For a long time, an MSCI World ETF was considered the gold standard for cost-effective investment for everyone. But now the next big trend is coming from the USA, taking ETFs to a new level: Active ETFs. In collaboration with J.P. Morgan Asset Management, UnitPlus has now launched the first active ETF portfolio in Germany – an innovation that offers investors a real alternative to traditional, passive ETFs and active funds. While active ETFs are already considered a mega-trend in the USA, their potential is also becoming apparent here in Germany: they can lead to higher returns after costs in the long term. What makes AktienPlus so special and how does the portfolio compare to the MSCI World Index? We explain this in this article.

Table of Contents

What are active ETFs?

Active ETFs combine the best of both worlds: the tradability and cost efficiency of traditional ETFs with the advantages of active, professional risk management. A fund manager makes conscious decisions regarding the selection and weighting of securities in the fund. The aim is to outperform the market through sound analysis and targeted strategies – instead of simply tracking the market, as passive ETFs do. The advantages of an ETF are nevertheless retained: The costs are significantly lower than active funds and the units can always be traded.

At our partner J.P. Morgan Asset Management, the active ETFs are so-called “index-aware” active strategies. This limits both the active risk and the tracking error. The ETFs are active, but the portfolio management deliberately remains very close to the benchmark in terms of regions, sectors and styles, so that the portfolio looks like the index from a bird’s eye view. The deviations from the benchmark are based on J.P. Morgan Asset Management’s fundamental research at the level of individual stocks. The deviation per security is significantly smaller compared to active strategies with higher active risk and higher tracking error, which then deviate significantly more from the benchmark.

How does AktienPlus work?

AktienPlus is currently made up of 7 active ETFs that can be adjusted dynamically. This flexible portfolio management ensures that your investment is more crisis-resistant and future-proof – without you having to actively intervene. Especially in turbulent market phases, you can sit back and relax while your money works for you.

Source: BlackRock Portfolio 360 – Europe – Portfolio Analysis Tool

The advantages compared to the MSCI World:

Over the last 5 years, AktienPlus has achieved an annual return of just under 2% above the benchmark (before costs)

