Did you know that in Germany alone, there are hundreds of billions of euros in call money accounts? The interest rates vary depending on the interest rate policy of the central bank and differ from bank to bank. Currently, up to 2% interest can be realized per year. At UnitPlus, we’re rethinking the concept of an overnight deposit account for the first time in the world. With our new FlexPlus portfolio, you can invest in a smart alternative that aims for an interest rate of around 3.5% a year and is even easier and more convenient to integrate into your everyday life. Sounds good, doesn’t it? We think so, too.

Table of Contents

What distinguishes a call money account from FlexPlus?

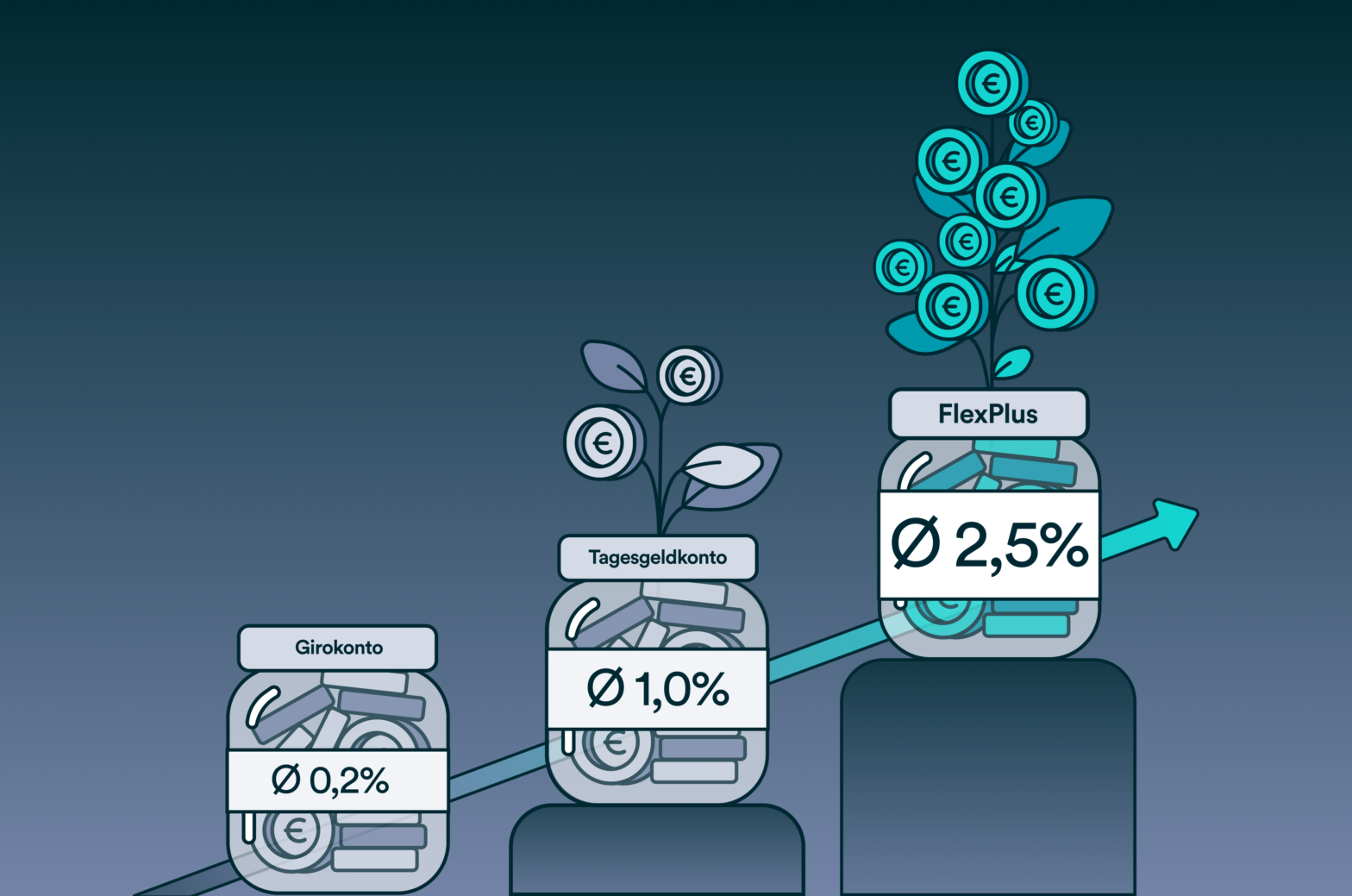

A call money account is an interest-bearing account where the account holder can dispose of the balance daily in any amount. It serves as a flexible and low-risk investment. In most cases, call money accounts are linked to a reference account from which money is transferred to the call money account and transferred back. This also means that a call money account cannot be used as a payment account or for bank transfers, for example. Currently, banks in Germany pay an average of around 1% interest on call money accounts. For instance, if there is €1,000 in a call money account, this corresponds to an interest rate of €10 per year.

At UnitPlus, we want to think about overnight deposit accounts more innovatively and profitably with our new FlexPlus portfolio. As with our other portfolios, money can be easily and conveniently invested in FlexPlus and used for payments worldwide free of charge. The unique feature: FlexPlus invests the money exclusively in short-dated European government bonds with a high credit rating and low probability of default. Consequently, there is no equity component. However, government bonds cannot completely rule out a risk of loss. Nevertheless, this slightly increased risk is offset by a targeted annual return of 3.5%.

Compared to overnight deposit accounts, on which banks pay interest, FlexPlus, therefore, makes it easy and convenient to invest in government bonds, which also pay annual interest (in the case of bonds, this is referred to as coupons) that is often higher than the interest rates on overnight deposit accounts. In addition, there is always the possibility to directly pay with government bonds worldwide free of charge, which is not possible with overnight deposit accounts.

