Today, UnitPlus launches its most extensive update since the market launch after six months of development. In addition to the ability to invest in any number of investment strategies simultaneously, the app’s user interface has been completely overhauled and offers an even more intuitive user experience with lots of helpful information on investment and payment…

Take your companies liquidity management to the next level with UnitPlus Business. Profit from 3.77% APY in the most flexible, secure and frictionless way. According to Statista, in 2021, there were 6.1 million businesses and self-employed individuals in the SME sector, generating annual sales of 5.6 trillion euros. Due to their significant figures, people often…

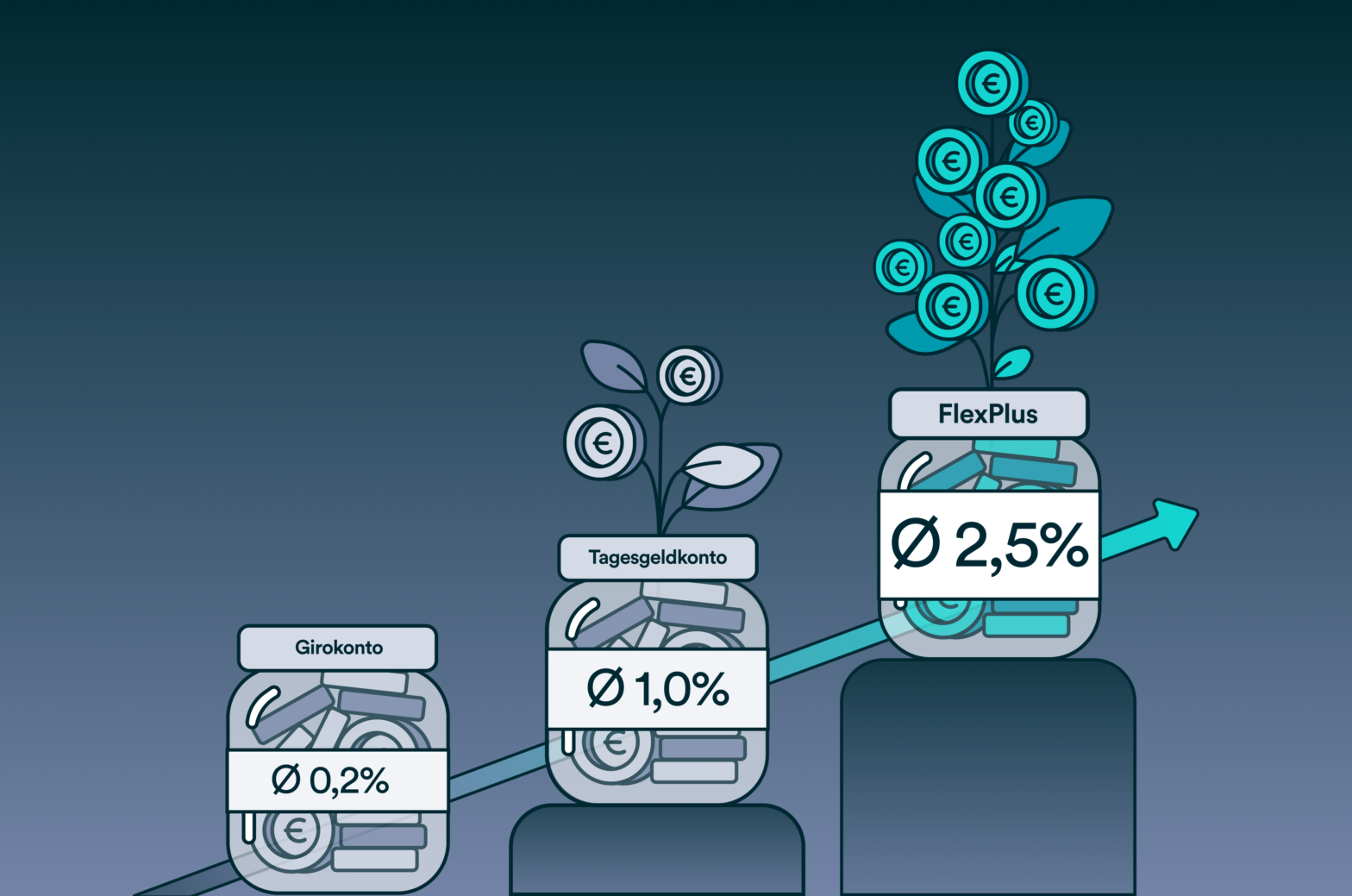

CashPlus combines the best of both worlds: attractive interest rates and payment flexibility. You benefit from interest rate developments unprecedentedly and receive interest rates significantly higher than current accounts and most call money accounts. While the interest received may vary, there is no risk of loss due to fluctuations in value. And the best part?…

by Capital and the Institut für Vermögensaufbau The business magazine Capital evaluates 40 digital investment advisors in Germany once a year in cooperation with the Institut für Vermögensaufbau. This year UnitPlus is represented for the first time and has directly received the top score of 5 stars and the first place as best investment newcomer.…

