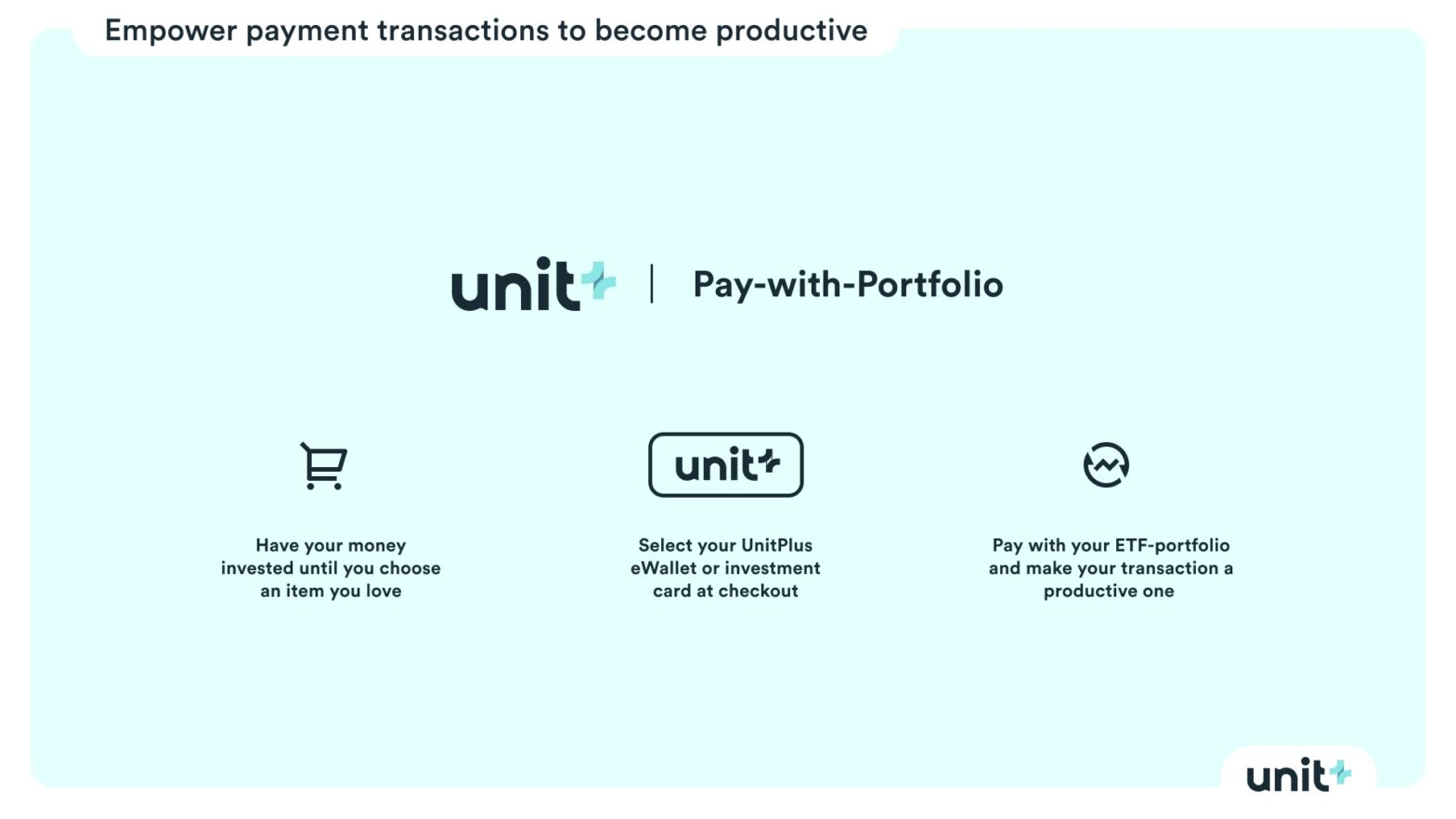

Keeping track of all payment methods out there is hard, isn’t it? Whether cash, debit, credit, prepaid, buy now – pay later, cryptocurrencies, you name it. So it’s fair to wonder if the world really needs a new payment method. We at UnitPlus strongly believe so and develop with what we call Pay-with-Portfolio a way to pay directly with your ETF portfolio for the brands you love.

Okay, I’ll admit it. I am an avid PayPal user. Whenever I want to pay for something online, my eyes automatically scan the checkout page for the PayPal button. I don’t even consider other payment options. Not bad PayPal, you hooked me! Maybe some of you feel the same way with your favorite payment method.

Table of Contents

To be, or not to be productive, that is the question

If you think about what all these payment methods have in common, you’ll notice that until money is used for payments, it hasn’t been working productively for us. It sits in our current accounts or eWallets and is literally waiting around to get used for transactions. Why isn’t there a payment method where money is actively working for us until we spend it? With a real inflation rate of 1.25% in Germany, money loses value every time we make a payment. Day after day.

Cash-back programs are great, but hardly anyone thinks about the interest- and inflation-related cash-burn program that is embedded in our payment system. With the 402 billion euros in card payments we Germans made in 2019, we encountered a hefty loss of purchasing power of over 13 million euros daily. To sweeten it up, you can triple this number, if you consider the official inflation number for July of 3.80%! I don’t even want to start talking about the 2.8 trillion euros we are hoarding in cash and deposits. True, that amount of money is a first-world problem, but a serious one, when you think about rising poverty among Germany′s elderly and increasing inequality between social classes. Unfortunately, it doesn’t look better in most other European countries.

So we do have the financial resources to invest more, but still only 17.5% of the German population above age 14 invested in 2020. I’ll tell you something else: over 150 million bank cards were in circulation in Germany in 2019. Do you recognize something here? Card payments are hot, while investments… well, for most of us are not.

Whats our take on this

That’s why we at UnitPlus are developing an investment solution that enables everyone to pay directly with their ETF portfolio all over the world. With that, money works for us exactly up until the point we like to spend it. Sounds smooth, right? Since capital markets rise on average (not every day), there is a built-in cash-back program financed by the investment itself. Furthermore, it is the first time a payment method is funded by what we call productive capital. What do I mean by that? Until further use, the money is invested in hundreds of companies that produce goods and services that we all use and consume. This is a major difference to cryptocurrencies, where the maxims of hope, trust, and speculation takes precedence. Another advantage is that while banks may pass on customer deposits to people who may not necessarily agree with our ethical code of values, such as Deutsche Bank did with loans to the former president of the USA, Donald Trump, the money is invested way more transparently in the capital market. Pay-with-Portfolio will also position itself as a substitute for credit cards and buy now, pay later payment options, where nasty surprises can await you with high overdrafts.

Investing is not trading

To set the level playing field here: Investing doesn’t necessarily mean becoming active in stock picking and market timing. That might be an exciting hobby, but for most of us a broader and more simplistic strategy seems to be the more appropriate way. In this regard, we read an interesting number mentioning the percentage of US retail investors who lose money by using the neo-broker Robinhood. Take a guess. 70% to 75%! Gamification is nice for engagement, but a killer for performance. Investing in plain vanilla ETF portfolios might appear boring, but it puts the long-term power of capital markets into everyone’s hands (quite literally with our investment card).

Admittedly, there is a capital market risk with the Pay-with-Portfolio payment option. However, we firmly believe that not investing at all is the much unhealthier alternative. While historically, the average daily return on the capital market has been positive, and thus even short investments can be profitable, the era of attractive interest rates seems to be over for the foreseeable future.

Inflation doesn’t care which money it’s eating up, but we do.