The UnitPlus Mountain portfolios are particularly suitable for long-term asset accumulation and were recognized as the best investment newcomer of 2023 in Germany last summer by the Institut für Vermögensaufbau.

To ensure the portfolios achieve attractive long-term performance with moderate capital market risk, we constantly review the composition of the portfolios and optimize them if necessary. We are carrying out such an optimization now by replacing 3 ETFs.

Table of Contents

This gives you three advantages:

1. The external costs for the ETFs are reduced from 0.19% of the invested money per year to 0.17%

2. The historical return of the three new ETFs has in some cases significantly exceeded the historical return of the three existing ETFs, which indicates a more effective composition of the ETFs and thus also makes the Mountain portfolios more future-oriented

3. With Xtrackers and BNP Paribas Asset Management, two renowned ETF providers have been added to the portfolios, which increases the provider diversification of the Mountain portfolios

Please make sure that your app is updated to the latest version to ensure the new ETFs are displayed correctly.

What is actually changing?

The MSCI World ETF from iShares, which invests globally and adheres to strict sustainability criteria, is being replaced by the MSCI World ESG ETF from Xtrackers. The reason for this is that the new ETF achieved a higher return of 8.03% over one year and a higher return of 4.76% over three years. Although historical performance is not indicative of future performance, the Xtrackers ETF has advantages due to its composition while still maintaining stringent sustainability criteria via the ESG approach.

The iShares MSCI Emerging Markets ETF used for emerging markets is replaced by an emerging markets ETF from Amundi. The main reason for this is that the total expense ratio can be reduced from the previous 0.25% to 0.18%. This product also achieved a 1.93% higher performance over the past year.

Thirdly, the sustainable Japan ETF will be replaced. Instead of an iShares ETF, an ETF from BNP Paribas Asset Management will be used in future. The ETF’s lower fees of 0.16% compared to the previous 0.20% and the overall very good performance are convincing. Incidentally, when constructing the portfolios for the first time, our portfolio experts explicitly opted for a Japan ETF in the portfolio in order to achieve greater diversification in the portfolio. A decision that has also been rewarded with a very attractive return, as the Nikkei 225, Japan’s most important share index, has climbed from one all-time high to the next all-time high in recent months.

Do you need to take action?

The change of ETFs is automatically made by our system at no cost. To avoid any negative tax implications, the old holdings will remain in the portfolio, and new investments will purchase the new ETFs. For withdrawals, the old ETFs are sold first, resulting in a gradual transition of the portfolios to the new structure over time.

If you have not yet invested in any of the UnitPlus Mountain portfolios, this may be a good opportunity to start and build up a long-term capital cushion to achieve your financial goals and provide for your retirement. You can easily set up your Mountain portfolio in the app.

What will happen to the Mountain portfolios in the future?

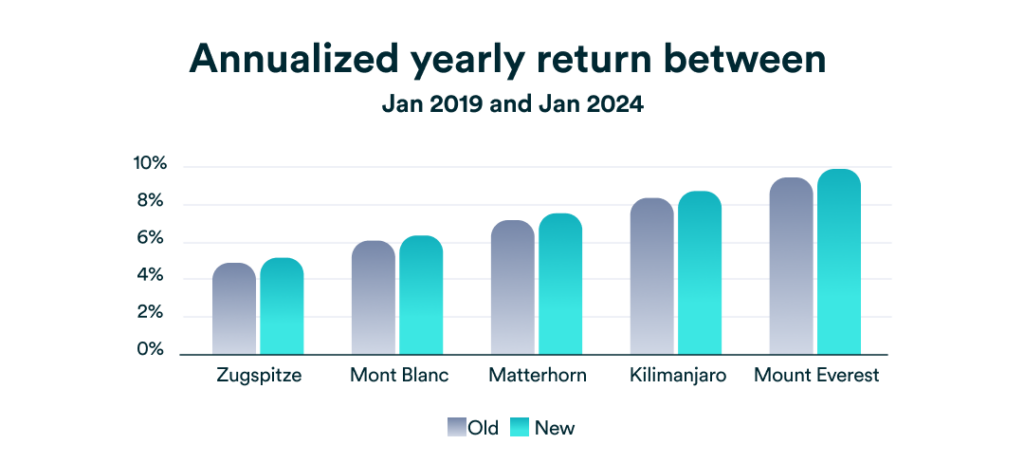

As the following chart shows, the Mountain portfolios have performed very well overall over the last 5 years and have achieved annual returns of over 5% to just under 10%. As a result of the changeover that is now taking place, the annual return would have been between 0.2% and 0.4% higher per year. The very positive return development could also be achieved with a lower risk compared to an investment in just a few shares or just a few ETFs.

Please note: Past performance is not a guarantee of future returns.