Table of Contents

The most important findings

- After years of no interest on bank deposits, they rise again as the European Central Bank fights inflation.

- However, the real interest rate, i.e., the return on bank deposits minus the inflation rate, remains in Europe’s negative territory. Rising interest rates mitigate but do not solve the loss of purchasing power issue.

- Thus, every saver should actively consider investing money in the capital market.

A brief classification

The older generations still know the joy of having the annual interest credited to their savings account. In good years, there were credit interest rates of up to 5% and more, giving the impression that the money became more on its own.

In the wake of the world financial crisis of 2007-2008, there was a significant “interest rate bust” as central banks worldwide had to intervene to stabilize the economy. To do so, they drastically reduced the key interest rate, a reference rate for banks. As a result, savers found that the interest rates on our savings and call money accounts only knew one direction: down. But unfortunately, the interest rates did not stop at 0% but turned negative for many banks, at least for certain deposits. So you had to pay the bank to keep your money there.

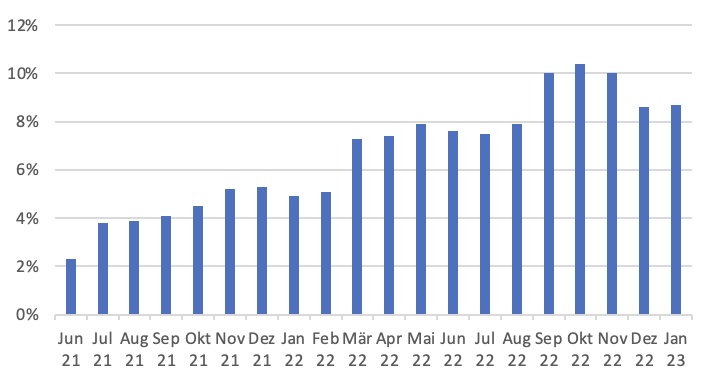

This was not a good development, but in 2021 it was exacerbated by another phenomenon. While the inflation rate, i.e., the annual price increase, remained at 0.5% in Germany in 2020 but rose to 3.1% in 2021 and 7.9% in 2022. The Federal Statistical Office thus reported the highest annual inflation since 1951.

There is no one reason why inflation has risen so sharply in recent quarters. Instead, it is a combination of the general economic recovery following the economic collapse caused by Corona, global supply shortages of goods, and the effects of the war in Ukraine that have caused prices to rise sharply and contribute to the decline in the value of money.

Let’s briefly summarize the events: While there have been effectively no interest rates over the last several years, the general price increase has jumped noticeably in the previous year. Taken together, this amounts to an enormous expropriation of wealth.

Why are interest rates back now?

The primary objective of the European Central Bank, or ECB, is to ensure price stability in the euro area. Since the euro is used in 19 countries of the EU, the central bank must ensure this for all countries. In the medium term, the aim is to achieve an inflation rate of around 2%. It is a challenging task considering how heterogeneous the individual countries in the European currency area are and how complex price developments are in principle.

So the ECB, in its role as an independent institution, began to raise the key interest rate in 2022, when the inflation rate moved further and further away from its target. As a rule, increasing the key interest rate makes companies less willing to invest, and consumers spend less on goods and services. As a result, demand falls while supply remains unchanged. However, if the ECB raises the key interest rate too quickly, this may not only be accompanied by a cooling of economic output but may also lead to a recession. A situation the ECB would very much like to avoid.

Since July 2022, the ECB has been combating high inflation by increasing the key interest rate. In February 2023, the ECB Council recently decided to raise the key interest rate further to 3.0%. Additional increases can be expected this year. The increase in the key interest rate now also has consequences for savers, who benefit from it through rising interest rates for overnight and fixed-term deposits. Even if many banks only hesitantly offer higher interest rates, some offers advertise an annual interest rate of 2% or more.

However, this is only a limited reason to be happy because the more important parameter for us savers is the so-called real interest rate. This takes the interest rate but also the inflation rate into account. With the real interest rate still well above -4%, unfortunately, we still experience a significant loss of purchasing power each year despite rising interest rates.

What can I do now?

With high negative real interest rates, there is no alternative to investing money, even if interest rates are rising. With overnight and fixed-term deposit offers, the money you don’t need but want to avoid exposing to any significant risk is in good hands. In addition, the stock market should also be considered an investment option for private retirement provision and effective long-term protection against loss of purchasing power. In the short term, fluctuations can occur here. In a globally diversified stock portfolio, however, a return of up to 8% per year can be possible in the long term so that one is rewarded for the risk taken. If you can do without money in the short term and are also prepared to take certain risks, you should actively consider the possibility of investing money in the stock market.

At UnitPlus, we not only want to help you do this in a very innovative and convenient way but also rely on professional and broadly diversified portfolios. With UnitPlus portfolios, money is invested globally, thus spreading the risk. With our new portfolio, FlexPlus launched at the beginning of February, we also offer an attractive alternative to overnight money. This portfolio invests only in comparatively low-risk European government bonds with a target yield of 3.0%. This allows the money to work flexibly with the government until you need it.

UnitPlus aims to build the most modern and innovative way of investing money in the long run, which optimally adapts to the needs of our investors. To achieve this, we look forward to hearing from you: support@unitplus.eu.

Risk Notice:

This article is not intended as an investment recommendation. Nor is it advice to buy or sell financial instruments. There are risks associated with capital market investments that can lead to a total loss. Historical performance is not a reliable indicator of future performance.