Today we would like to introduce our four UnitPlus portfolios in more detail. First of all, all portfolios were put together with the utmost care. That’s why we think all four portfolios are equally great.

Table of Contents

The secret recipe – portfolio construction

The portfolio construction is carried out with the help of a particular choice of exchange-traded index funds, or ETFs. The most crucial ingredient in our portfolio construction is a broad investment diversification, taking into account an adequate risk-return ratio and recognized sustainability criteria. The investment diversification is global and very broad across the two asset classes, equities, and bonds. The four portfolio concepts available at UnitPlus pursue an identical market strategy but differ in the target weighting of the respective ETFs. This results in four risk profiles seeking the same investment policy with differing risk-return ratios.

Stocks or bonds? Yes, both.

Our four portfolios bear the names of well-known mountains. The height of the mountains symbolizes the respective risk-return profile. The higher the mountain, the higher the potential return and risk of loss. This means that the Zugspitze portfolio, for example, is less risky than the Mount Everest portfolio. However, this also means that it is likely to generate a lower return in the long run.

Investments are broadly diversified worldwide in over 800 different companies within the equity portion. At the same time, through sustainability criteria, investments are not made in companies that obstruct this objective. In addition, the geographical allocation of the portfolios is divided between the US market, Europe, Japan, and emerging markets, to avoid overweighting in individual regions or countries.

A distinction is made between government and corporate bonds in the bond asset class. Sustainability criteria are also considered with our ESG approach and the focus on green bonds. In the case of green bonds, proceeds are allocated exclusively to projects promoting the climate or other ecological purposes.

