Earlier this month, the European Central Bank (ECB) cut its interest rates by 25 basis points (bps) for the first time since 2019. This significant move marks a potential shift in monetary policy, with experts predicting further rate cuts later this year, possibly another 25 bps in September or December. But what does this mean for your small business in Germany?

Table of Contents

What Are ECB Interest Rates and How Do They Affect Ordinary Citizens and Businesses?

ECB interest rates are the rates at which commercial banks borrow money from the ECB or deposit money with it. When the ECB changes these rates, commercial banks adjust the rates they charge their customers. Typically, the rates banks charge for loans are much higher than the ECB rates, and the rates for deposits are much lower. Essentially, when the ECB raises or cuts its rates, it influences the interest your bank charges you on loans or pays you on deposits.

Why Is The ECB Cutting Rates?

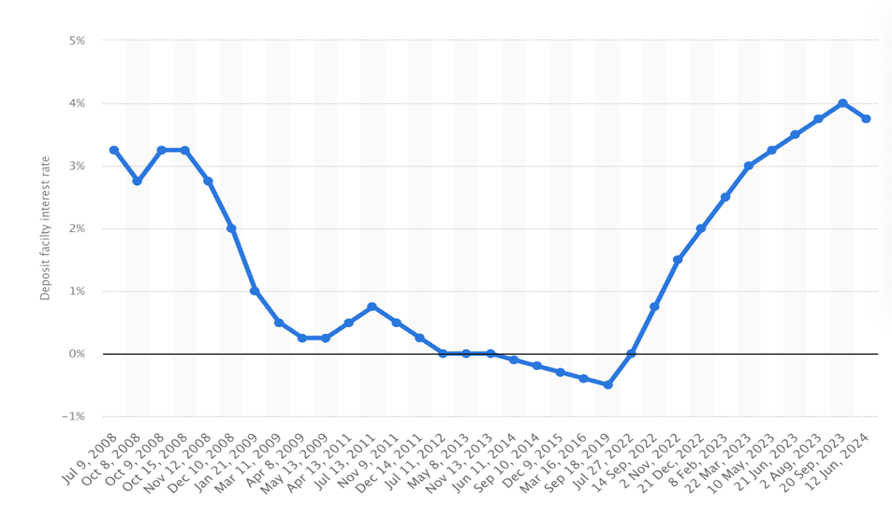

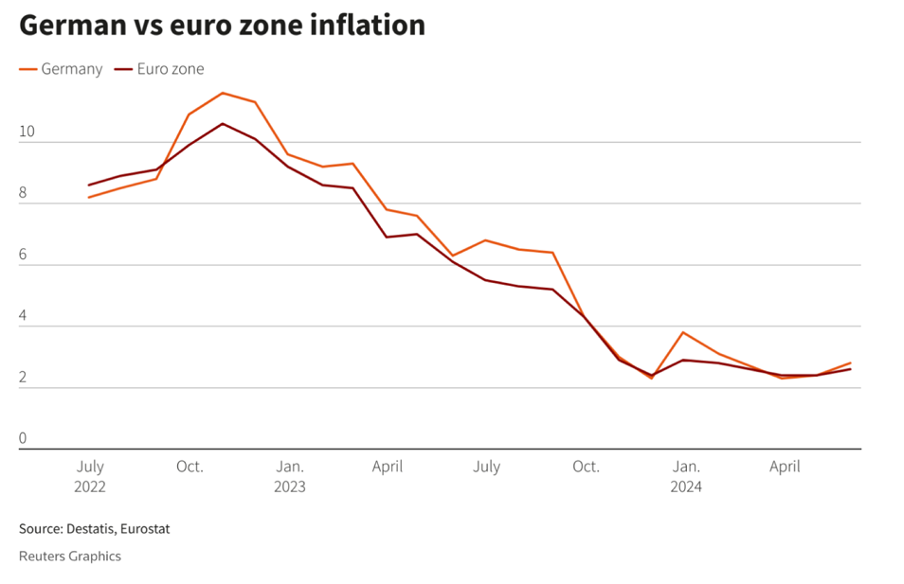

The ECB had increased rates in the past couple of years to combat rising inflation. Over the course of 2024, inflation has started to return to normal levels and is currently close to the ECB’s target inflation rate of 2%. In September 2023, the ECB raised interest rates to a decade-high 4% to address inflation, which had been hovering between 6% and 10% in late 2022, peaking at 10.6% in October 2022.

Now that inflation is back on track, the ECB is cutting the rates it had previously raised, returning to more normal levels. The ECB tactically uses interest rates as a tool to regulate inflation. Lowering rates encourages spending by making borrowing cheaper and saving less attractive. Conversely, raising rates curbs inflation by encouraging saving and making borrowing more expensive.

