Capital markets in the crossfire of new tariffs – why long-term investing matters now

In recent days, global financial markets have experienced significant turbulence—triggered by the renewed announcement of sweeping tariffs by the U.S. government. President Trump declared in early April that imports would soon be subject to a base tariff of 10%, with even higher rates for specific regions: 20% for the EU and a staggering 34% for China. These protectionist measures have caused widespread uncertainty internationally, sending markets around the world into a downward spiral.

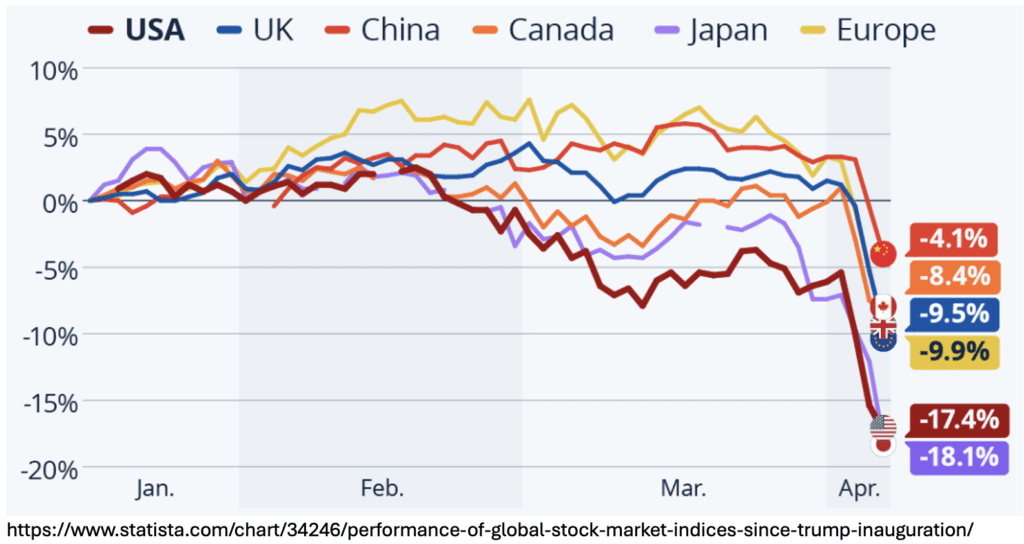

The extent of the impact is strikingly illustrated in the following chart:

Since Trump’s inauguration in mid-January, the world’s major stock markets have recorded double-digit losses in some cases. China (-18.1%) and the U.S. (-17.4%) have been hit particularly hard, followed closely by Europe (-9.9%) and Japan (-9.5%). Even traditionally stable markets such as the UK (-8.4%) and Canada (-4.1%) have not been spared. These synchronized losses clearly demonstrate how interconnected today’s global markets are—and how strongly political decisions can influence investor behavior worldwide.

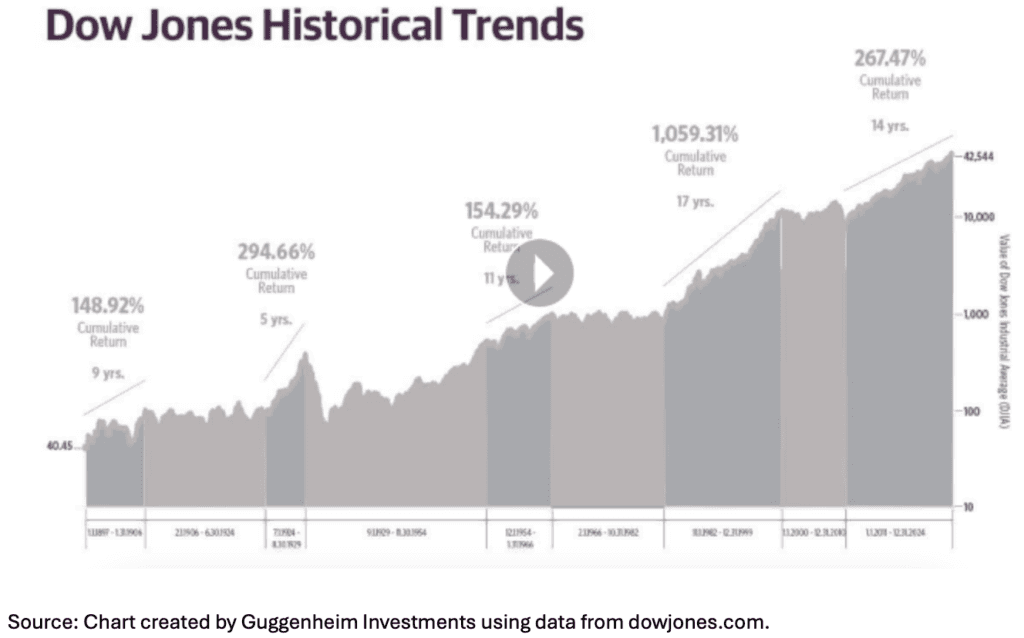

For investors, such developments are undoubtedly nerve-racking. But this is exactly where the crucial point lies: those who focus only on short-term swings often miss the broader, long-term perspective. Historically, stock markets have performed exceptionally well over time—despite countless crises, trade disputes, and geopolitical tensions. Over the past few decades, globally diversified equity portfolios have delivered average annual returns of around 8%, sometimes even higher—provided investors stayed the course and didn’t react emotionally to short-term market noise.

Times like these highlight the real value of a broadly diversified ETF portfolio. By investing across different regions, industries, and asset classes, investors not only reduce the risk of localized market downturns, but also benefit from global growth opportunities over the long run. A well-diversified investment strategy isn’t a guarantee against short-term losses—but it is the best defense against emotional decision-making and provides greater stability in the portfolio. This is also illustrated by the following chart, which tracks one of the world’s oldest stock indices—the Dow Jones—over the past decades. While there have been regular periods of drawdowns, the long-term trend has remained decisively positive.

The key, then, is to think long-term and stay invested. Those who remain calm and rely on a solid foundation of diversification and discipline have the best chance of achieving sustainable investment success—even in times of political uncertainty. This is the exact philosophy UnitPlus follows when it comes to investing.

Fabian Mohr