Also suitable for non-mountaineers

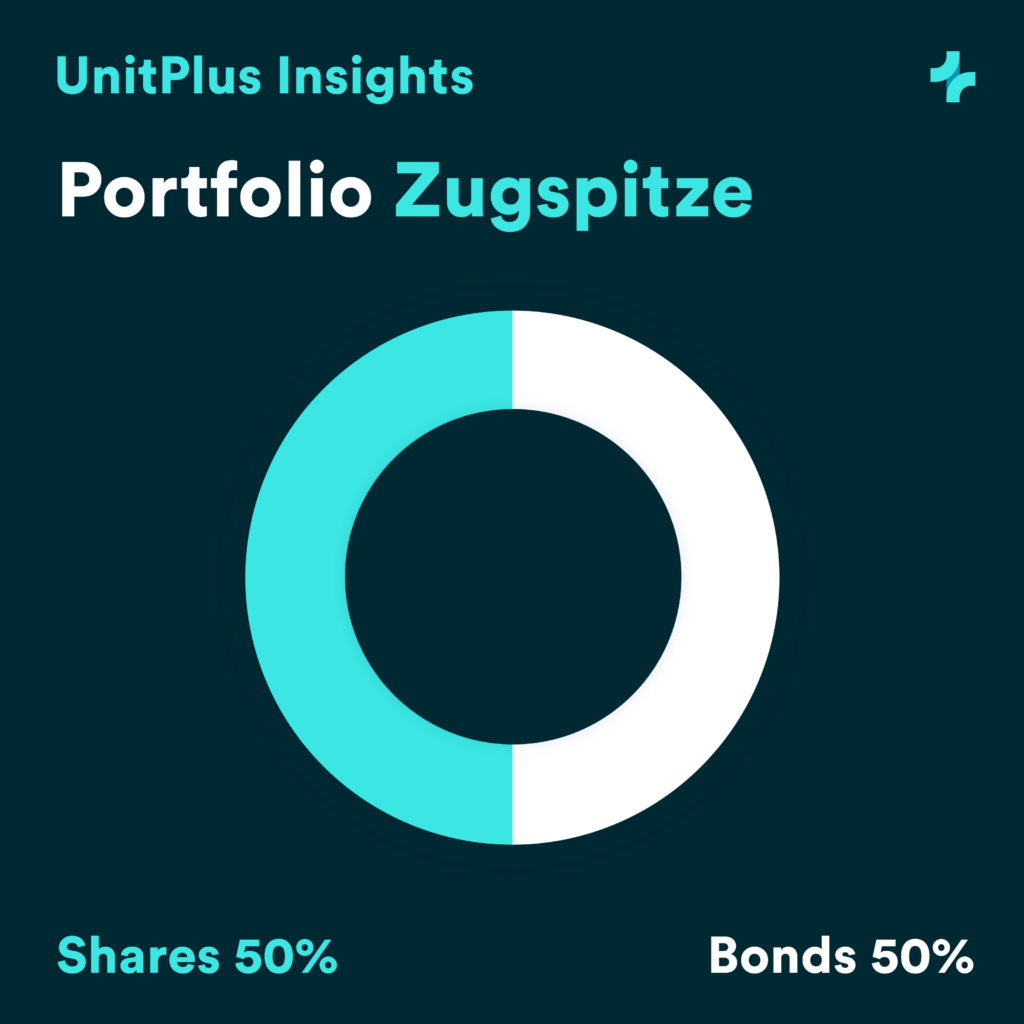

With our Zugspitze portfolio, you invest 50% in equities and 50% in bonds. It is the most risk-free UnitPlus portfolio, as the share of bonds is the highest here at 50%.

In 2021 the portfolio could achieve a positive return of about 12%. However, it is also important to mention that a historical yield development does not allow any conclusions to be drawn about future yields. Therefore, the risk of a negative return development is present at all times but is the lowest among our four UnitPlus portfolios.

When you pay with your UnitPlus card, card payments are moderately exposed to the stock market because 50% of your money is invested in bonds, which have relatively less risk.

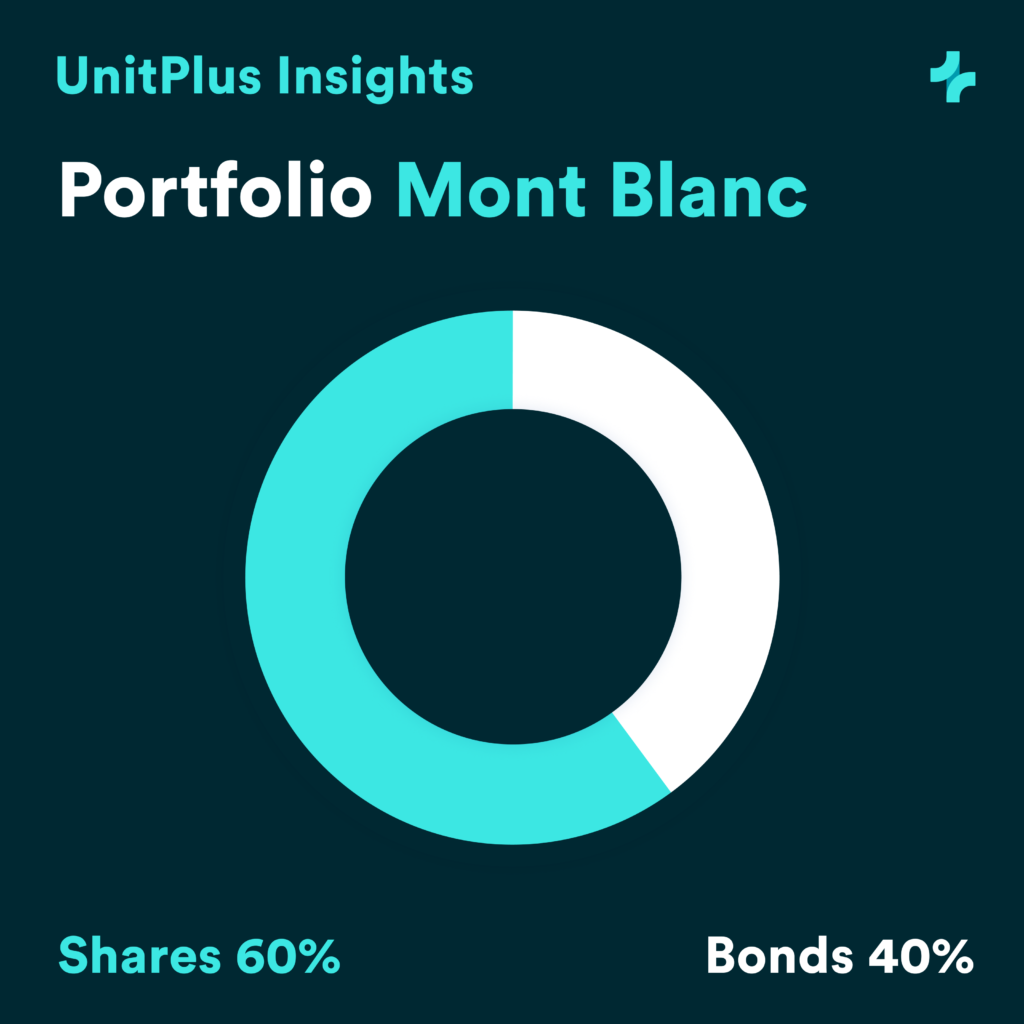

Mont Blanc is the highest mountain in Europe. Therefore, this portfolio is slightly riskier than the Zugspitze portfolio. With Mont Blanc, you invest 60% in stocks and 40% in bonds.