How Did Inflation Reach These Highs?

Inflation soared to multi-decade highs in 2021 and 2022 due to a convergence of global and geopolitical factors. The rapid economic rebound from the COVID-19 pandemic in 2021 led to significant supply chain disruptions and delivery bottlenecks, driving up prices across various sectors. In addition, Russia’s invasion of Ukraine in February 2022 severely disrupted global energy and food supplies. This upheaval caused oil and food prices to surge, with household energy costs in Germany increasing by around 35% in 2022, according to official data. These combined pressures pushed inflation in the eurozone to record levels since the creation of the euro, impacting economies worldwide.

How Can This Rate Cut Be Beneficial for Your Business?

When the ECB cuts rates, the interest rates commercial banks charge their customers tend to decrease as well. This can be beneficial for businesses as it makes borrowing cheaper over time. If your business has a variable or floating rate loan, the interest rate will decrease gradually as banks adjust their rates.

Lower borrowing costs can provide a significant advantage for small and medium-sized enterprises (SMEs), potentially enabling them to invest more in their operations, hire additional staff, or expand their business. For businesses planning to take out new loans, this could be an opportune time to secure financing at more favorable rates.

Is There a Flip Side?

While lower borrowing costs are beneficial, lower interest rates also mean that the returns on your bank deposits will decrease. This is intentional, as the ECB aims to encourage spending and discourage saving.

For businesses that rely on interest income from their savings, this can be a drawback. However, this also opens up opportunities to explore alternative investment options that offer better returns than traditional bank deposits.

How Can You Further Optimize Your Finances in a Low-Interest Environment?

Managing cash in a changing interest rate environment presents multiple complexities that require a nuanced approach. As interest rates fluctuate, businesses must continuously adapt their cash management strategies to balance liquidity and optimize yields. With the ECB cutting rates and expecting further reductions, traditional savings accounts offer minimal returns, making it challenging to preserve purchasing power as inflation outpaces interest earned. Additionally, investing in higher-yield options like equities, bonds, or alternative assets requires specialized market knowledge and significant time commitments, which can be daunting for SMEs.

One major complexity is maintaining liquidity while seeking better returns. SMEs often face a trade-off between keeping cash readily available for operational needs and investing in higher-yielding assets that may tie up funds. This balance is difficult to achieve, especially without the resources and expertise that large institutional investors possess. Consequently, many SMEs resort to placing their funds in low-yielding bank accounts for the sake of liquidity and safety.

To address this issue, UnitPlus has partnered with Goldman Sachs Asset Management to offer all SMEs access to money market funds, normally accessible only by large corporations. The activation of a corporate custody account is not only possible in 30 minutes, significantly cutting the time from on average 4 to 8 weeks in Germany, but also allows for an easy to use and intuitive tool that optimizes corporate cash reserves in every interest environment with the highest flexibility and security possible.

So! The first key question for SME is:

Why Should You Consider Money Market Funds as a potential investment?

Money market funds offer several advantages over traditional bank deposits:

- Higher Yield Potential: As interest rates decline, bank deposit returns often fail to keep pace with inflation. Money market funds, however, can capitalize on interest rate fluctuations. These funds actively manage their portfolios to extend maturities when rate cuts are expected, potentially locking in higher yields for longer periods than bank deposits. This dynamic management allows money market funds to generate higher returns.

- Diversification and Risk Mitigation: Unlike bank deposits, which expose investors to the risk of a single counterparty (read: Silicon Valley Bank goes bust), money market funds diversify across a range of high-quality, short-term securities issued by various entities. This strategy spreads risk across multiple issuers, reducing the impact of any single entity’s financial distress.

- Liquidity and Flexibility: Money market funds provide high liquidity, allowing investors to redeem their investments daily or on any business day. This feature aligns well with the cash flow needs of SMEs, providing quick access to funds for operational expenses, capital investments, or other business requirements.

And the second question is:

Why UnitPlus?

UnitPlus has collaborated with Goldman Sachs Asset Management to provide German SMEs with a compelling solution to optimize their liquidity management. UnitPlus Business offers German SMEs access to a Goldman Sachs Asset Management managed money market fund, an investment opportunity typically reserved for large corporations and institutional investors. This innovative product empowers SMEs to invest their liquidity reserves flexibly, without any minimum or maximum deposit requirements, with utmost security; All assets are safeguarded as special assets, ensuring their security and protecting the company’s investments. With interest accruing daily, UnitPlus Business is suitable for both short-term parking of funds and long-term compounding. Recognizing that SMEs often lack the resources and expertise to navigate traditional banking channels, UnitPlus Business provides a seamless solution for investing in money market funds, leveling the playing field for businesses of all sizes.

Want to know more about the product? Book a personalised demo session here!