis by UnitPlus in collaboration with Barkow Consulting reveals: Every year, SMEs miss out on around €1.8 billion in interest income because banks pass on only half of the ECB interest rates.

The silent expropriation by the banks

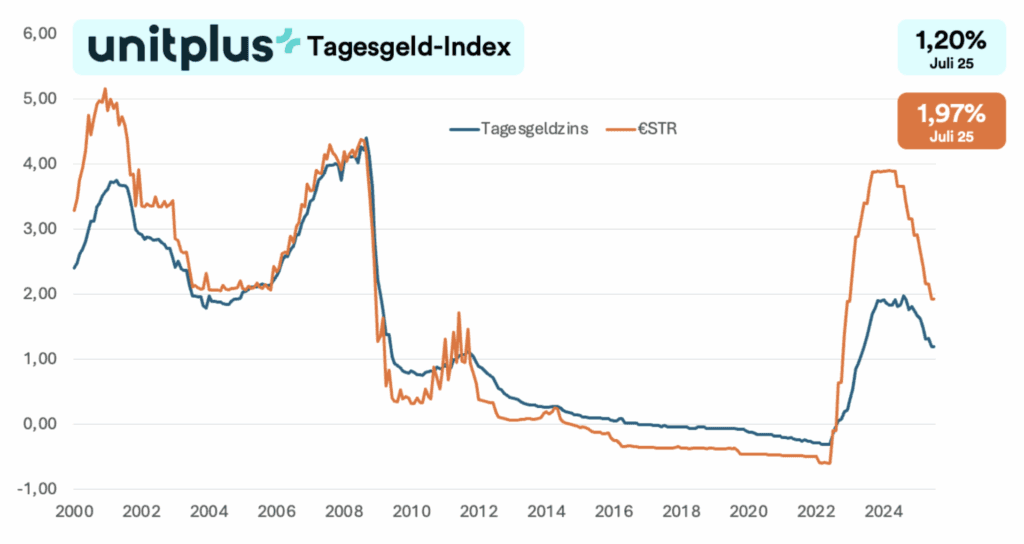

While the European Central Bank (ECB) has recently cut the key interest rate several times – now at 2.00% – banks’ pass-through of interest rates has worsened. According to the UnitPlus overnight deposit index for companies, German banks currently pass on just over 50% of possible interest to their business customers. The rest stays in the banks’ margins.

Treasury interest rates remain significantly below €STR

Overnight deposits vs. €STR, Germany, interest rates, corporate sector, by month, in % p.a.

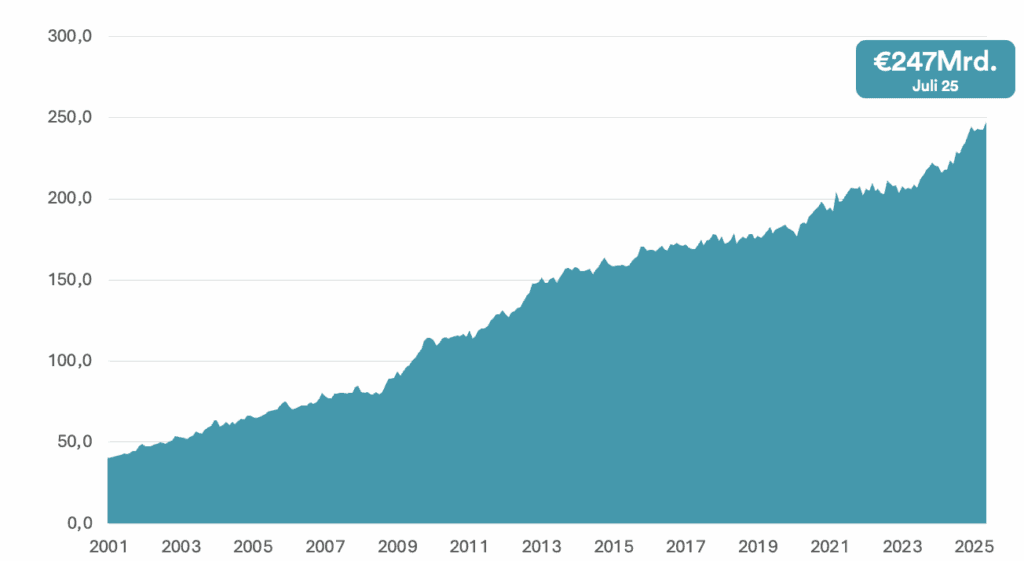

€247 billion lie idle

Especially alarming: €247 billion in corporate liquidity currently sits idle in overnight accounts – a historic high. The amount of unused potential is growing. While companies try to boost efficiency in a competitive environment, they lose billions annually simply due to poor interest rate pass-through.

Companies hold increasing amounts of overnight deposits

Overnight deposits, Germany, volume, corporate sector, by month, in € billion

Politics and banks are abandoning the SME sector

Although the economic importance of SMEs is undisputed, politics remains surprisingly reserved on this issue. At the recent “Made for Germany” summit at the Chancellor’s Office, for example, no SME representative was invited. Banks also have little incentive to reduce their margins in favor of business customers.

Companies seek alternatives

Many companies now recognize the problem and take action: they professionalize their cash management. They focus on providers that combine transparency, returns, and flexibility – like UnitPlus Business.

UnitPlus Business: Professional Cash Management for the SME sector

UnitPlus Business enables companies to invest excess liquidity securely, flexibly, and profitably. Unlike traditional banks that profit from opaque margins, UnitPlus Business is based on a fair, market-based model. It uses the institutional money and bond markets, which are available daily and independent of banks – just like successful large corporations.

As co-founder Fabian Mohr explains:

“UnitPlus Business brings the investment strategies of the world’s most successful corporations to the SMEs – putting a bit of Warren Buffett into every company.”

Conclusion: It’s time to stop the interest loss

The SMEs deserves better than low interest rates and opaque bank models. The numbers are clear: nearly two billion euros are lost annually. With UnitPlus Business, there is now a solution that gives SMEs access to professional cash strategies – simple, efficient, and transparent.

👉 Learn more at: UnitPlus Business

Kilian Siegmund