As part of the first UnitPlus Investment Summit, Co-Founder and CTO of Unstoppable Finance, Peter Großkopf, gave a presentation on Decentralised Finance and the future of banking. Here you can find a summary of the most important topics.

Table of Contents

Blockchain

We hear the term blockchain more and more often, especially in the context of cryptocurrency. The term is also essential to understand the concept of Decentralised Finance. So what is behind it?

A blockchain enables the forgery-proof transmission of information with the help of a decentralised database shared by many participants. The database is stored on many computers in a peer-to-peer network, with each new node forming a complete copy of the blockchain. They also have the task of documenting and verifying transactions. The respective nodes do not know each other and trust each other.

Specifically, it goes like this: Someone initiates a process by generating a record (block), which is then verified and stored by a large number of computers in the network. The resulting block is cryptographically encrypted and attached to a chain of data records. Hence the name blockchain. By attaching the blockchain to the chain, many unique data records are created, each with its traceable history. Blockchains are, therefore, secure, always up-to-date directories through which digital transactions can be documented reliably and traceable for participants.

The Bitcoin blockchain was the first project to prove the functionality of the blockchain concept. The cryptocurrency Ethereum then introduced the concept of smart contracts, a digital contract based on blockchain technology. For example, the conditions between “buyers” and “sellers” are written directly into the lines of code.

Today’s financial services

Marc Andreessen, the co-founder of venture capital firm Andreessen Horowitz, argued in 2011, “Software is eating the world.” By this, he meant the revolution of various industries triggered by the Internet and software. For example, Amazon has revolutionised retail, Spotify has revolutionised the music industry, and Netflix has revolutionised how we consume movies and series. However, the financial services industry has been largely unaffected by the software revolution. This is led by financial service providers, institutions, and banks. The respective providers require licences to ensure that local legal requirements are met. In addition, each industry sub-sector has its regulations, which is why there are only a handful of global players. The day-to-day business has been mainly conducted with technology since the 1990s; real-time transactions are still the exception.

Peter Großkopf thus sees the FinTech movement as a response to the industry’s failure to adapt to changing customer needs. Problems that arise because of today’s environment are something we repeatedly see in the form of scandals: Wirecard, Cum-Ex, Lehman Brothers, and money laundering. The problem is that regulation is based on reactions and cannot occur everywhere. Moreover, wherever people are involved, there will be manipulation, false incentives, and fraud.

The financial service of tomorrow: Decentralised Finance (DeFi).

Decentralised Finance describes financial services provided by “smart contracts” and powered by blockchain technology. Important: It is not a system based on cryptocurrencies but blockchain technology. DeFi is made accessible through so-called “non-custodial wallets.” These tools allow users to create a virtual wallet with a private key to access a specific blockchain. Users have complete control over their assets, as they are not sent to a third party for safekeeping; they actually own them, as only they have the private key to the wallet. “Non-custodial wallets” thus make DeFi accessible, but what are the advantages?

No Permits: You don’t need permission to participate. Anyone can develop DeFi apps, and anyone can use them. There are no gatekeepers. “Open banking” is also built-in, as any “frontend” or “backend” can interact with a “smart contract.”

Global: Available worldwide from day one, as blockchain is available everywhere.

Tamper-free: Services are not managed by institutions or employees – everything is in the “smart contracts” code. Once the “smart contracts” are incorporated into the Blockchain, DeFi apps can be operated autonomously, requiring little to no human intervention.

Transparency: The blockchain’s code is transparent and available for anyone to see. Thus, anyone can verify its accuracy and security.

All transactions are also publicly visible to everyone. However, what sounds like a privacy nightmare at first is not, as all transactions take place pseudonymously. The real identity of the user is, therefore, not revealed.

