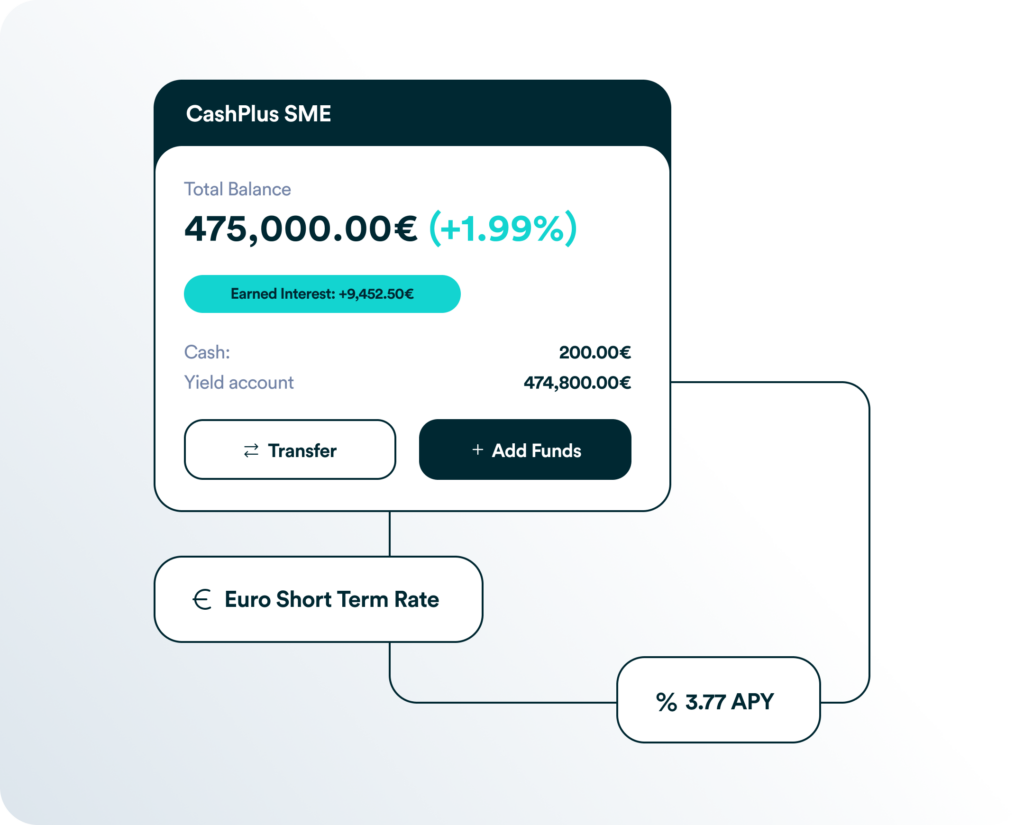

Take your companies liquidity management to the next level with CashPlus SME. Profit from 3.77% APY in the most flexible, secure and frictionless way.

According to Statista, in 2021, there were 6.1 million businesses and self-employed individuals in the SME sector, generating annual sales of 5.6 trillion euros. Due to their significant figures, people often refer to SMEs as the backbone of the German economy.

