The European Central Bank, or ECB, is responsible for price stability in the European Monetary Area. Its primary goal is to achieve a medium-term inflation target of around 2%. Currently, the ECB is far from this target, as we can see every week at the supermarket checkout. But how can the ECB effectively combat the current inflation rates of 8% and more?

Table of Contents

What is the key interest rate?

Here, the so-called prime rate plays a central role. The prime rate is the interest rate at which commercial banks can borrow money from the ECB and invest it.

Currently, the prime rate is 0%. Low prime rates tend to boost the economy, as companies can borrow capital cheaply for investment. This in turn increases the demand for labor. As a result, unemployment falls and wage levels rise. Higher income leads to higher demand for products and services. Because demand increases but supply cannot be increased directly, prices rise. High prime rates have the opposite effect.

What are the effects of the prime rate?

The prime rate also affects other interest rates, such as savings rates. After all, it is no secret that there is hardly any interest left at banks on our deposits and savings accounts. This is due to the “cheap money” policy that the ECB is currently pursuing with its prime rate.

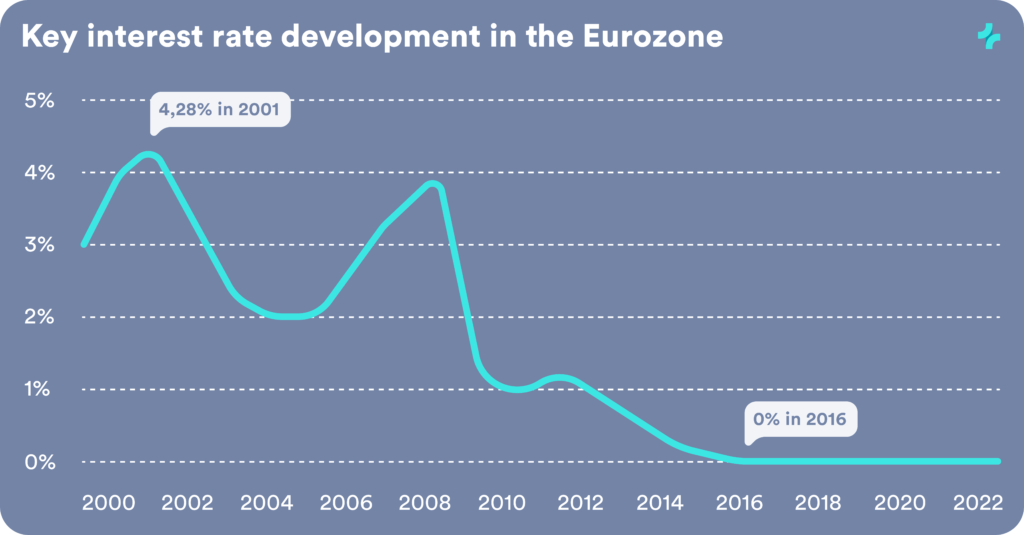

The prime rate has been at zero since March 2016, which has thus contributed to banks borrowing more money from the ECB, which brings more money into the economic cycle overall. As a result, money loses value and prices climb upward – inflation increases.

Raising the prime rate becomes more likely

It is becoming increasingly likely that, as a result of high inflation, the ECB will raise the prime rate in the coming months in order to cool down the economy and stabilize prices. This could be the case as early as July 2022.

How quickly the ECB will get a grip on galloping inflation in Europe remains unclear. The capital markets, which, it is said, often anticipate economic developments 6 months ahead, have been falling sharply for at least a few weeks and are assuming a noticeable cooling of economic development. This is also because the U.S. Federal Reserve is already much further advanced with interest rate increases, as the inflation rate in the U.S. is similarly high.

Implications for investors and savers

For investors who have a long-term approach to investing and invest broadly, more favorable prices on the capital markets can be a reason to buy more. If you have a monthly savings plan, this happens automatically.

However, anyone hoping for noticeable interest rates on saving accounts and the like in the near future is likely to be disappointed. That’s why we at UnitPlus have developed a modern way of investing money that flexibly adapts to our individual needs.