CashPlus fundamentally rethinks call money by improving the weak points of a classic call money account regarding interest, flexibility, and security. In today’s article, we talk about how CashPlus works technically. For those who would like to learn more about CashPlus generally, we recommend the article “The Interest is Back.” What does call money 2.0…

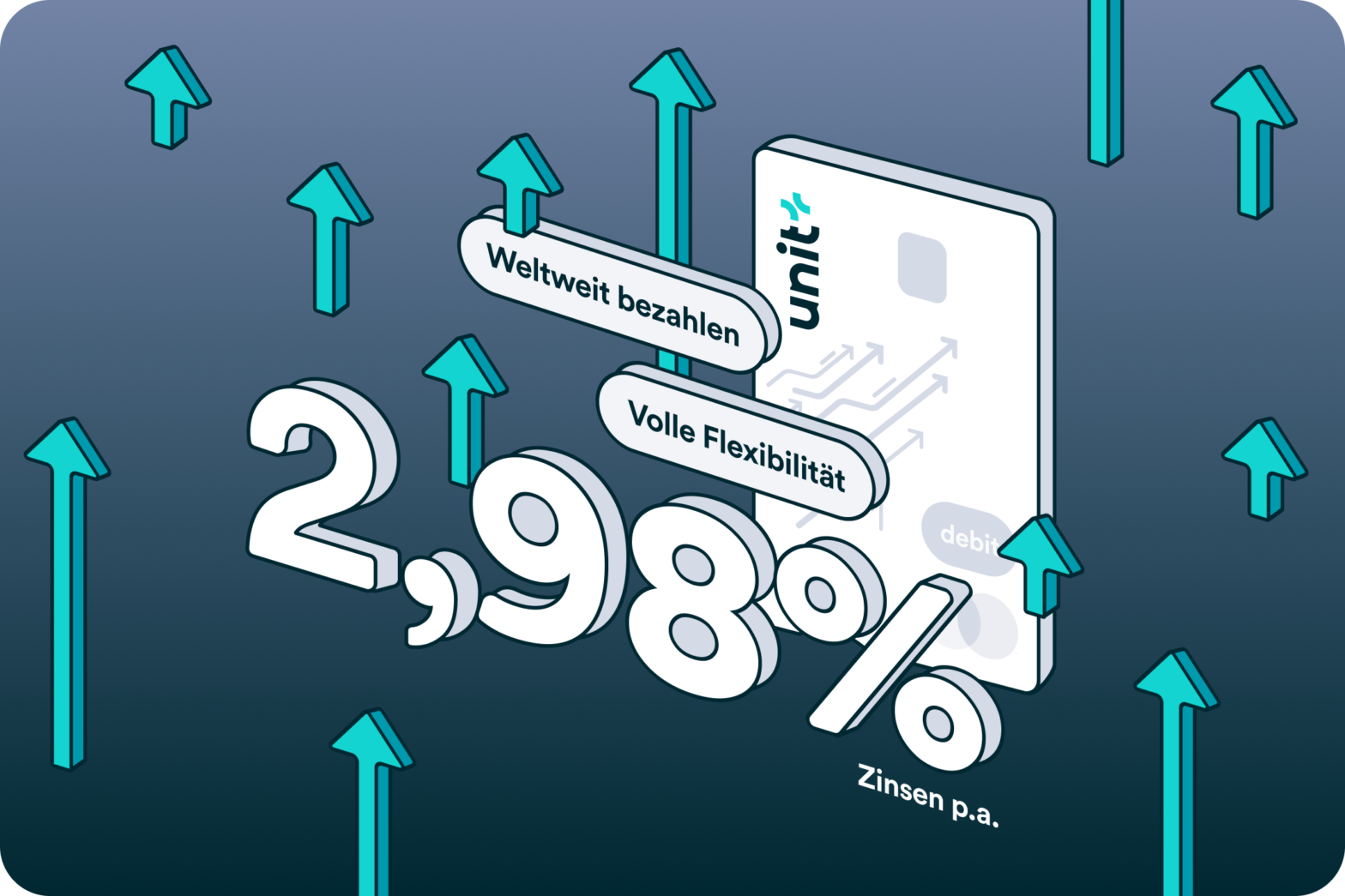

In Germany alone, there are more than 150 million bank cards that are used every day to make payments all over the world. The bank cards are linked to current accounts, which generally offer no or, at most, very low-interest rates. This means that high inflation results in an enormous loss of purchasing power and…

Berlin, 05.04.2023 UnitPlus has won several new investors from the top management of the German banking scene. Among others, the former CEO of Commerzbank, Martin Zielke, and the former co-owner of Berenberg Bank, Claus Budelmann, are among the supporters. Investors from the startup world, such as the serial founder of Helpling and Planetly, Benedikt Franke,…