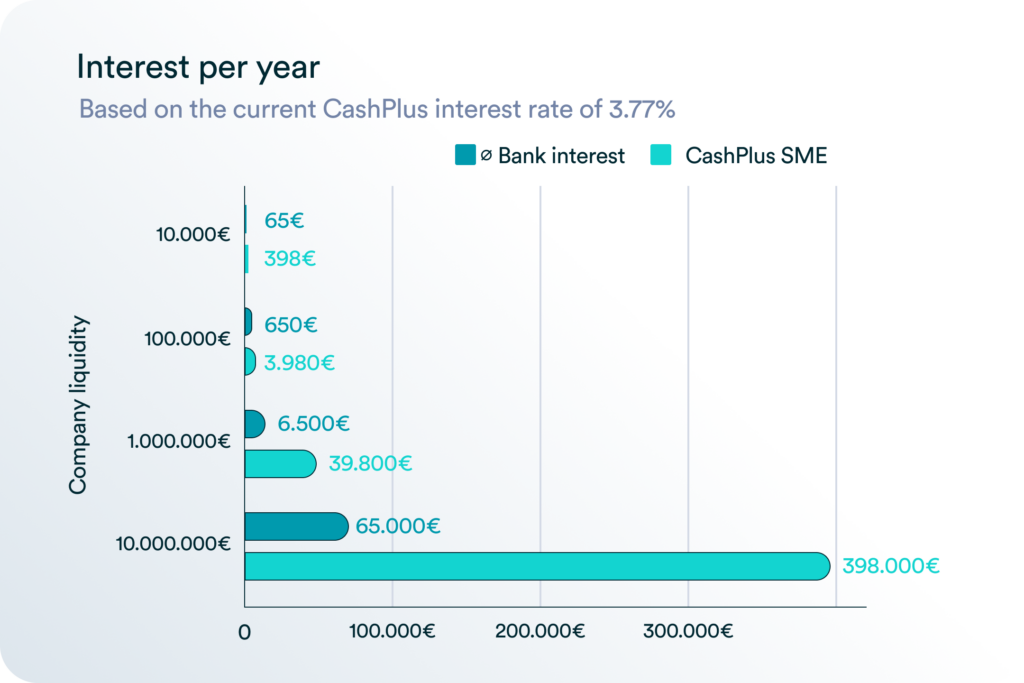

However, SMEs do not always have the highest priority, especially regarding their interaction with the banking sector. For example, according to current figures from the European Central Bank, a company in the European currency area invests money at an interest rate of just 0.75% p.a. on the basis of a call money account.

By contrast, the deposit facility, i.e., the interest rate at which banks can park money not needed in the short term at the central bank, stands at 3.75%.

To enable companies of all sizes to manage their liquidity better and invest it more profitably, we are developing CashPlus SME. CashPlus SME is a co-pilot for corporate liquidity that provides a profitable, flexible, and secure solution for depositing unused corporate liquidity through the money market.

Table of Contents

What is CashPlus SME?

A changing interest rate environment for companies creates new risks and opportunities. Efficient management of unused company liquidity plays an essential role in this context. After all, when adequately allocated, capital can quickly generate additional five- or six-digit interest gains per year. This income can then be used for the essentials: entrepreneurial success.

That is why we are launching CashPlus SME in the first quarter of 2024, a co-pilot for corporate liquidity that helps companies of all sizes make the most of their unused liquidity. Since May 2023, we have successfully revolutionized call money 2.0 with CashPlus for end customers and are now bringing it to companies.

What are the advantages of CashPlus SME?

Compared to a classic call money account for companies, CashPlus SME has several significant advantages.

Interest rate: The company liquidity is fully remunerated with currently 3.77% p.a. The interest rate is based directly on the European Central Bank and is continuously updated. Therefore, the company’s capital is always subject to the most attractive interest rate without the need for manual attention within the company. At the same time, there are no conditions such as a maturity limit or a maximum deposit. No matter whether €10,000 is deposited in CashPlus SME or €10 million. The interest rate is always the same.

Another plus point is the daily interest credited on banking days. This allows for optimal benefit from compound interest, regardless of holding periods.

Flexibility: You can make deposits and withdrawals anytime and conveniently access them immediately, anywhere in the world, using your UnitPlus bank card. This increases business flexibility and enables you to remain in a position to act even in unforeseen circumstances. At the same time, the UnitPlus bank card can be integrated into digital wallets, and payments can be debited through it.

Security: Although significant bank failures are a rarity, the insolvency of Silicon Valley Bank, and with it the 16th largest U.S. bank after all, in March 2023 showed that there is risk when all “eggs are in one basket.”

In Germany, deposit insurance applies up to EUR 100,000, and many banks have also taken out additional insurance. Nonetheless, when large amounts are involved, there is a risk if the company’s liquidity is parked in only one bank account. Since CashPlus SME intelligently uses the money market to earn more attractive interest on liquidity, and the company capital must be kept in a legally independent custody account separate from a bank’s balance sheet, all amounts are protected from bank insolvency as special assets. This provides an additional security mechanism.

How can your company use CashPlus SME?

UnitPlus aims to launch CashPlus KMU in Q2 2024 the product in Germany. To ensure you don’t miss the market launch, you can sign up for the waiting list on our CashPlus SME homepage.