Building wealth in 2026 with the Mega-Trend of active ETFs: What you need to know

ETFs have long become mainstream: transparent, cost-effective, and tradable at any time. However, by 2026, a new generation of ETFs will be gaining more attention: active ETFs. They combine the advantages of traditional ETFs with professional management and can be particularly intriguing when markets become more volatile.

But what lies behind them? And how can private investors benefit from them?

What are active ETFs – and what makes them “active”?

Most ETFs are passive: They track an index (e.g., MSCI World). An active ETF takes it a step further. It remains an ETF with typical ETF advantages (tradability, transparency, cost efficiency) but is actively managed with the goal of controlling risks and seizing opportunities more effectively.

A common approach is the so-called “index-aware” strategy: The portfolio is benchmark-oriented but deliberately deviates in minimal steps. During this process, both the active risk and the so-called tracking error are limited. Tracking error means: How much does the performance of the portfolio differ from the benchmark?

In brief: Not “everything different,” but “purposely better” – with comparable or even lower risk.

Growth figures indicate: Active ETFs are more than a hype

The market for active ETFs has been growing above average for years. And it is expected to continue gaining momentum: Morningstar forecasts an increasing volume over the coming years – reaching up to several trillion US dollars in active ETFs. The reason is simple: Many investors want the simplicity of ETFs but do not want to forgo professional risk management.

More active ETFs are being launched in Europe as well. In Germany, UnitPlus positioned early: In 2024, in cooperation with J.P. Morgan Asset Management, the first active ETF portfolio for private investors in Germany, AktienPlus, was introduced to the market.

AktienPlus: Inside the active ETF portfolio

AktienPlus is an alternative to traditional passive ETFs and conventionally actively managed funds. The portfolio combines the advantages of traditional ETFs, such as daily tradability, transparency, and diversification, with the benefits of slightly active portfolio management by one of the largest asset managers in the world: active risk management and thus potential for excess returns versus pure market/index replication.

The product's portfolio consists of seven active equity ETFs investing globally across all regions and sectors. The portfolio management by J.P. Morgan is consciously very close to the benchmark (regions, sectors, styles) – deviations occur at the individual stock level based on fundamental research. The goal: to increase returns after costs with comparable risk.

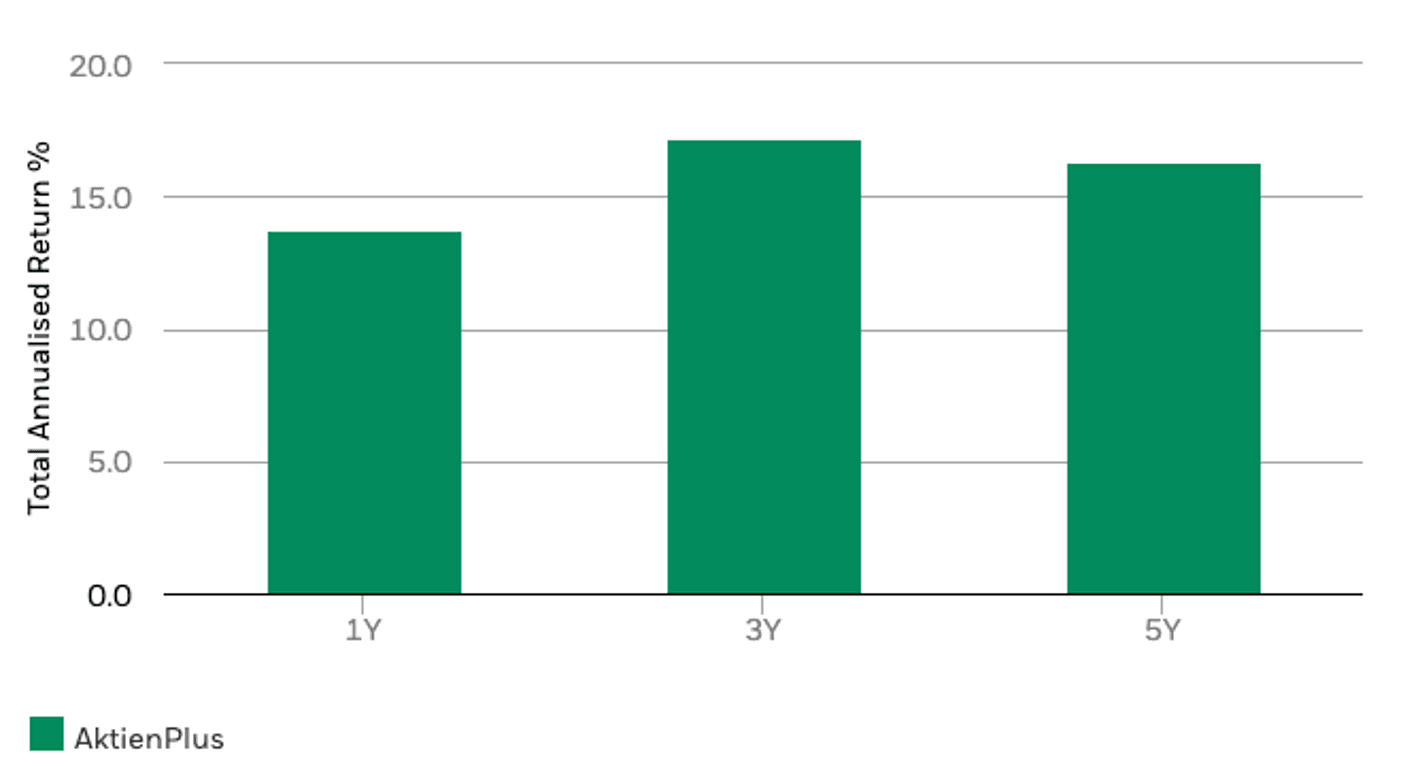

Looking at the historical performance, AktienPlus has achieved an annualized return of 16.33% per year over the past five years (period November 2020 to November 2025), outperforming the MSCI World by over half a percentage point annually.

Why active ETFs could be particularly interesting in 2026

Many market observers expect a more volatile and complex environment after years of strong stock market phases. This is precisely where an active approach offers advantages: more consciously managing risks, responding more quickly, and exploiting opportunities more selectively, without giving up the fundamental advantages of ETFs.

AktienPlus provides a convenient yet professional way to do this: digital, transparent, globally diversified, and with J.P. Morgan Asset Management as a strong partner by your side. If you want to build wealth long-term, AktienPlus can be a sensible component.

Fabian Mohr