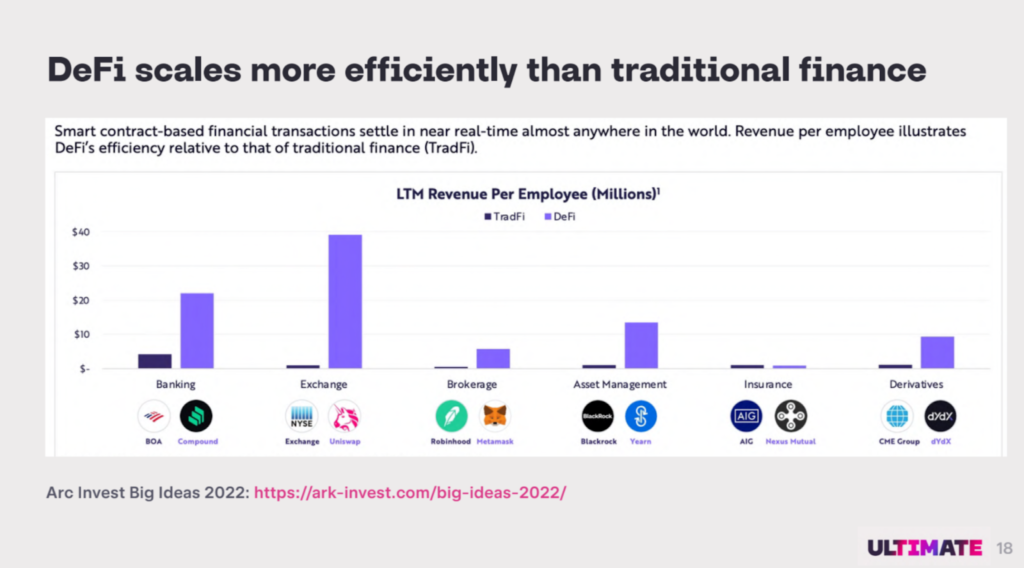

Higher scalability than current financial service providers

What are the use cases of decentralised finance?

- Stablecoins (cryptocurrency linked to the value of the US dollar)

- Crypto lending: lend money and earn interest or take out a loan

- Decentralised exchanges

- Derivatives: synthetic investments like stocks

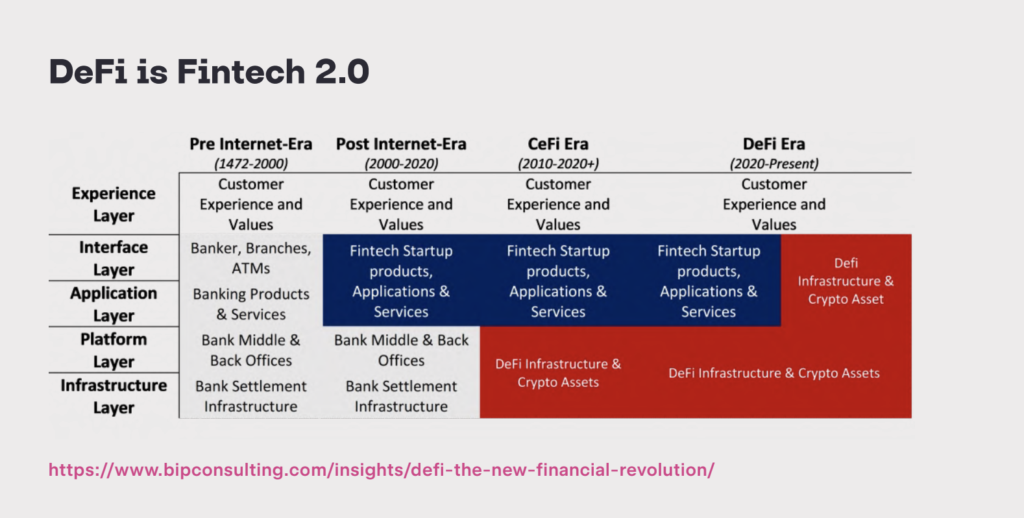

If Peter Grosskopf has his way, DeFi will become the standard for the entire industry as “Fintech 2.0,” replacing current technologies and institutions.

“Because Blockchain technology / DeFi is open, decentralised, cannot be manipulated, and is accessible to everyone, it can enable the best and most transparent financial services industry and banking ecosystem that has ever existed!”

Peter Grosskopf