At some point, every successful company will inevitably face a critical question: what do we do with our cash? Whether this cash came through operational income or other revenue streams, SMEs and companies in general should once in a while rethink their current strategy and weigh out different options and new opportunities from time to time. After all, this hard-earned money should not be invested carelessly, especially since it can be a significant positive driver in the company’s financial success. This potential is part of why there is such a vast variety of possibilities open to companies, and also why it can sometimes be challenging to navigate through the offers and pick a suitable one.

Before investing the excess cash, companies need to first determine how much of their liquidity is surplus and when this cash might still be needed. The horizon over which the money is invested and whether it still has to be accessible can have a strong influence on the decision of what investment to pursue and the return this brings in. Nowadays there are plenty of software solutions that create forecasts and certain business scenarios that may help to answer these questions more accurately, however, it will almost always come down to the company’s tendencies and preferences in this matter. Once the decision has been made on how much capital to invest, the next question is where to place this investment. Let us look at 4 of the common options that are available to small and medium-sized enterprises.

Table of Contents

Overnight Deposit Accounts

This is one of the most common options among SMEs to park liquidity, as it is relatively simple and regarded as pretty secure. Excess cash that the company has at hand is transferred to the overnight deposit account and secures steady interest payments, while the capital remains liquid and accessible. The return on these accounts differs by a large margin, depending on certain deals available at different banks. However, do not let these deals fool you, as the high interest rates banks advertise with, are often only applicable for a few months, before they then drop to a low base rate. With the UnitPlus Overnight Deposit Index for Businesses, which we recently launched in cooperation with Barkow Consulting, we found out that the average interest rate for overnight deposits for companies is only 1.78 % p.a. Considering that the current Euro short-term* rate is 3,415 % implies that banks give only approximately 50 % of what they get from the ECB back to the client. This doesn’t seem particularly fair to us, which is why with UnitPlus Business you fully participate in the short-term Euro interest rate.

Looking at the security of the deposited money, which is at least as important of an aspect as the return, the deposits at the bank are unsecured liabilities, meaning that the statutory deposit insurance protects only up to 100,000 €. Resulting, every deposit above this limit will be lost in the case of bank insolvency for example.

*Info: The Euro Short-Term Rate (also known as €STR) is a reference interest rate published by the European Central Bank (ECB). It reflects the costs at which banks lend money to each other on a short-term basis, overnight, in the interbank market. The €STR is an important indicator of short-term financing costs in the euro area and is calculated daily based on actual transactions between banks.

Fixed Deposit Accounts

If it is the case that a company already knows with high certainty that it will not need a specific amount of cash for a while, one also has the possibility to deposit the money for a predetermined period of time in a fixed deposit account. This means that the money will not be accessible during this period, however, also brings in higher interest rates, compared to overnight deposit accounts. On one hand, having a fixed interest rate offers predictable returns and low risk for the company, making it a good choice for capital preservation. On the other hand, the inflexibility of the funds and potential costs that are incurred by early withdrawals may limit the potential growth of the company. Apart from that, just like in the overnight deposit accounts, the statutory deposit insurance protects the money up to 100,000 €.

Tip: UnitPlus Business offers SMEs the flexibility of an overnight deposit account while paying out an attractive interest rate of 3,56% p.a.*, presenting an attractive alternative to overnight or fixed deposit accounts. With UnitPlus Business you gain access to invest in a Goldman Sachs Asset Management money market fund, usually reserved only for large, institutional investors. Investing into this fund ensures a return linked to the ECB interest rate, full protection of the investment with no limit, full flexibility, and no minimum or maximum deposit. Find out more about the product here.

Overnight and Fixed Depot Accounts in comparison to UnitPlus Business

Overnight and

Fixed Depot Accounts

UnitPlus Business

Base interest rate of approx. 1.0% p.a., partly time-limited higher new customer offers Interest credit usually monthly or quarterly

3.56% capital return p.a. before costs, automatically adjusts to the interest rate environment For optimal use of the compound interest effect daily on working days

Statutory deposit insurance up to 100,000€ Bank insolvencies occur regularly

Protected as special assets in any amount

Often interest rate guarantee for only a few months, then lower base interest rate

Unlimited duration

Often limits such as 250,000€

No minimum or maximum deposits

Bonds

Bonds are another investment option for companies looking to manage excess capital. When a company invests in bonds, it essentially lends money to the bond issuer, which could be a government or another corporation. In return, the company earns regular interest payments, known as coupon payments, over the bond’s term. At maturity, the original investment is returned. The risk and reward relationship depends on who the money is lent to, the likelihood of them being able to pay back the money once maturity is reached, as well as the timespan the debtor keeps the money for. The general relationship here is that the lower the creditworthiness and with it the likelihood of getting the money back, the higher the return received. If the invested money is quickly needed, it is also possible to sell the bond, however, the money received for selling, depends on the current value of the bond, which is subject to changes. It could therefore be that you may gain a profit, but also that you can incur a loss when sold. Additionally, opening a custody account can be challenging for SMEs and adds unnecessary complexity. With UnitPlus Business, we will reduce this complexity and add more bond products to the platform, so that the money is optimally invested.

