Table of Contents

What are bonds

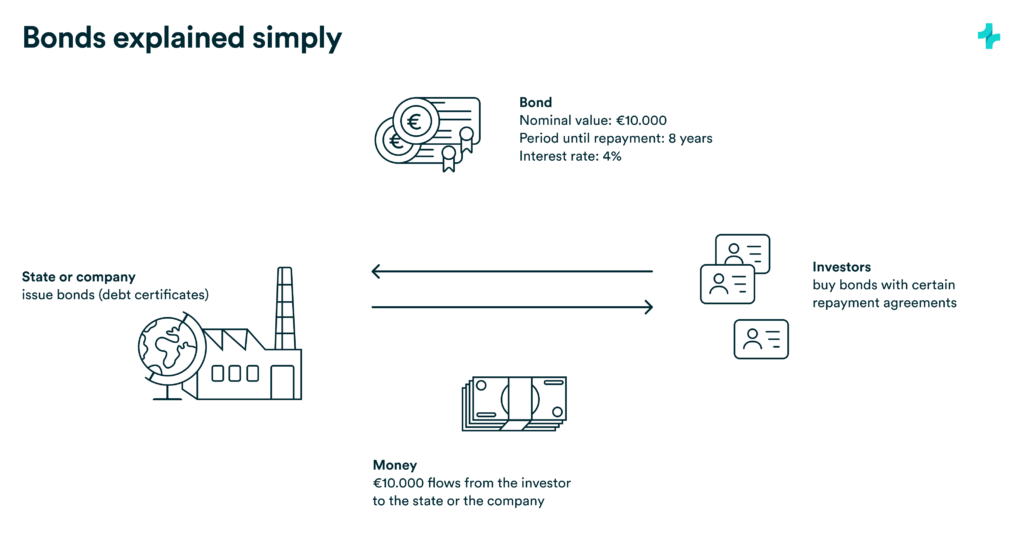

Bonds, like shares, are a means of raising capital. While shares are part of the so-called equity capital, and one becomes a co-owner of the respective company by acquiring shares, bonds are part of the debt capital. As a rule, these are fixed-interest securities with a fixed term. This means they are securities that pay regular interest over a predefined period. If you buy bonds, you lend money to the company for a certain period, get paid interest quarterly or annually, and get the borrowed money back at the end of the term. If the company becomes insolvent, lenders are paid out of the insolvency estate before equity investors. The economic risk with bonds is, therefore, lower. In return, one also participates to a lesser extent in the economic success.

In the following example, an investor purchases bonds worth €10,000 from a company or government. The term until repayment is eight years, and the interest rate is 4%. This means an investor receives €400 interest annually and gets back his original €10,000 at the end of the term.

Governments also need to refinance

However, not only companies issue bonds, but also governments. For example, the Federal Republic of Germany is one of the world’s largest – and most solvent – debtors. At the end of 2022 alone, Germany had outstanding 7-, 10-, 15- and 30-year federal bonds with a volume of more than €1,090 billion. Looking across the pond to America, it becomes clear how large the market for government bonds is. At €20,813 billion, the volume of outstanding U.S. government bonds is around five times Germany’s economic output measured in gross domestic product.

As usual on the stock market, the interest payable depends on supply and demand. As a rule, countries with high credit ratings pay lower interest rates than those with poor credit ratings. If a country defaults on payments, this is effectively equivalent to national bankruptcy. A country’s creditworthiness depends on many determinants, and rating agencies specialize in evaluating them. While countries such as Germany or Switzerland have the highest possible rating (AAA) and are thus classified with a very low probability of default, countries such as Brazil or Egypt have a significantly higher chance of default, which is reflected accordingly in a lower rating. The higher the probability of default, the higher the interest payable. The background to this is understandable: Investors want to be rewarded accordingly for the higher risk.

The term of the bonds also plays a vital role in interest payments. The longer the term, the higher the interest. At least, that is the theory. Depending on what interest rate level market participants expect in the future, market players’ expectations also play a significant role, especially for longer-dated bonds.

Why can it be interesting to invest in government bonds?

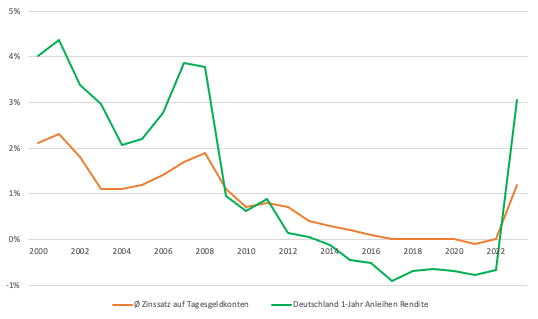

Because central banks worldwide want to get a grip on the current high inflation to return to a target level of around 2% in the long term, key interest rates are being raised everywhere, severely impacting the bond market. While interest rates on one-year government bonds issued by the Federal Republic of Germany were still slightly negative at the beginning of 2022, they have risen to over 3% by the end of February 2023. So if you lend the German government €10,000 for one year, at the end of the term, you will get the €10,000 back and an accrued interest of €300. This is only at risk if the German government faces payment difficulties during the bond term – an existing, albeit improbable, risk.

Are government bonds the better overnight money?

Using data points from Statista and investing.com, we looked at the average interest rates on German call money accounts and put them in relation to the yield on one-year German government bonds. The graph impressively shows that the yield before 2008 and since the end of 2022 has been significantly higher than the interest rates received on overnight money accounts.

A relatively safe investment in government bonds can pay off, especially in the current macroeconomic climate. In addition, interest on call money accounts is often guaranteed up to specified maximum amounts and is linked to maturity. In the case of government bonds, these restrictions do not exist in such a direct form. On the other hand, as is usual with capital market investments, there is also a risk of loss here, which is small but present. Therefore, in the case of call money accounts, the interest rate is usually lower but guaranteed.

We at UnitPlus are also very open to bonds and have launched FlexPlus, the first European alternative to overnight deposit accounts. This portfolio invests exclusively in short-dated European government bonds and, at the same time, allows worldwide payments with them. In this way, money can be invested in a yield-oriented manner without foregoing flexibility.

Are you curious, or would you like to share your opinion with us? Then we look forward to hearing from you: support@unitplus.eu.

Risk Notice:

This article must not be understood as an investment recommendation. Nor is it advice to buy or sell financial instruments. There are risks associated with capital market investing that can lead to a total loss. Historical performance is not a reliable indicator of future performance.