UnitPlus is being created to get the most out of investing and make investing as easy and usual as saving. However, to ensure that money can be invested efficiently in the capital market in the short and long term, the construction of portfolios takes on a decisive role. That’s why we’re taking a closer look…

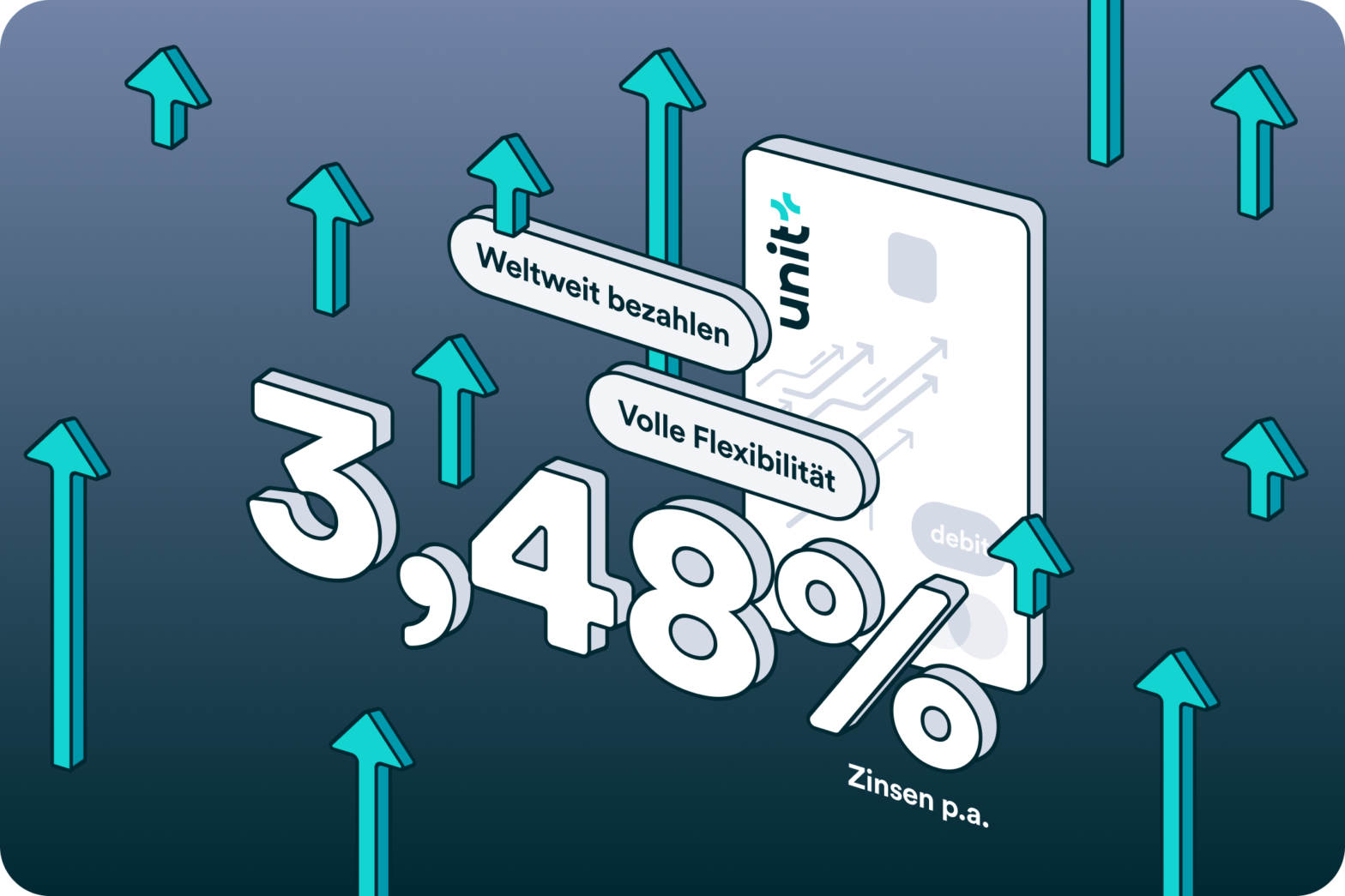

In recent weeks, we have received many inquiries about government bonds and the advantages of FlexPlus. In the following article, we will go into more detail and show you how to profit optimally from the interest rate turnaround with FlexPlus.

What are bonds Bonds, like shares, are a means of raising capital. While shares are part of the so-called equity capital, and one becomes a co-owner of the respective company by acquiring shares, bonds are part of the debt capital. As a rule, these are fixed-interest securities with a fixed term. This means they are…

The most important findings A brief classification The older generations still know the joy of having the annual interest credited to their savings account. In good years, there were credit interest rates of up to 5% and more, giving the impression that the money became more on its own. In the wake of the world…

Did you know that in Germany alone, there are hundreds of billions of euros in call money accounts? The interest rates vary depending on the interest rate policy of the central bank and differ from bank to bank. Currently, up to 2% interest can be realized per year. At UnitPlus, we’re rethinking the concept of…