Women invest less often than men, and when they do, they do so with less focus on returns. The savings account is currently still the most popular place to park money. And although women save diligently, it doesn’t prove to be an effective way to build wealth or provide for retirement in the long run. As a result, they are at a higher risk for financial shortfalls. Why is there this discrepancy in investment behavior between men and women, and how can we do better?

According to the German Equities Institute, the number of people investing in equities in Germany was 12.1 million in 2020, with women accounting for only 4.3 million or just under 35%. And this is the case despite the fact that women are a powerful force in the global economy and, according to estimates, 80% of purchasing decisions worldwide are influenced by women.

Table of Contents

So what stops women from investing?

Financial knowledge and security: For 41%, a lack of knowledge about financial topics and investment strategy is the decisive factor, coupled with skepticism about safety.

Income: According to women’s opinions, income is insufficient to invest money. Coupled with the gender pay gap, less is invested.

(Risk) awareness: 66% opt for lower-risk products, but there is a strong emphasis on positive environmental and social impacts (84%).

Individuality and trust: Financial offers and services usually do not meet individual needs, which fuels a lack of trust.

Above all, women should not lack confidence when investing, as they are statistically better investors with a return of 0.4% more per year than men. At first, this might not sound like much, but if 10.000€ were invested over 15 years, this would generate an additional 1.800€. In addition, J.P. Morgan Asset Management estimates the potential assets of women aged 30 to 60 in Europe to amount to an additional €177 billion. These figures highlight the importance of encouraging more women to invest. In the best case, as early as possible, because:

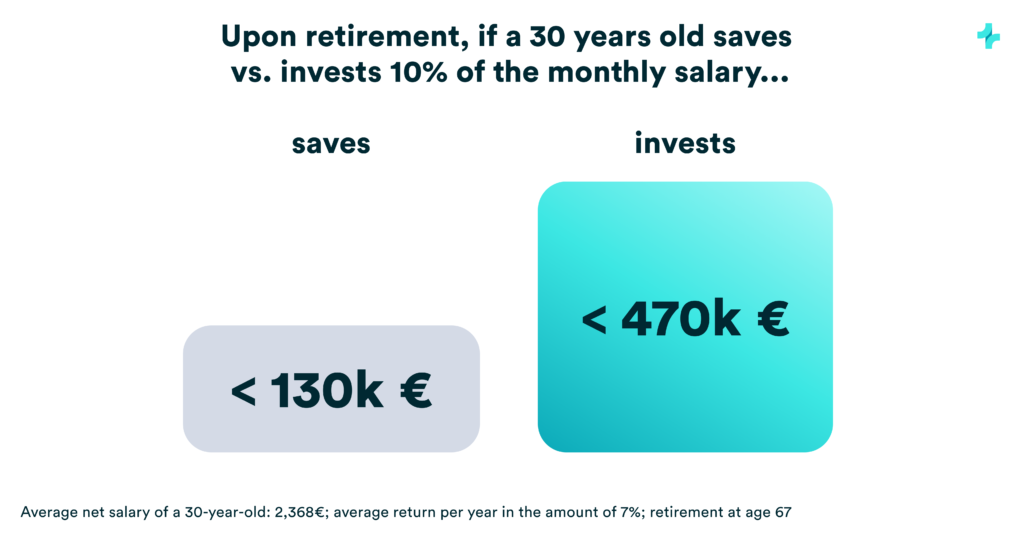

Investing early pays off to close the pension gap:

Role models are important

Regarding finance, women highly value and appreciate role models. But unfortunately, the faces of the financial industry are dominated by men. This leads to the field of finance being perceived by many as a male affair, even though this is not the case.

The women’s quota in DAX companies, which came into force on August 1, 2022, is a step in the right direction. However, you don’t have to work at a DAX company to become a role model. By investing, you can serve as a role model for your environment and help investing lose the stigma of being a “male thing.”