Last year, this portfolio generated about 15% in returns. But, as you might guess, your card payments are a bit more dependent on the stock market

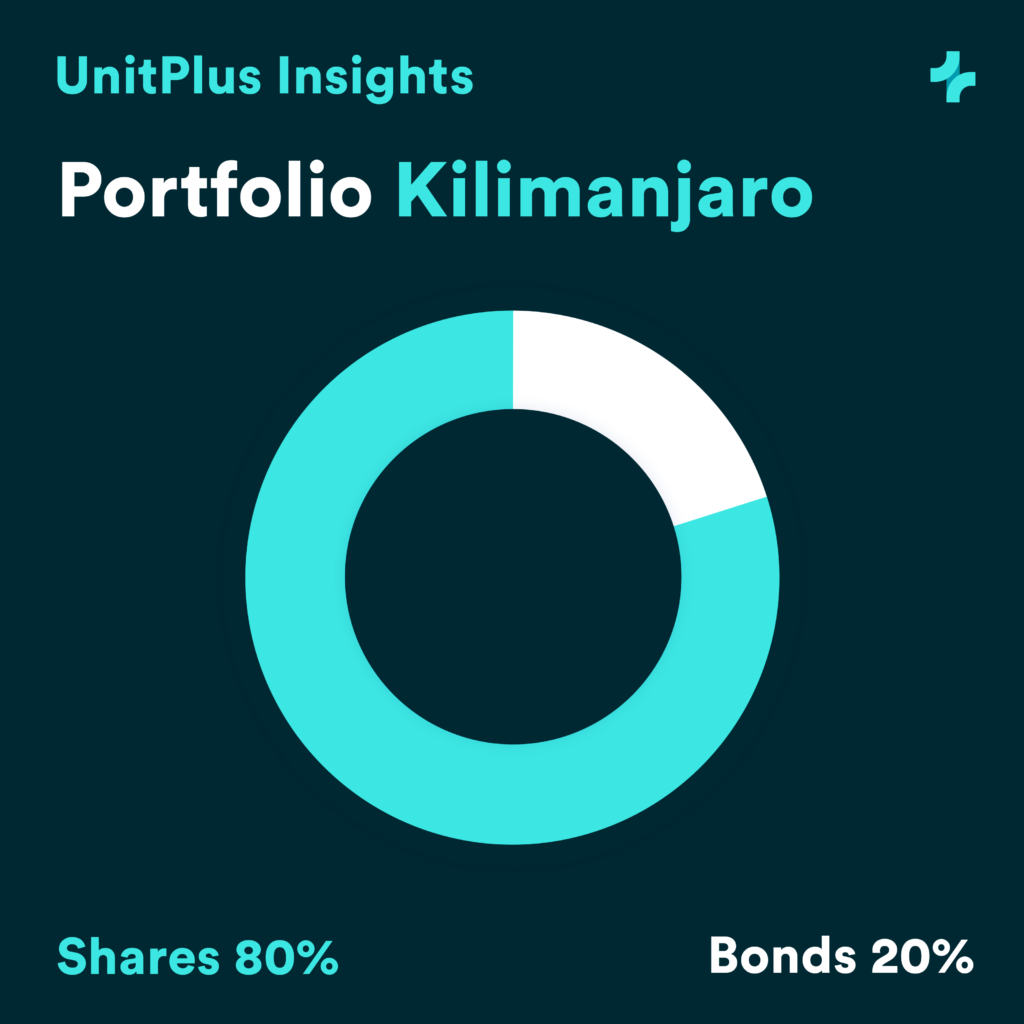

If you want to pay with your UnitPlus card, the payments strongly depend on the stock market.

Africa’s highest mountain is called Kilimanjaro. At UnitPlus, the Kilimanjaro portfolio invests 80% in equities and 20% in bonds. Because the stock markets had an above-average year last year and our Kilimanjaro portfolio has a high proportion of equities, it also achieved a higher return of around 20% than the two previous portfolios. The risk of loss is correspondingly higher.

