You save up for a long time for many things in life, such as your dream apartment, a nice vacation, or a new car, unless you happen to win the lottery. That’s why it is logical to invest your money to generate a long-term return on your invested money. The so-called compound interest effect gives you a power boost without you having to do anything. Here you can find out what the compound interest is and what Albert Einstein allegedly said about it.

Table of Contents

The “eighth world wonder”

Compound interest refers to the effect of the interest you earn on your invested money, which in return makes interest again. This means that if the interest rate remains the same, you will receive more interest every year, which means that your savings will grow steadily. Because the effect is often underestimated but very powerful over a longer period, Albert Einstein referred to it as “the most powerful force in the universe” and the “eighth wonder of the world.” Sounds impressive? Let’s take a closer look at the whole phenomenon.

1 and 1 becomes 3

It makes sense to explain it with a simple example to understand compound interest better. Let’s assume that we have 1.000€ on our savings account. This savings account pays us 5% interest every year. With this interest rate, we would then receive 50€ of interest after the first year, which would increase our savings to 1050€. In the second year, the 1,050€ would then earn interest, bringing our interest in the second year to 52.50€. Therefore, after the second year, we would have 1,102.50€ in our account.

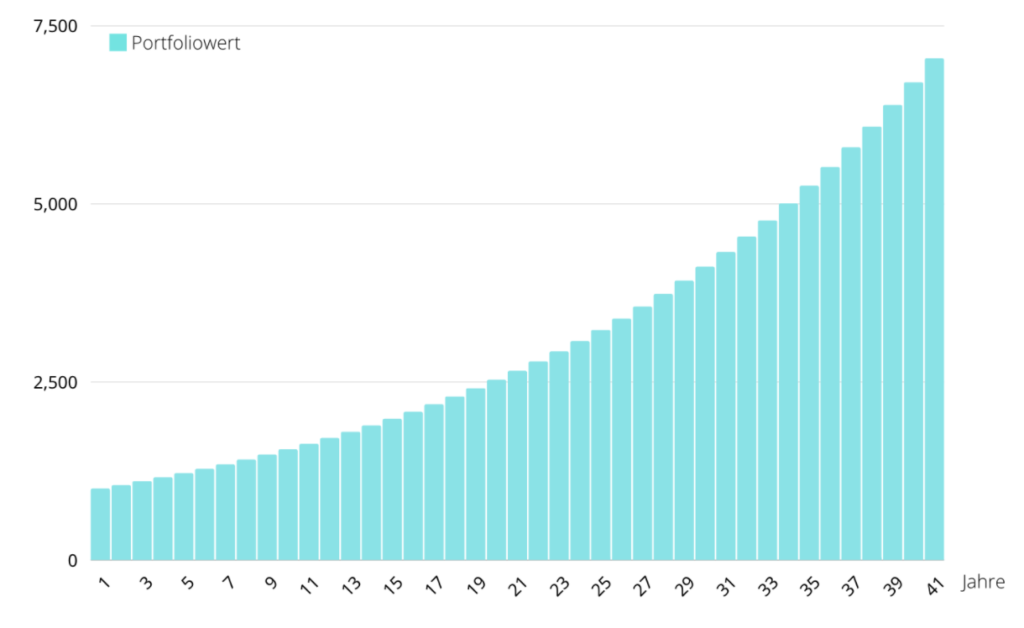

Now imagine that you would invest your money for 40 years:

The graph shows that the increase in interest rates over time becomes more significant as more interest is paid each year due to the compound interest effect. Therefore, we like to take advantage of this trend.

However, since there is currently hardly any interest left on savings and bank accounts, it can make sense to invest at least part of your money elsewhere to achieve this effect. This is where UnitPlus comes to your rescue. With us, you don’t leave your money lying in your bank account but invest it broadly and sustainably in the capital market in a portfolio of various ETFs. This way, we help you get more out of your savings in the long term.

Interest is only available at the bank, isn’t it?

As we explained earlier, compound interest is the interest you earn on your interest. There is a similar effect in the form of yield on yield in the capital market. Let’s take the return on a DAX ETF as an example:

The German share index has risen by an average of around 8% over the last 30 years. This means that thanks to the compound interest effect, you would have doubled your money after just ten years if you had also reinvested the return every year. Not bad, right? Of course, since an ETF doesn’t always rise constantly, it’s also possible that the compound interest effect may be more significant or more minor, or even that your investment may lose value. But especially in the long run, ETFs can be an attractive way to invest your money. At Unit Plus, we even invest in several ETFs, which means you invest in over 800 companies. So you reduce your risk even further – but give yourself the chance to take advantage of compound interest when you save up for something.

Do you agree with Albert Einstein about compound interest being the eighth world wonder after taking a closer look at compound interest?