With the imminent market launch of CashPlus SME, UnitPlus is taking liquidity management for German SMEs to a new level. What makes the money market so interesting for modern liquidity management is shown in two exciting graphics, which we examine in more detail below.

Table of Contents

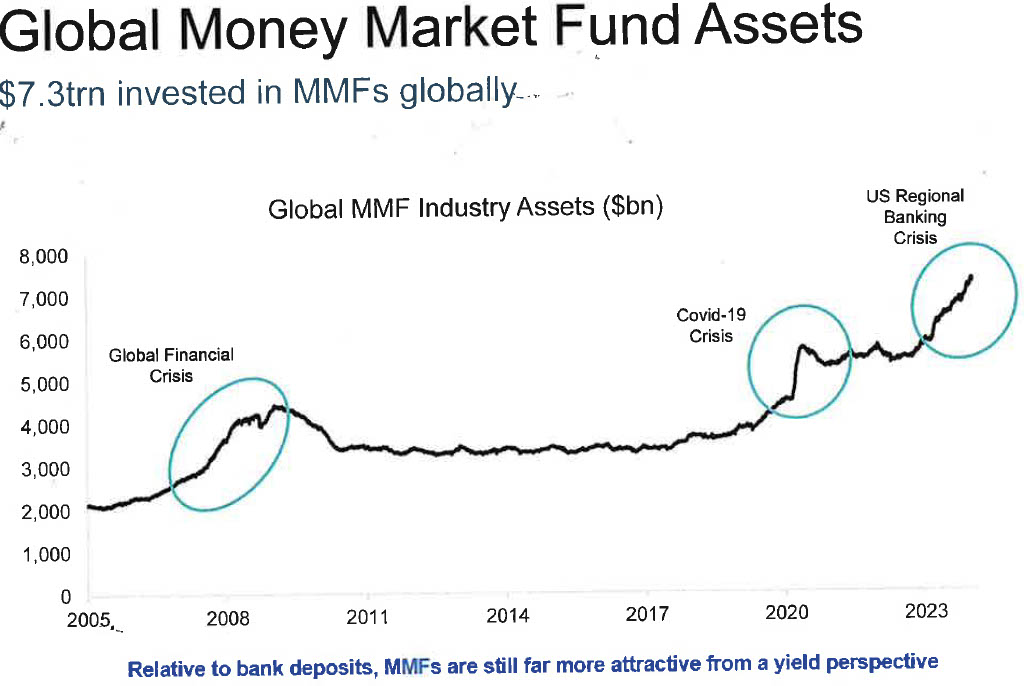

Money invested in the money market increases significantly during times of crisis

With CashPlus SME, money should not only be invested with above-average returns but also safely. As the chart below shows, money invested in the money market increases significantly in times of major crises, such as the financial crisis in 2008, during Covid 2020, and the US bank crisis in 2023.

This has to do in particular with the fact that, compared to a bank account, where bank deposits are unsecured liabilities on a bank’s balance sheet, the money in money market funds is spread globally, which protects the invested capital much more effectively against any bank insolvencies and cluster risks.

As the chart also shows, there is now $7.3 trillion in the money market. This large sum also highlights the fundamental attractiveness of the asset class.

Warren Buffett’s cash holdings rise to almost $160 billion

The second chart shows the cash holdings of Warren Buffett’s corporate conglomerate Berkshire Hathaway. As the company’s annual report published on February 24, 2024 shows, $129.6 billion of the $167.6 billion in cash is invested in short-dated government bonds.

Especially in times of high-interest rates, Buffett impressively emphasizes the value of good

liquidity management. By investing in short-term US government bonds, Buffett was able to enjoy an interest gain of $115 million per week last year alone.