In which countries does FlexPlus invest the money?

To ensure that the FlexPlus portfolio has no exchange rate risk, it invests exclusively in European government bonds. To enable a broad diversification here as well, the money is not invested in just one country but in 10. As seen in the table below, Italy, France, and Germany take the three most prominent positions.

| Country | FlexPlus |

| Italy | 32% |

| France | 22% |

| Germany | 24% |

| Spain | 14% |

| Belgium | 1% |

| Netherlands | 3% |

| Austria | 1% |

| Portugal | 1% |

| Ireland | 1% |

| Finland | 1% |

What advantages does FlexPlus offer me?

FlexPlus is not a call money account, but by investing money in low-risk government bonds, it achieves a return on the capital market that tends to be higher and, at the same time, has a direct payment option.

The most important advantages at a glance:

- Investing in European government bonds is comparatively low-risk

- Government bonds currently pay an annual return that is mostly higher than the interest rates on overnight deposit accounts

- Money is invested directly in the capital market, while banks still want to make a profit

- Government bonds can be used to make payments worldwide at low risk and free of charge

And what are the disadvantages?

Because FlexPlus does not park the money in banks but actively invests it in the capital market, there is a risk of loss. Even though government bonds are considered particularly low-risk, the risk can be minimized but not completely eliminated.

UnitPlus says bye, bye call money, and hello FlexPlus

With the new FlexPlus portfolio, unused money can be invested at comparatively low risk. In addition, users can make free, offline, and online payments directly with the portfolio at any time. Users can also change their portfolio in the app at any time, free of charge. To offer an even more effective investment in the future, the possibility of investing in several portfolio strategies simultaneously will also be made possible over the next few months.

Risk Notice:

This article is not intended as an investment recommendation. Nor is it advice to buy or sell financial instruments. There are risks associated with capital market investments that can lead to a total loss. Historical earnings performance is not a reliable indicator of future performance.