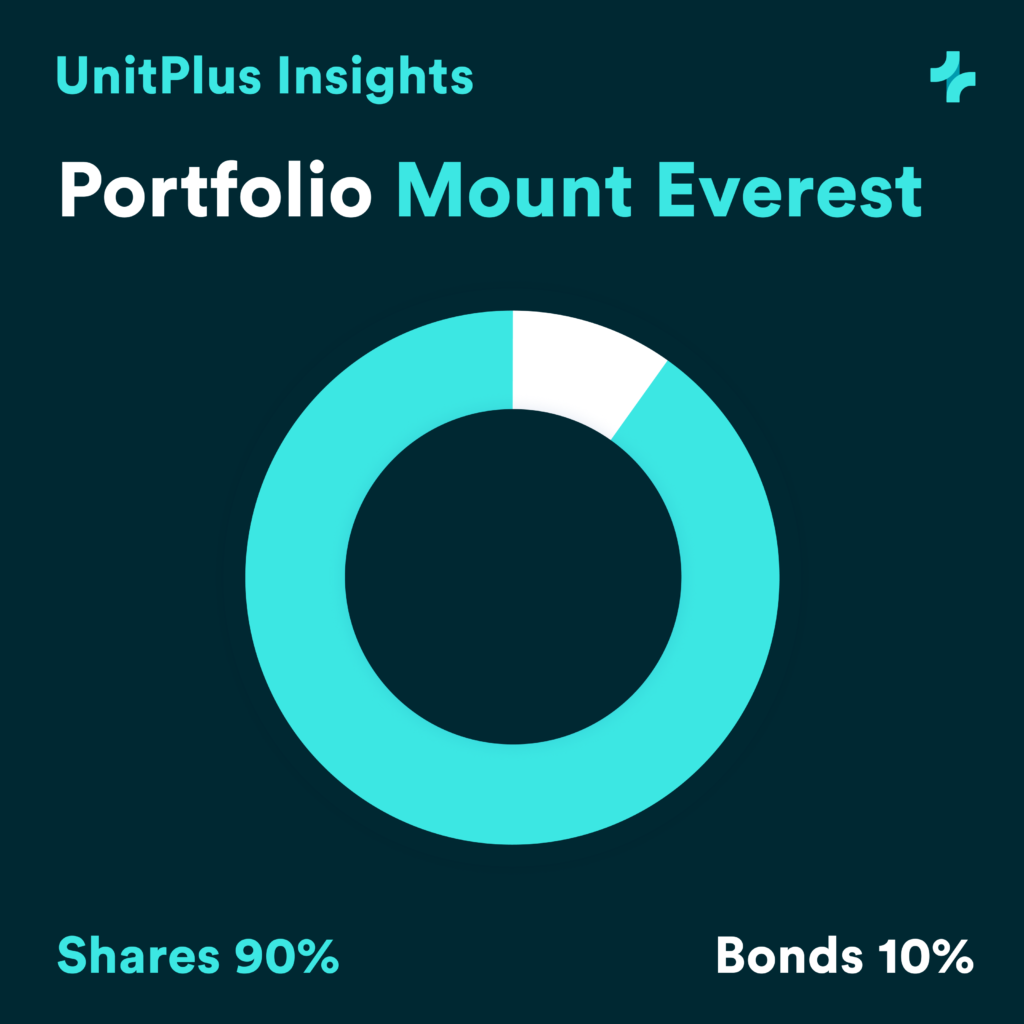

Our fourth and final portfolio is called Mount Everest. It invests 90% in stocks and 10% in bonds and thus has the highest risk-return profile at UnitPlus.

Last year, the high risk was rewarded with a positive return of around 23%. On the other hand, of the four UnitPlus portfolios, the risk of loss is also highest here. When making payments with your UnitPlus card, payments are very dependent on the stock market.

Summary

All four portfolios invest globally on a broad basis in over 800 companies and according to recognized sustainability criteria. Each portfolio has a different proportion of equities and bonds. As a rule, the higher the ratio of stocks in the portfolio, the higher the portfolio’s risk. The higher risk may be rewarded with a higher return in the long run, but it may also fluctuate more.

We hope you enjoyed this brief introduction to our four portfolios. Anyone who wants to know even more can download our UnitPlus whitepaper on investing for free on our website.

Have fun while smartly investing.