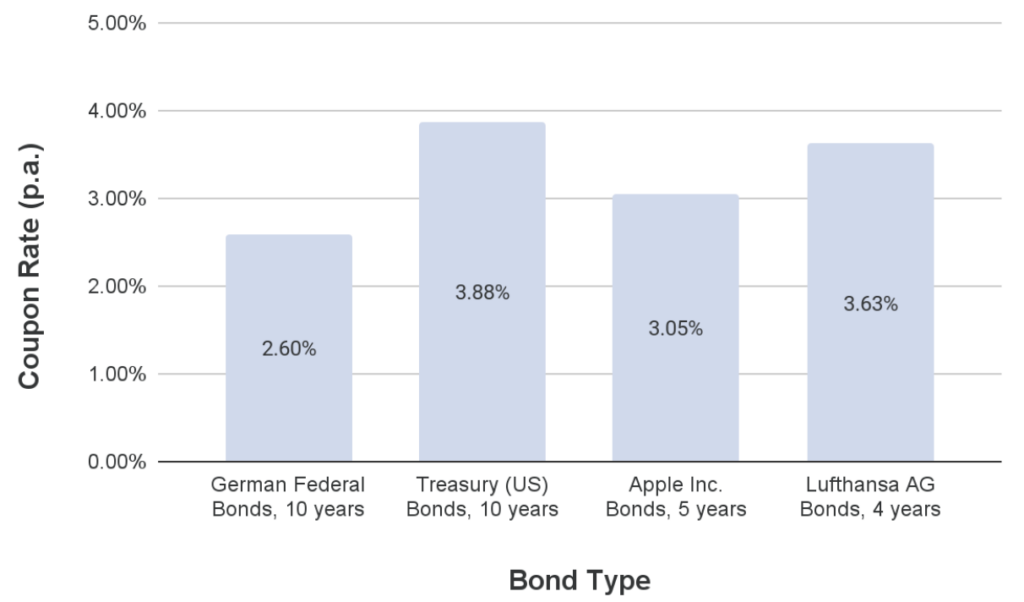

Below are some examples of bonds issued by governments and companies and their respective coupon rates.

Source: Bloomberg, Börse Frankfurt, Lufthansa AG, retrieved 26.09.24

Shares and Funds

Excess cash can also be invested directly into a company by acquiring shares. By gaining ownership of a company it is possible that if that company performs well, the shares increase in value, and the shareholder profits in the form of capital gains or dividends. While this can be very beneficial, the return can also be negative in case of poor stock performance, which would mean that the investment will lose its value. To minimize such risk, a common strategy is to invest in funds that hold several different companies in the portfolio. If money is invested in a fund, it is essentially automatically distributed into shares of different companies, which diversifies and therefore minimizes the risk. Some funds even include other asset classes like bonds, real estate, or raw materials, depending on the fund’s strategy, in order to diversify more broadly. Funds also have the advantage that the investor does not need to monitor, evaluate, and decide on specific stocks that are bought and sold on a rolling basis, which could otherwise distract the company from its core competencies. Generally, large companies only invest a small fraction of their liquidity into equity, due to the higher risk associated with it. Nevertheless, for diversification elements and long-term gain, it can add significant benefits.

Info: UnitPlus Business invests in an actively managed money market fund by Goldman Sachs, the Goldman Sachs Euro Liquid Reserves Fund, which mainly consists of government and non-government money market securities with high credit ratings (investment grade). This fund has a volume of over €20 billion and is therefore ideally suited for UnitPlus Business due to its size and long existence. It is worthwhile to mention that the money market fund has come through all economic and financial crises without any restrictions since its launch in 1999.

As we see, SMEs have a wide range of investment opportunities to explore when managing excess cash, each with its own balance of risk and reward. The primary consideration for any company should be understanding its financial position, determining how much capital can be set aside, how soon the funds might be needed, and the company’s overall risk tolerance. This understanding will shape the investment strategy, whether it is focusing on more conservative options like overnight or fixed deposit accounts, which provide security and predictability, or opting for more risky investments such as shares and funds. By carefully balancing risk and reward, SMEs can make the most of their capital, safeguarding financial stability while pursuing growth.

*as of August 2024, before costs of 0.25%-0.4%