AktienPlus sets new standards in portfolio construction with active ETFs. In cooperation with JP Morgan Asset Management, it offers a portfolio that combines the advantages of traditional ETFs with the investment expertise of JP Morgan Asset Management – and thus aims to outperform the market as a whole over the long term. Below we take a closer look at what active ETFs are and how AktienPlus is structured.

Table of Contents

The triumph of passive investing

Since the first ETF went public in Canada in 1990, passive investing has become established worldwide. At the end of 2023, the net assets of passive equity funds reached a new record of an impressive USD 15.1 trillion – surpassing the USD 14.3 trillion of active funds for the first time.

As a quick reminder: active and passive investing differ fundamentally in their approach. In active investing, fund managers and investors aim to outperform the market through targeted buying and selling of securities. This requires constant market analysis and frequent adjustments to the portfolio, which often leads to high fees and transaction costs. Passive investing, on the other hand, relies on replicating a market index such as the DAX or S&P 500 without regularly intervening in the market. This strategy offers lower costs and often more attractive long-term performance, as active fund management rarely beats the market in the long term.

Active ETFs – the best of both worlds

Active ETFs are an innovative trend that has established itself in the USA in particular and is growing strongly. With this form of investment, a fund manager actively controls the selection and weighting of the securities contained in the fund. While passive ETFs replicate the market index, active ETFs pursue a more flexible investment strategy based on in-depth market analyses and current trends. The aim is to achieve a higher return than the market through targeted investments.

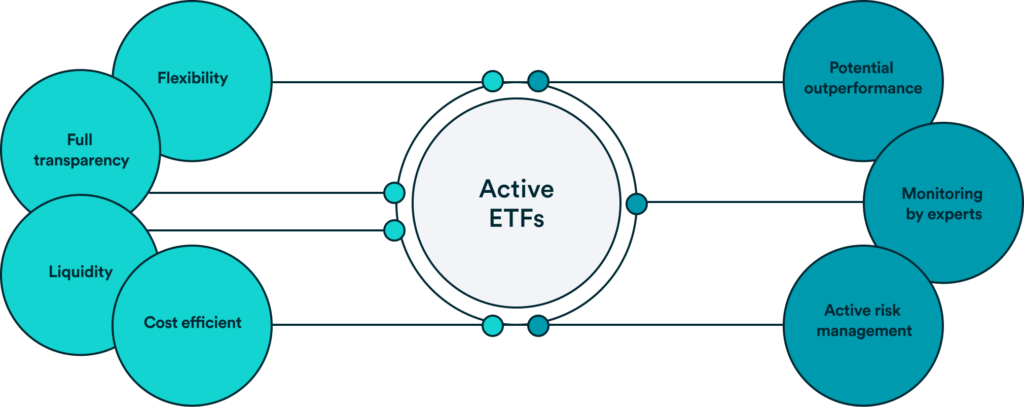

The biggest advantage of active ETFs is their flexibility: fund managers can react quickly to market changes and adjust the portfolio, which offers opportunities for value appreciation, particularly in volatile phases. Investors also benefit from the transparency and liquidity that characterize traditional ETFs, as active ETFs are also traded on the stock exchange and can be bought or sold at any time. In addition, the costs are only slightly higher compared to passive ETFs and are significantly lower than the costs of active funds. For example, AktienPlus at UnitPlus costs a total of just 0.76% of the money invested per year. The costs for active ETFs are already included here. Active funds, on the other hand, often charge up to 2.0% management fee per year, as well as a performance-related fee.

The fact that active ETFs are a fast-growing market is also shown by the forecast of asset manager Blackrock, which expects USD 4 trillion to be invested in active ETFs by 2030 and to gain market share from traditional ETFs.

Active ETFs therefore combine the best of both worlds: the cost efficiency, flexibility and liquidity of traditional ETFs and the possibility of active risk management with the aim of outperforming the market as a whole. The growth of this market speaks for itself: while the ETF industry as a whole has grown at a compound annual growth rate (CAGR) of 24% over the last ten years, the market for active ETFs has grown at an impressive CAGR of 51%.

