The UnitPlus portfolios have now been on the market for six months. Reason enough to take a closer look at their performance. We are particularly confident that two of our portfolios have outperformed the benchmark S&P 500 and Nasdaq indices with lower volatility over this period. But first things first.

Table of Contents

What do beautiful mountains and professional portfolios have in common?

Through UnitPlus, you can invest in four different portfolios. We have named the portfolios after famous mountains. From the Zugspitze and Mont Blanc to Kilimanjaro and Mount Everest. As a rule, the higher the mountain, the higher the risk-return ratio.

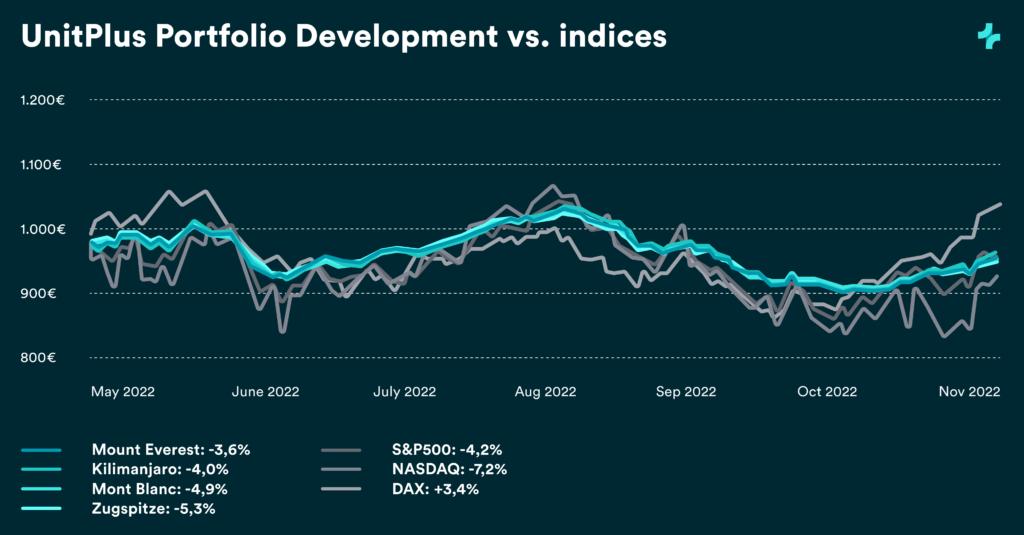

As many of you already know, the portfolios invest broadly in over 800 companies worldwide, thus exploiting the earnings potential worldwide. Here, investments are only made in companies that take recognized sustainability criteria into account. Furthermore, by varying the mix of equities and bonds, the diversification can be further increased and the respective risk-return ratio optimally balanced. This is also reflected in the performance of the UnitPlus portfolios over the last six months. In the following chart, the three stock indices, DAX, S&P 500, and Nasdaq, have been taken into account as a reference:

As can be seen, all four UnitPlus portfolios outperformed the earnings performance of the Nasdaq technology index by up to almost 4% over the period. In addition, the Kilimanjaro and Mount Everest portfolios also outperformed the S&P 500. At the same time, only the German DAX stock index posted a strong upward movement in recent weeks due to its rally since mid-October, outperforming all UnitPlus portfolios.

Even though the UnitPlus portfolios have thus had a slightly negative overall return performance since launch due to the very challenging market environment, this is still predominantly above that of pure equity indices. At the same time, the fluctuation range is significantly lower than the three equity indices, which speaks for the excellent balance of the UnitPlus portfolios.

Outlook

To make investing and paying with UnitPlus even better in the future, we are continuously developing the portfolio strategies. In addition, we are launching two additional portfolios and further developing the UnitPlus app so that multiple portfolio strategies can be created in one account. The expansion of the personalized savings plan, which suggests an optimal amount to invest each month based on individual input and spending behavior, is also underway.