In collaboration with J.P. Morgan Asset Management, UnitPlus launched Germany’s first active ETF portfolio in November 2024—an innovation providing investors with a real alternative to traditional passive ETFs and actively managed funds. While active ETFs are already a mega-trend in the US, their potential is now becoming evident in Germany as well: they can lead to higher long-term returns, even after fees, and offer active risk management to better navigate market volatility, reducing risk compared to conventional ETFs.

Table of Contents

What are Active ETFs?

Active ETFs combine the best of both worlds: the tradability and cost efficiency of classic ETFs with the advantages of active, professional risk management. We’ve discussed active ETFs extensively in our article “How AktienPlus is Setting New Standards for Investing in Germany”.

Active ETFs can have different objectives. Unlike high-risk approaches, like that of Cathie Wood, AktienPlus follows an “index-aware” active strategy. This means that both the active risk and the tracking error—the deviation from the benchmark—are controlled. The portfolio managed by J.P. Morgan Asset Management remains close to the benchmark in terms of regions, sectors, and styles. Deviations occur based on J.P. Morgan’s fundamental research at the individual stock level. As a result, deviations per stock are significantly smaller compared to high-risk approaches like Cathie Wood’s.

How Does AktienPlus Work?

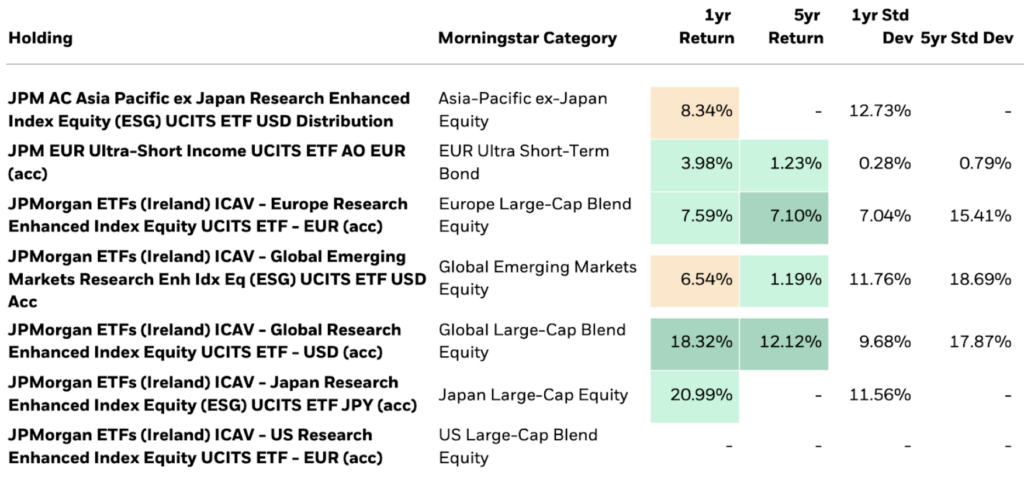

AktienPlus currently consists of 7 active ETFs that can be dynamically adjusted. This means the portfolio can flexibly include more or fewer active ETFs as needed. This flexible portfolio management ensures that your investment remains resilient and future-proof, even during turbulent market phases—all without you needing to take any action. In uncertain markets, you can sit back and let your money work for you.

How Does AktienPlus Compare to the MSCI World?

Let’s look at the actual realized returns and the risk level of AktienPlus over the past five years (01.01.2020 to 01.01.2025) compared to the MSCI World. The MSCI World serves as the benchmark, as both portfolios invest globally in equities and reflect the global stock market.

✅ AktienPlus Outperforms in Terms of Returns (After Costs)

