On the stock market, you can invest your money not only in shares but also in funds. One particular type of fund has been in vogue for years are so-called Exchange-Traded Funds (ETFs). In this context, the Financial Times speaks of the coming age of the ETF and describes ETFs as one of the most critical inventions in financial history. But what exactly are ETFs, and why are they so popular?

Table of Contents

Actively managed funds vs. ETFs

A fund is a compilation of various financial products such as stocks, bonds, or real estate assets. Investments are always subject to fluctuations. If a stock in the fund loses value, it is not the end of the world because the other fund components can compensate for these losses. Mutual funds, therefore, have one significant advantage – they spread risk. Here you can find out what actively managed funds are and to what extent they can be helpful to you.

ETFs are classic investment funds that bundle a portfolio of securities. The remarkable thing about ETFs compared to regular index funds is that they are traded on the stock exchange. So they can be bought and sold on the stock exchange at any time, just like stocks.

Since much can be automated and ETFs are usually passively managed by a computer system, investors benefit from lower fees than actively managed funds. In addition, ETFs allow for tracking price development in real-time.

The history of ETFs

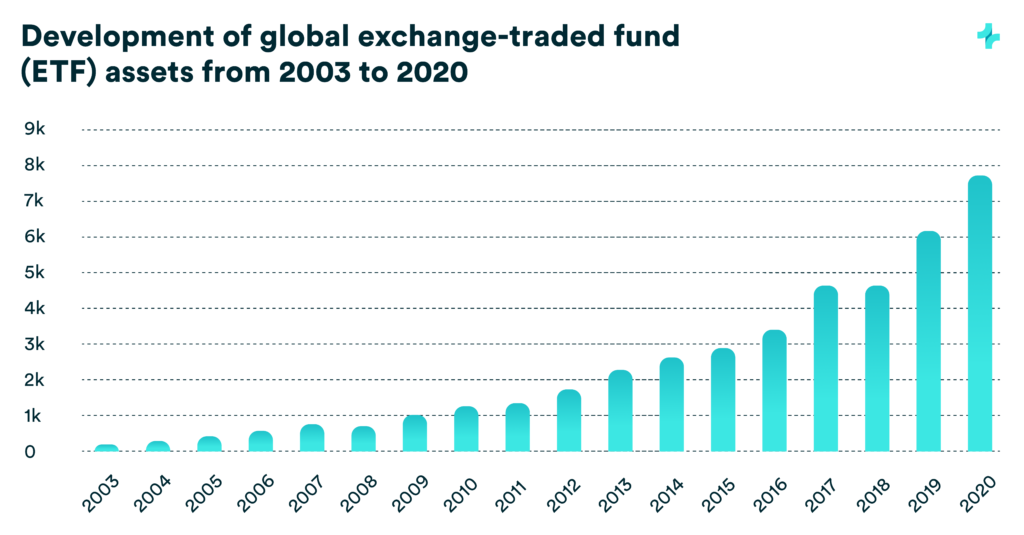

In 1993, the first known ETF – the SPDR, which tracks the S&P 500 (including 500 U.S. stocks) – was listed in the United States. This ETF was so successful that it quickly became the template for an industry now worth nearly $8 trillion. Ten years later, ETFs were also offered in Europe, wherein Deutsche Börse was a pioneer with two ETFs.

One of the best-known indexes is the MSCI World, which is tracked by many ETFs. The MSCI World is composed of nearly 1,600 stocks from around the world and has been traded since 2005. Today, there are about 7,000 ETFs worldwide. Especially in the low-interest environment, ETFs have become interesting for private investors. As a result, the ETF market has been proliferating for years.

Development of assets of global exchange-traded funds (ETFs):

Source: Statista

The choice of ETFs is wide

Today, there are not only equity ETFs on indices (such as the DAX ETF), but also on bonds, such as government and corporate bonds; on individual sectors, such as finance, pharmaceuticals, or technology. Furthermore, there are also ETFs on commodities, such as gold or water, and special ETFs that focus only on stocks in individual countries. With so-called short ETFs, it is also possible to speculate on falling prices. Finally, leveraged ETFs, which disproportionately weigh a change in the underlying index, offer exceptionally high profits – but can also result in high losses.

What are the advantages of ETFs?

The exponential growth rates reveal: ETFs are becoming increasingly popular. We have summarized the most important reasons why ETFs are so popular:

- Low costs: fund management fees for ETFs are significantly lower compared to actively managed funds.

- Low risk: With ETFs, you automatically invest in hundreds or thousands of companies, so the risk is widely spread.

- Flexibility: Since ETFs are traded on the stock exchange, they can be bought and sold quickly and safely.

- Transparency: Since ETFs track an index, investors know exactly what they are investing in.

- Security: The capital is protected by law from the access of possible creditors if an ETF provider files for insolvency.

- Versatility: The choice is enormous and ranges from ETFs on indices to commodities to ETFs on shares of individual countries or regions. Meanwhile, there are even active ETFs, but more on that in another blog post.

- Simplicity: ETFs are easily accessible even for non-financial experts.

How do we deal with this at UnitPlus?

At UnitPlus, we’ve created a variety of ETF portfolios based on ESG (Environment, Social, Governance) criteria. This allows you to invest your money in over 800 companies that meet stringent environmental, social, and governance requirements. More about our investment and portfolios can be found HERE.