AktienPlus – The next generation stock portfolio

UnitPlus is now going one step further and is bringing the first active ETF portfolio to Germany in collaboration with JP Morgan Asset Management. For JP Morgan Asset Management, this is the first partnership of its kind on the German market. The “AktienPlus” portfolio consists of seven active ETFs that draw on the comprehensive research strength and expertise of one of the most renowned investment banks and manage the portfolio weighting of the individual ETFs in a diversified portfolio context.

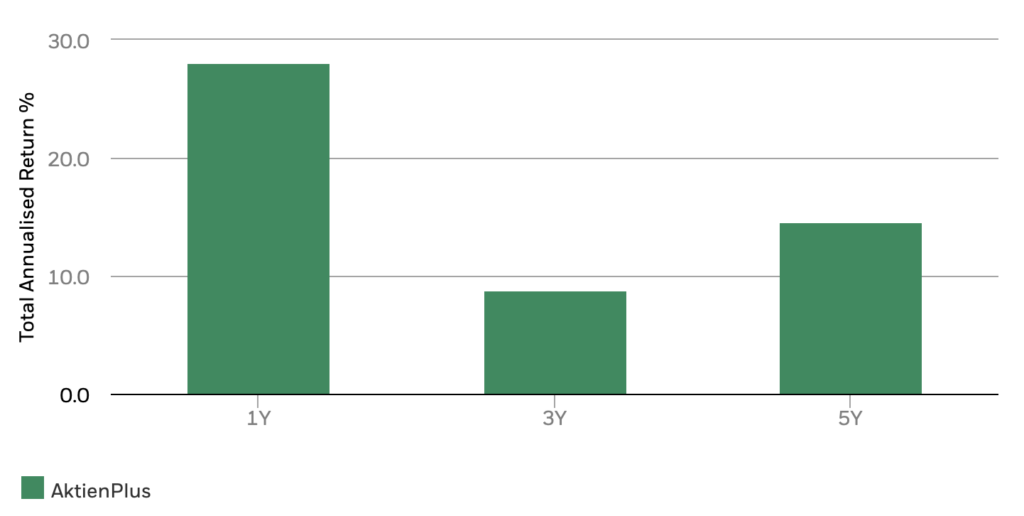

The active ETF components flow into the portfolio with an individual weighting in such a way that opportunities for returns on the stock market can be realized worldwide and the risks are broadly diversified at the same time. Although historical performance does not guarantee future results, it can be stated that AktienPlus has achieved a very attractive annualized return in recent years. For example, the performance in one year was 28.1%, over three years an average of 8.5% and over five years an impressive 14.6% (period November 2019 to October 2024).

A look at the individual active ETF components and their annualized returns and standard deviations (a measure of volatility, i.e. the fluctuation range of the respective active ETF) over 1 and 5 years shows that the individual components harmonize very well with each other. This enriches the overall portfolio with different geographical returns and reduces the risk thanks to the low correlation between the individual active ETFs.

Another advantage of AktienPlus and its components is that active risk management is also used in economically challenging times and falling capital markets. This is intended to make the portfolio more resilient and crisis-resistant.

The perfect companion for long-term investments

In summary, AktienPlus is an innovative investment product that combines the advantages of traditional ETFs with an active, professional approach. The aim is to achieve an excess return after costs and to precisely manage the risks of the equity market through all market phases. The portfolio is ideal for long-term investment and, like all UnitPlus portfolios, is also available for free savings plans.

Risk warning:

This article does not constitute an investment recommendation. No advice is given to buy or sell financial instruments. Every capital market investment is associated with risks that can lead to a total loss. Historical performance is not a reliable indicator of future performance. JP Morgan Asset Management assumes no responsibility for the accuracy, completeness or timeliness of this article.