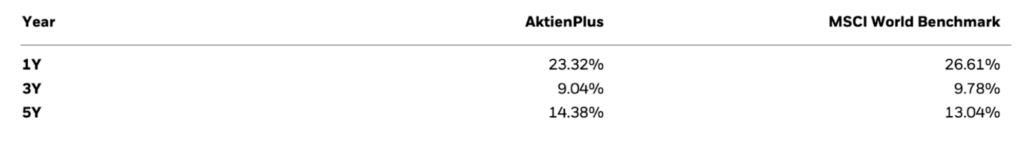

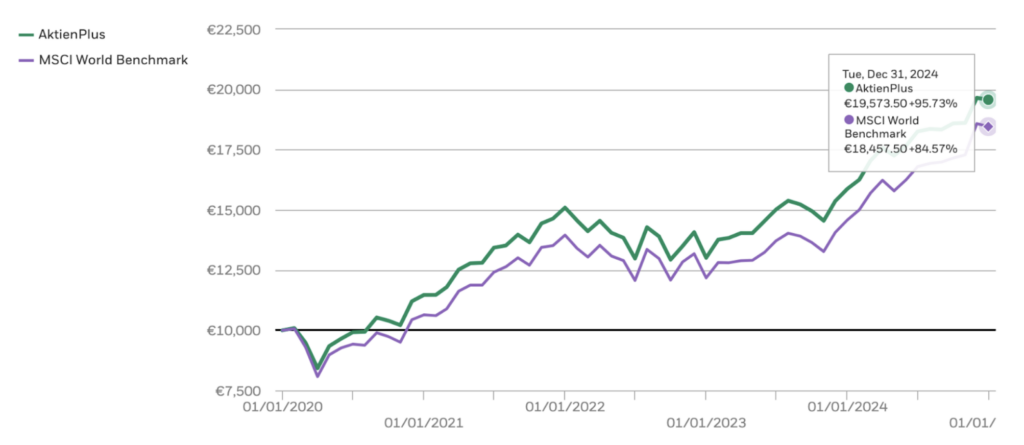

The following evaluation shows the realized returns of AktienPlus compared to the MSCI World. Over the five-year period, AktienPlus achieved an annualized return of 14.38%, more than 1 percentage point per year higher than the MSCI World.

Looking at a hypothetical investment of €10,000 at the beginning of 2020, the compounding effect results in over €1,000 more returns after five years with AktienPlus.

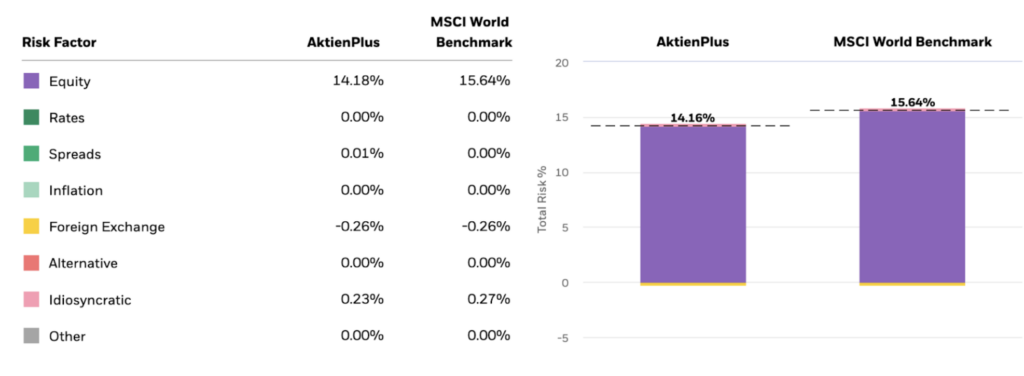

✅ AktienPlus Has Lower Risk (Volatility)

When examining the portfolio’s volatility—the measure of price fluctuations—AktienPlus exhibits lower volatility than the MSCI World. This means higher returns with lower risk.

In today’s uncertain environment, where markets face high valuations and unpredictable events (e.g., threats of tariffs under Donald Trump or Europe lagging economically), active risk management offers opportunities that a passive ETF simply cannot.

Costs and Performance: A Strong Overall Package

With an annual fee of only 0.76%, composed of 0.26% for active ETFs and 0.50% for UnitPlus’s usage fee, AktienPlus provides a cost-efficient way to benefit from active strategies and the expertise of one of the world’s most renowned asset managers.

Despite the fees, the portfolio’s annual returns after costs still outperform the MSCI World ETF—and with significantly lower risk.

Moreover, AktienPlus integrates seamlessly with other UnitPlus products, such as alternatives to day and fixed-term deposits and the award-winning multi-asset strategies from the Berg series. This allows you to cover all time horizons for your investments optimally with UnitPlus.

Conclusion: AktienPlus as a Quality Leader in Investing

Together with J.P. Morgan Asset Management, UnitPlus introduces a revolutionary investment solution with AktienPlus. As Germany’s first active ETF portfolio, it combines the strengths of classic ETFs with the advantages of active management. In its first weeks after launch, AktienPlus has already exceeded expectations and established itself as a professional companion for long-term investing.

For investors looking for long-term growth with higher returns and minimal effort, AktienPlus is the perfect choice. Whether for retirement savings or wealth accumulation, AktienPlus offers you the chance to outperform the market over the long term.

Risk Disclaimer:

This article does not constitute investment advice. It does not recommend the purchase or sale of financial instruments. Every capital market investment involves risks, including the risk of total loss. Past performance is not a reliable indicator of future performance. J.P. Morgan Asset Management does not guarantee the accuracy, completeness, or timeliness of this article.