You’ve probably heard of the word inflation – especially in the news – but what exactly is inflation, what does it do, and how does it affect your finances? That’s what you’ll find out in this article.

Table of Contents

What exactly is inflation?

Inflation translates to “swelling” and measures how much prices for goods and services increase over time. The inflation rate indicates, as a percentage, how much prices rise in a year across the economy.

It is still essential to understand that prices do not rise by the same amount for everything. For example, if the inflation rate is 2%, the prices of apples and pens will not increase by exactly 2% each. But on average, the prices of all goods (i.e., all types of apples you find on the German market and all ballpoint pens of all colours and shapes as well as all other goods and services) increase by 2%.

How is inflation measured?

To measure inflation, a fictional basket of goods representative for the economy is compiled with 600 goods (you already know apples and pens) and services (e.g., blogger, songwriter). The prices of these goods and services are determined and compared with the prices in the previous year. The percentage increase corresponds to the inflation rate.

Why is there inflation?

Three factors influence inflation: increasing money supply, increased demand, and lack of supply. But one at a time.

Increasing money supply: The central bank partly decides to raise the money supply. This is to increase the liquidity (the financial resources available) of people and companies, which stimulates the economy. But if the money supply increases more than the quantity of goods and services (output) does, prices rise.

A simple example clarifies this: imagine there are only two goods in an economy, e.g., two identical racing bikes. This is matched by a money supply of 4,000 EUR, i.e., 2,000 EUR per racing bike. If the central bank now increases the money supply to, e.g., 6,000 EUR without offering more racing bikes or other outputs, each racing bike would cost 3,000 EUR. The prices for racing bikes increase – but you do not earn more. The result is money supply inflation.

Increased demand: Let’s remember an age-old economic concept: prices are driven up if demand is greater than supply. Increased demand can have different backgrounds; maybe a product is hot right now – or a pandemic breaks out, and suddenly everyone wants to buy masks or toilet paper. If demand for specific outputs increases, prices will rise, provided that production cannot be increased (at least in the short term). Demand is greater than supply; therefore, prices rise, and demand inflation occurs.

Lack of supply: the scarcity of an output increases the price. Gold, for example, is a limited commodity that is very expensive. Oil, too, is only available in limited quantities in the world. If, for example, Germany’s trade relations with an oil producer go down the drain, the price increases while demand remains constant. Companies pass on increased costs to consumers. As a result, employees demand higher wages. This increases the companies’ production costs, which leads to supply inflation.

And what is deflation?!

Deflation is the opposite of inflation. If prices fall, goods and services become cheaper. Consumers can buy more for their money. The problem with deflation, or too low inflation, is that people are discouraged from consuming because they think prices will continue to fall. Although the thought of lower prices sounds excellent, the continued decline in spending can slow economic growth, causing businesses to go bankrupt and unemployment to rise. Deflation is a long-term poison for the economy.

Central banks as watchdogs

The so-called central banks regulate the financial markets and act as watchdogs to keep inflation in check. In Germany, the European Central Bank (ECB) controls inflation. The ECB recently raised its inflation target to two percent, which has not yet been achieved.

Inflation in Germany

At 3.9 percent, inflation in Germany is at its highest level in almost 30 years (as of Sept 2021). In August 2021, goods and services were on average 3.9 percent more expensive than in the same month of the previous year. The Federal Statistical Office even expects the figure to climb further to 5 percent!

What does inflation mean for you and your finances?

Inflation eats up your savings. It causes you to lose purchasing power – or, put simply, you can afford less in the future with the same amount of money as you can today.

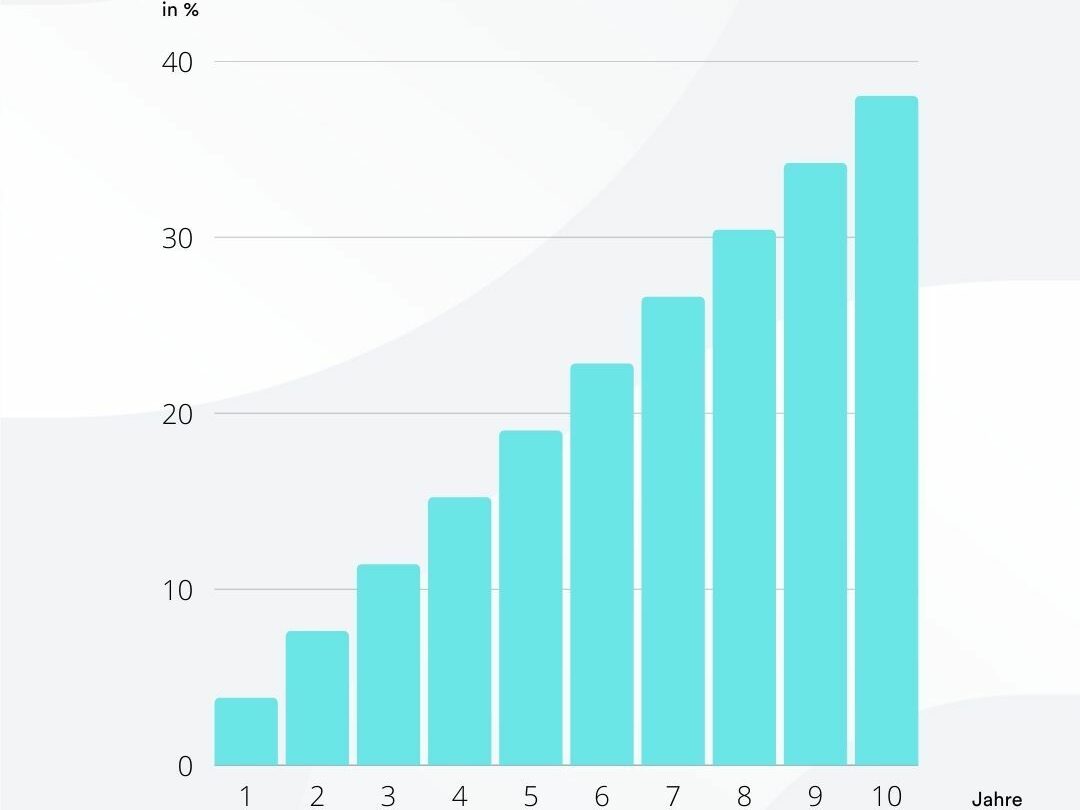

Let’s look at a simple example to understand how inflation affects your money. With an inflation rate of almost 4 percent over the next ten years, your 100 EUR will be worth only 62 EUR. In other words, you have lost 38 EUR and thus ~40% of your purchasing power.

Inflation and what now?

With interest rates near zero and inflation rising, your savings are being eaten up as we speak. As a result, the money lying around in your savings account will be worth less tomorrow than it is today. Therefore, you should think about alternatives and invest your money wisely – so that your hard-earned savings don’t diminish over time but grow.