Source: BlackRock Portfolio 360 – Europe – Portfolio Analysis Tool

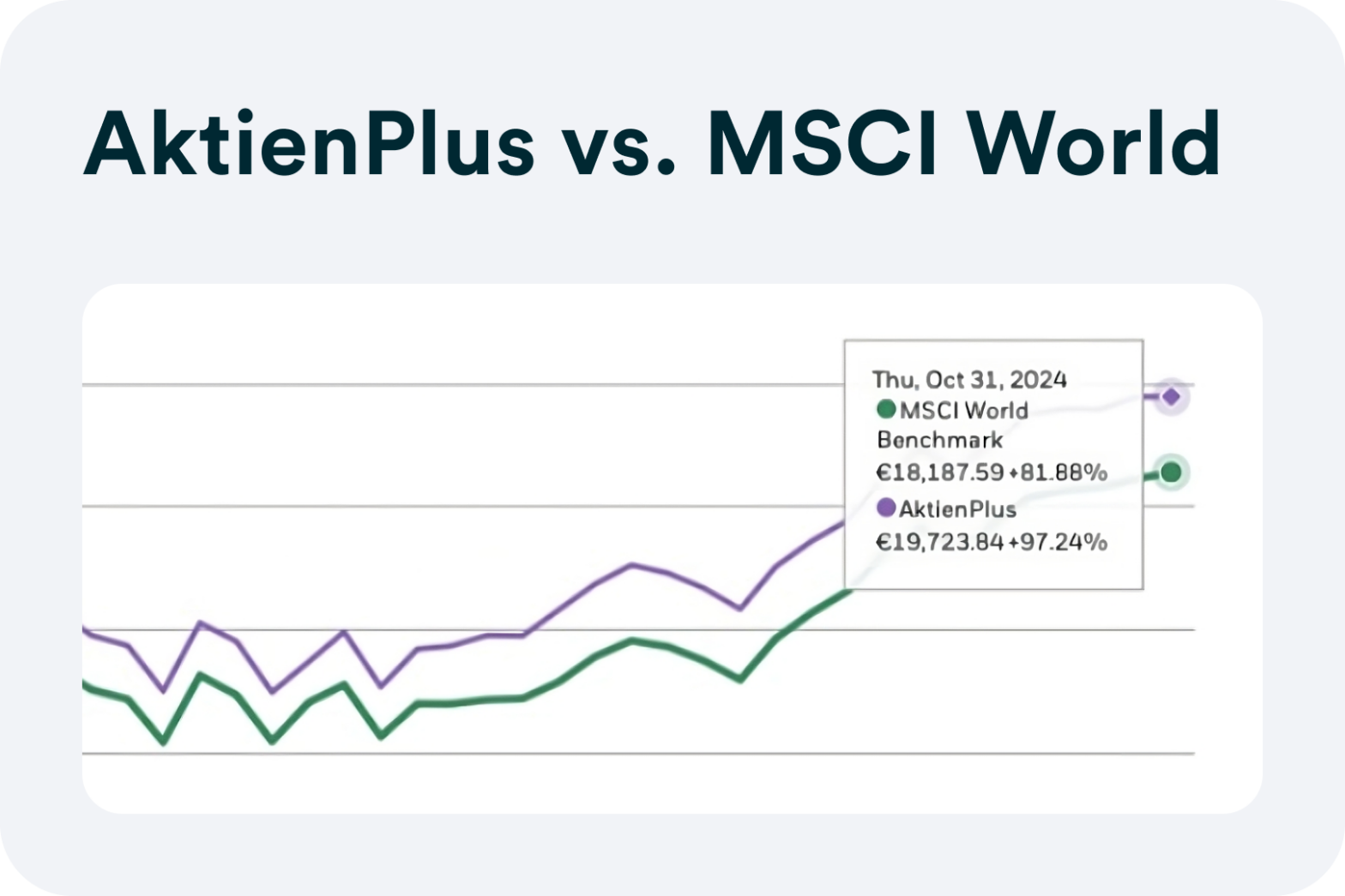

Thanks to the compound interest effect, a hypothetical investment of € 10,000 results in a final return that is over 15 % higher.

Source: BlackRock Portfolio 360 – Europe – Portfolio Analysis Tool

At the same time, there was a lower risk as measured by the standard deviation.

Costs and performance: a strong overall package

With a fee of just 0.76% per year, 0.26% of which is made up of the costs of the active ETFs and 0.50% of the UnitPlus usage fee, AktienPlus offers a cost-effective way to benefit from active strategies. Despite the costs, the annual return after costs is still higher than that of the MSCI World ETF – and with less risk.

Why AktienPlus? Your advantage at a glance

Historically higher returns after costs: market advantages are exploited through active optimization.

Lower risk: Stability through well thought-out diversification and active risk management.

Simplicity: No manual adjustments required – you invest and can sit back and relax.

Future-proof: Dynamic adjustments make the portfolio robust in the face of market changes.

And what are the disadvantages?

Even if a higher return has been achieved over the last 5 years compared to the MSCI World, this does not necessarily have to be the case in the future

Active ETFs are still a new type of investment in Germany, so you should have familiarized yourself with the advantages and disadvantages of active ETFs beforehand

Conclusion: AktienPlus sets new standards

With AktienPlus, UnitPlus and J.P. Morgan Asset Management are launching a revolutionary investment solution on the market. The first active ETF portfolio in Germany combines the strengths of traditional ETFs (liquidity, diversification, transparency) with the advantages of active management.

AktienPlus is the perfect choice for investors who want to invest for the long term and at the same time achieve higher returns with less effort. Whether for retirement provision or wealth accumulation, AktienPlus offers you the opportunity to outperform the market in the long term.

Risk warning:

This article does not constitute an investment recommendation. No advice is given to buy or sell financial instruments. Every capital market investment is associated with risks that can lead to a total loss. Historical performance is not a reliable indicator of future performance. JP Morgan Asset Management assumes no responsibility for the accuracy, completeness or timeliness of this article.